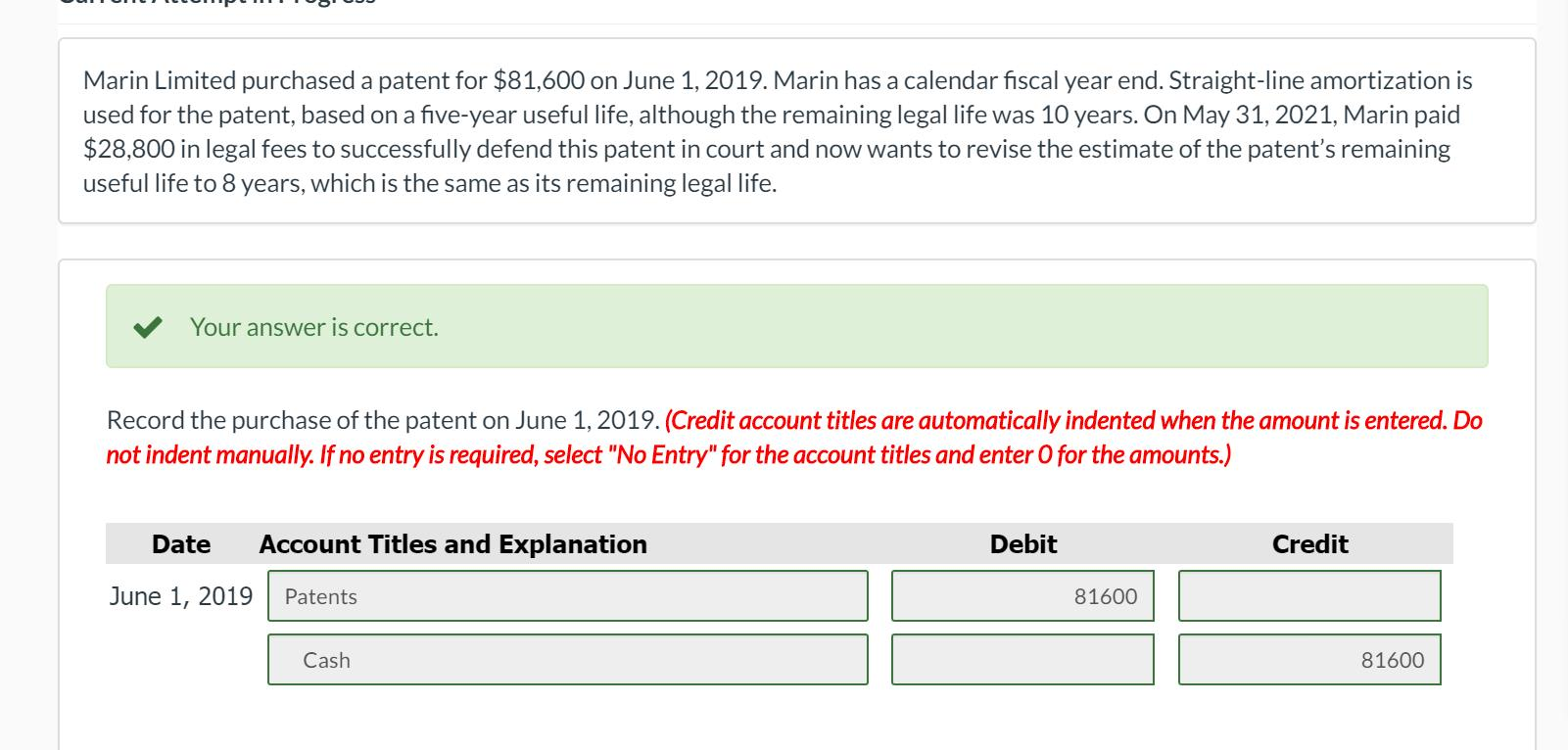

