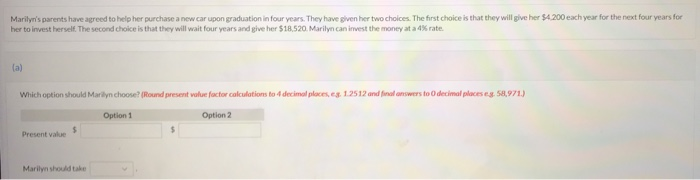

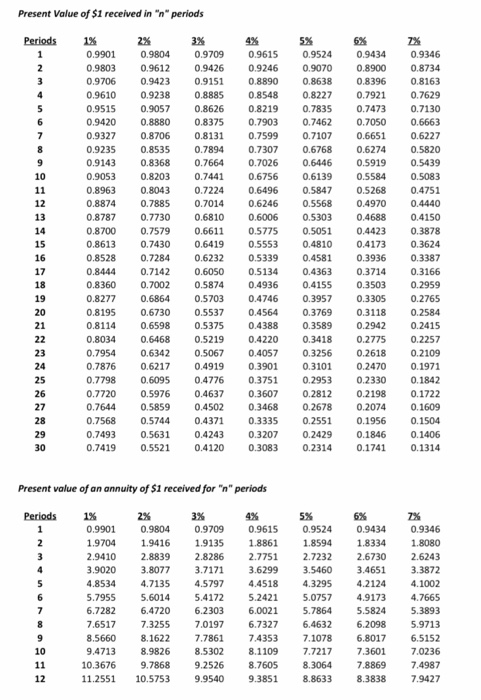

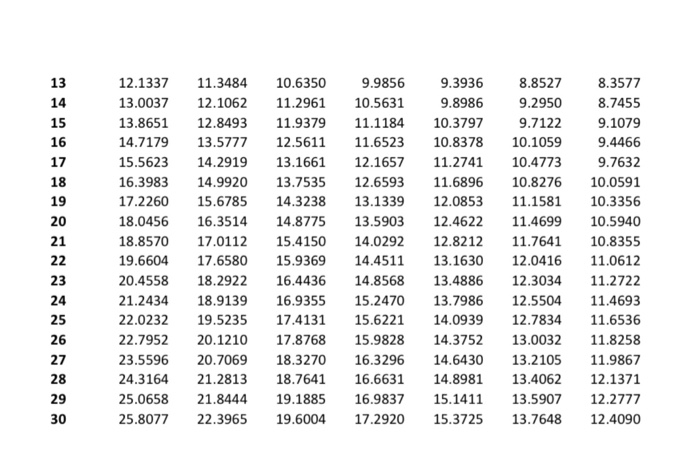

Marilyn's parents have agreed to help her purchase a new car upon graduation in four years. They have given her two choices. The first choice is that they will give her $4200 each year for the next four years for her to invest herself. The second choice is that they will wait four years and give her $18.520. Marilyn can invest the money at a 4%rate. Which option should Marilyn choose (Round present value factor calculations to 1 decimal places, s. 12512 and find answers to decimal placeses 58,971.) Option 1 Option 2 Presentatoes Marilyn should take Present Value of $1 received in 'n periods Periods 1% 0.9901 0.9803 0.9706 0.9610 0.9515 0.9420 0.9327 0.9235 0.9143 0.9053 0.8963 0.8874 0.8787 0.8700 0.8613 0.8528 0.8444 0.8360 0.8277 0.8195 0.8114 0.8034 0.7954 0.7876 0.7798 0.7720 0.7644 0.7568 0.7493 0.7419 0.9804 0.9612 0.9423 0.9238 0.9057 0.8880 0.8706 0.8535 0.8368 0.8203 0.8043 0.7885 0.7730 0.7579 0.7430 0.7284 0.7142 0.7002 0.6864 0.6730 0.6598 0.6468 0.6342 0.6217 0.6095 0.5976 0.5859 0.5744 0.5631 0.5521 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 0.8131 0.7894 0.7664 0.7441 0.7224 0.7014 0.6810 0.6611 0.6419 0.6232 0.6050 0.5874 0.5703 0.5537 0.5375 0.5219 0.5067 0.4919 0.4776 0.4637 0.4502 0.4371 0.4243 0.4120 4% 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 0.6496 0.6246 0.6006 0.5775 0.5553 0.5339 0.5134 0.4936 0.4746 0.4564 0.4388 0.4220 0.4057 0.3901 0.3751 0.3607 0.3468 0.3335 0.3207 0.3083 5% 0.9524 0.9070 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 0.5847 0.5568 0.5303 0.5051 0.4810 0.4581 0.4363 0.4155 0.3957 0.3769 0.3589 0.3418 0.3256 0.3101 0.2953 0.2812 0.2678 0.2551 0.2429 0.2314 0.9434 0.8900 0.8396 0.7921 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 0.5268 0.4970 0.4688 0.4423 0.4173 0.3936 0.3714 0.3503 0.3305 0.3118 0.2942 0.2775 