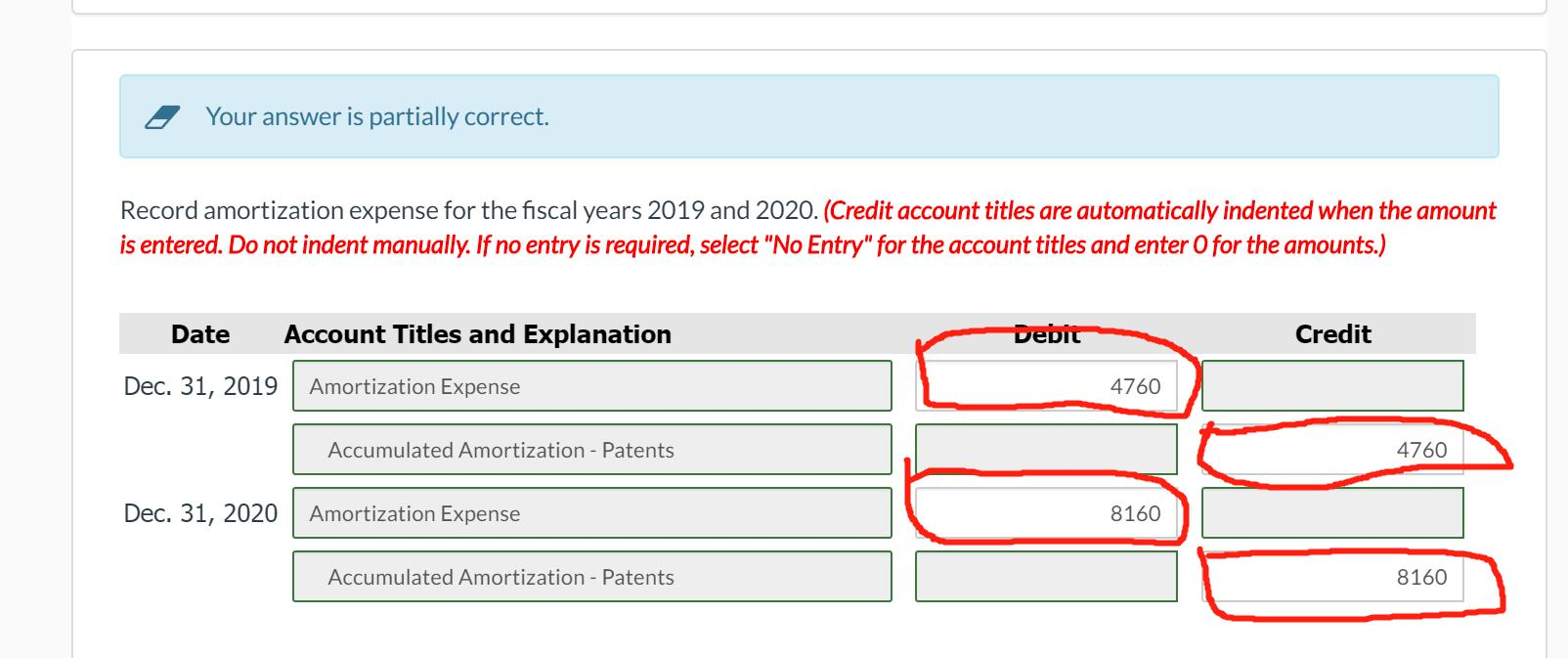