0.2618 0.2470 0.2330 0.2198 0.2074 0.1956 0.1846 0.1741 2X 0.9346 0.8734 0.8163 0.7629 0.7130 0.6663 0.6227 0.5820 0.5439 0.5083 0.4751 0.4440 0.4150 0.3878 0.3624 0.3387 0.3166 0.2959 0.2765 0.2584 0.2415 0.2257 0.2109 0.1971 0.1842 0.1722 0.1609 0.1504 0.1406 0.1314 Present value of an annuity of $1 received for "n" periods Periods 1% 5% 2% 0.9901 0.9804 1.9704 1.9416 2.9410 2.8839 3.9020 3.8077 4.8534 4.7135 5.7955 5.6014 6.7282 6.4720 7.6517 7.3255 8.5660 8.1622 9.47138.9826 10.3676 9.7868 11.2551 10.5753 3% 0.9709 1.9135 2.8286 3.7171 4.5797 5.4172 6.2303 7.0197 7.7861 8.5302 9.2526 9.9540 0.9615 0.9524 0.9434 1.8861 1.8594 1.8334 2.7751 2.72322.6730 3.6299 3.5460 3.4651 4.4518 4.3295 4.2124 5.2421 5.0757 4.9173 6.0021 5.7864 5.5824 6.7327 6.4632 6.2098 74353 7.1078 6.8017 8.1109 7.7217 7.3601 8.7605 8.3064 7.8869 9.38518.8633 8.3838 0.9346 1.8080 2.6243 3.3872 4.1002 4.7665 5.3893 5.9713 6.5152 7.0236 7.4987 7.9427 10 12.1337 13.0037 13.8651 14.7179 15.5623 16.3983 17.2260 18.0456 18.8570 19.6604 20.4558 21.2434 22.0232 22.7952 23.5596 24.3164 25.0658 25.8077 11.3484 12.1062 12.8493 13.5777 14.2919 14.9920 15.6785 16.3514 17.0112 17.6580 18.2922 18.9139 19.5235 20.1210 20.7069 21.2813 21.8444 22.3965 10.6350 11.2961 11.9379 12.5611 13.1661 13.7535 14.3238 14.8775 15.4150 | 15.9369 16.4436 16.9355 17.4131 17.8768 | 18.3270 18.7641 19.1885 19.6004 9.9856 10.5631 11.1184 11.6523 12.1657 12.6593 13.1339 13.5903 14.0292 | 14.4511 14. 8568 15.2470 15.6221 15.9828 16.3296 16.6631 16.9837 17.2920 9.3936 9.8986 10.3797 10.8378 11.2741 11.6896 12.0853 12.4622 12.8212 13.1630 13.4886 13.7986 14.0939 14.3752 14.6430 14.8981 15.1411 15.3725 8.8527 9.2950 9.7122 10.1059 10.4773 | 10.8276 11.1581 11.4699 11.7641 12.0416 12.3034 12.5504 12.7834 13.0032 13.2105 13.4062 13.5907 13.7648 8.3577 8.7455 9.1079 9.4466 9.7632 | 10.0591 10.3356 10.5940 10.8355 | 11.0612 11.2722 11.4693 11.6536 11.8258 11.9867 12.1371 12.2777 12.4090