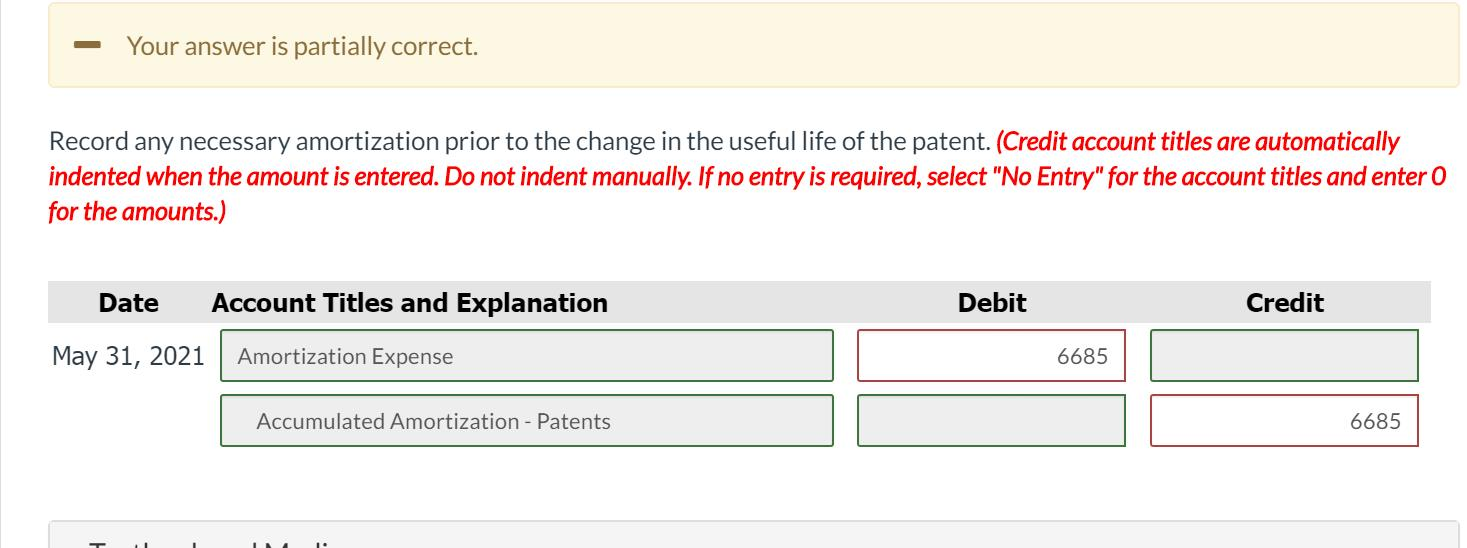

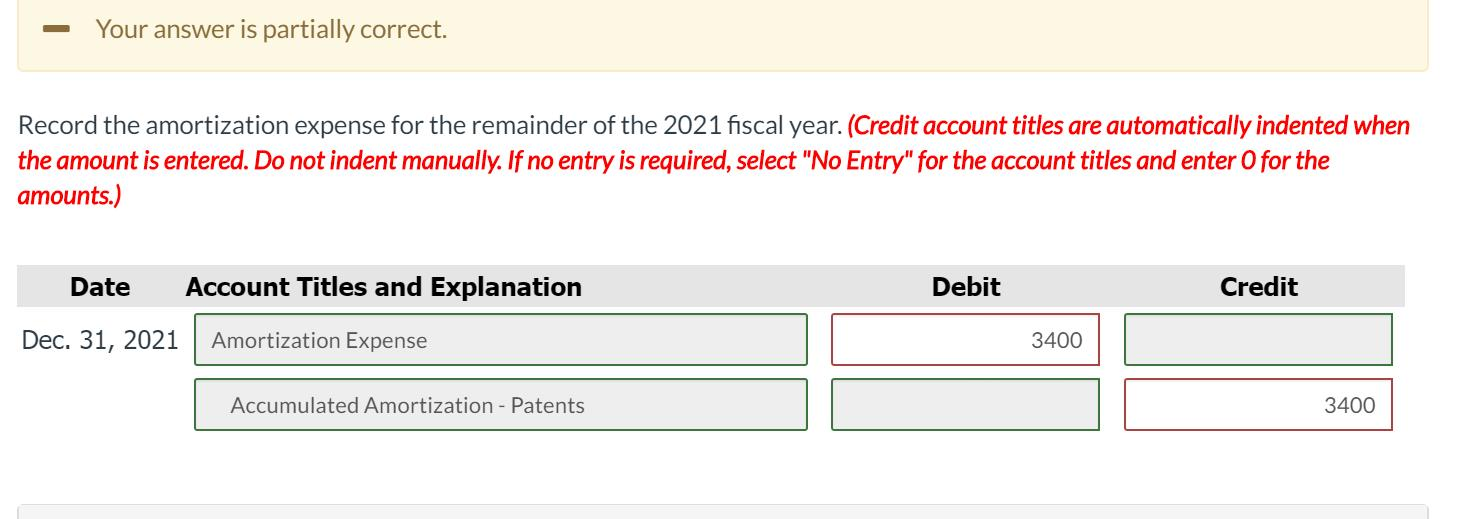

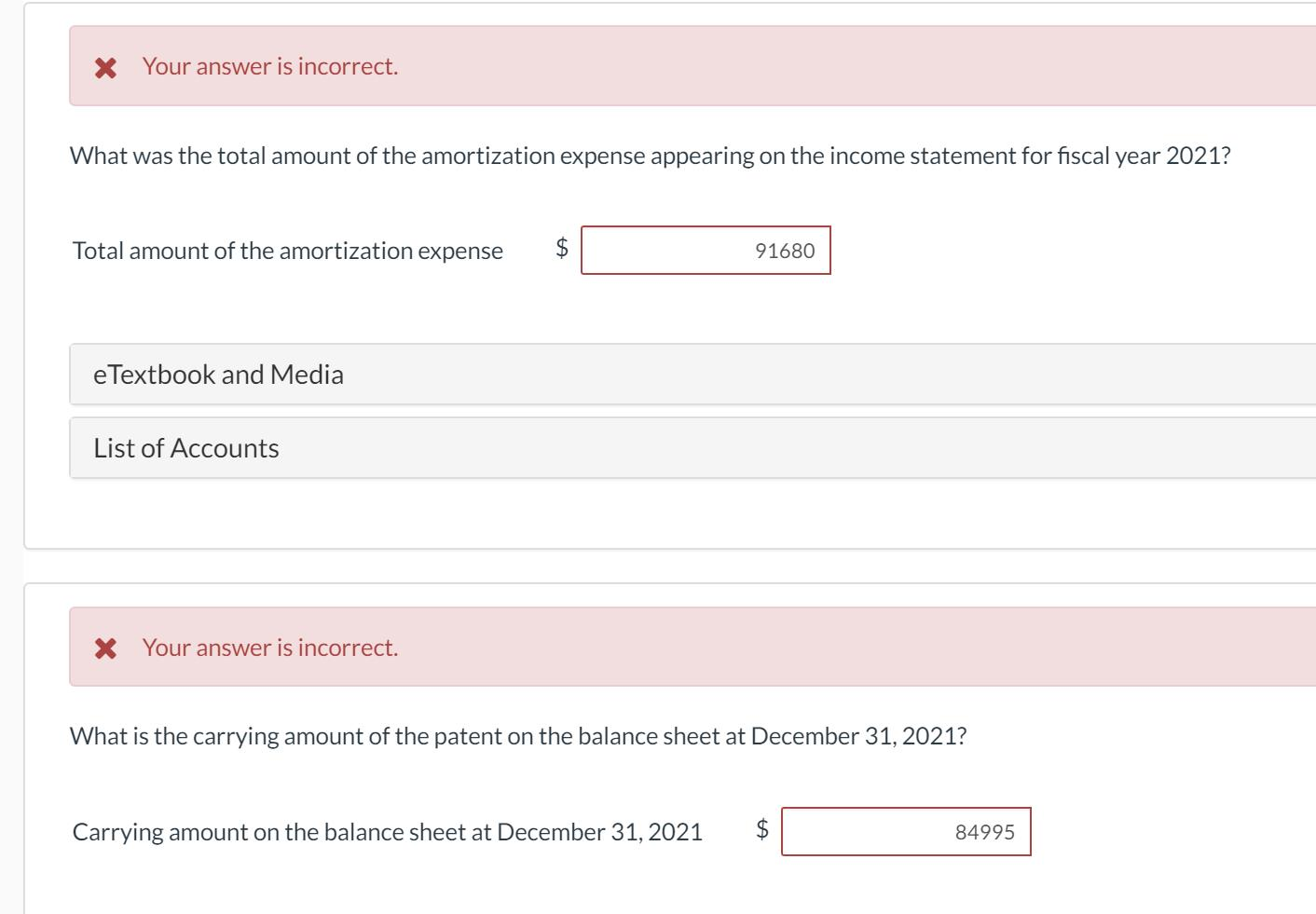

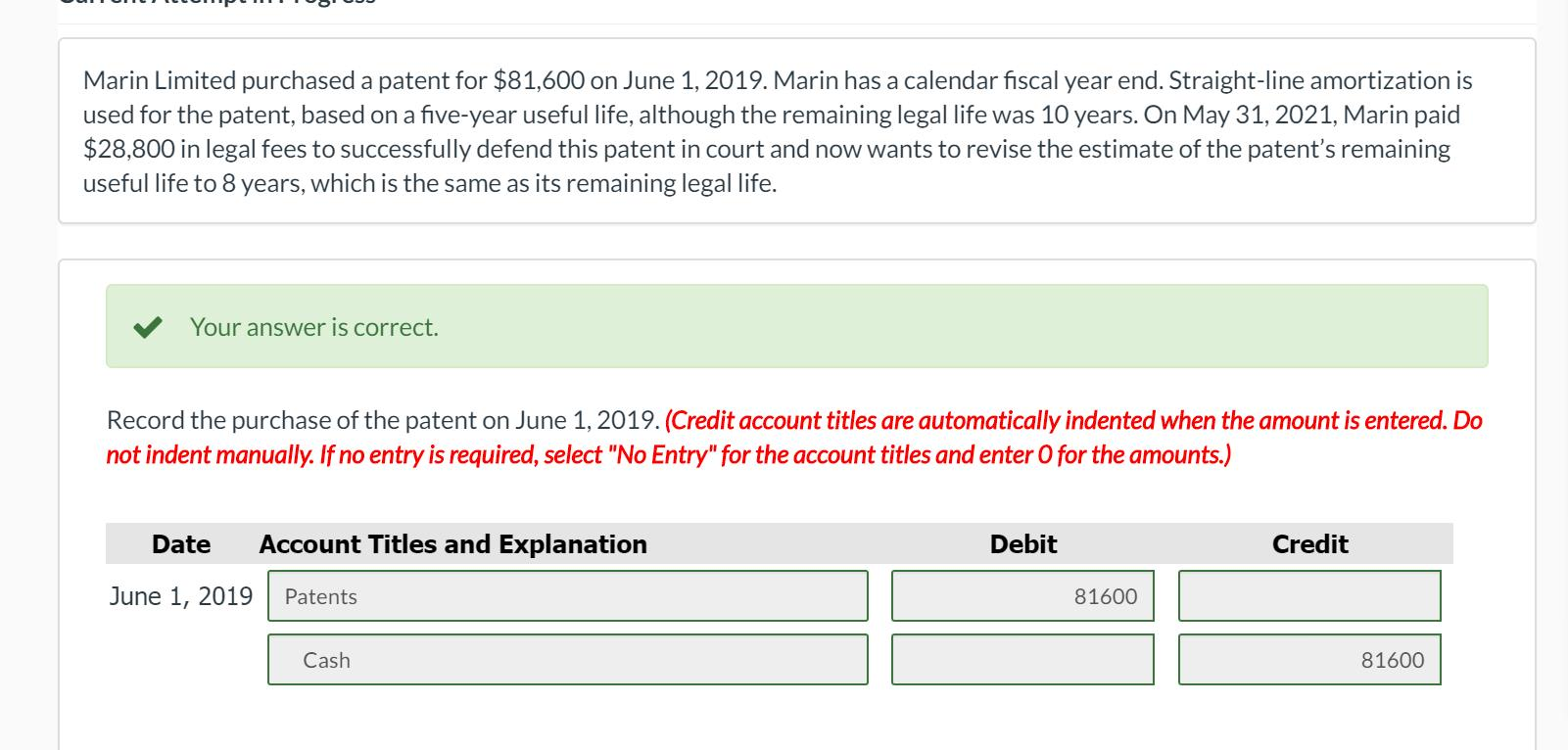

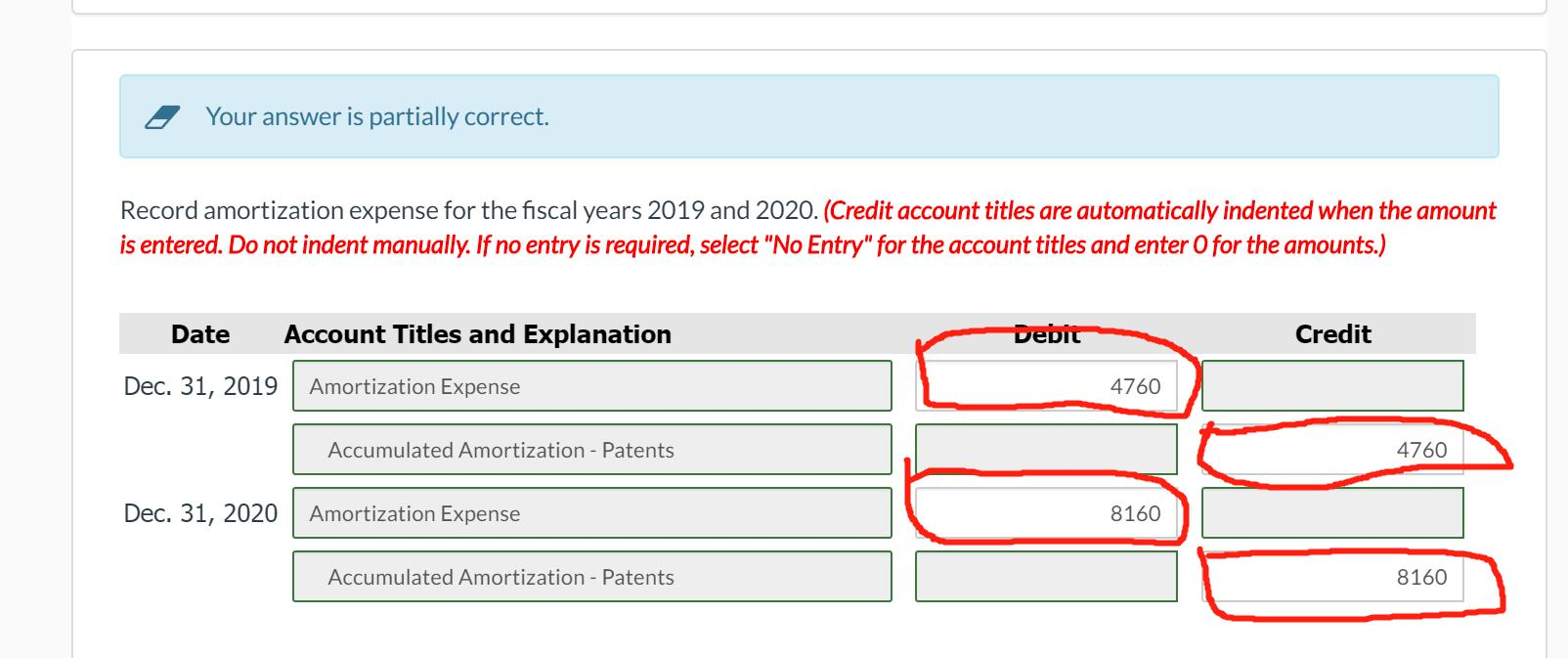

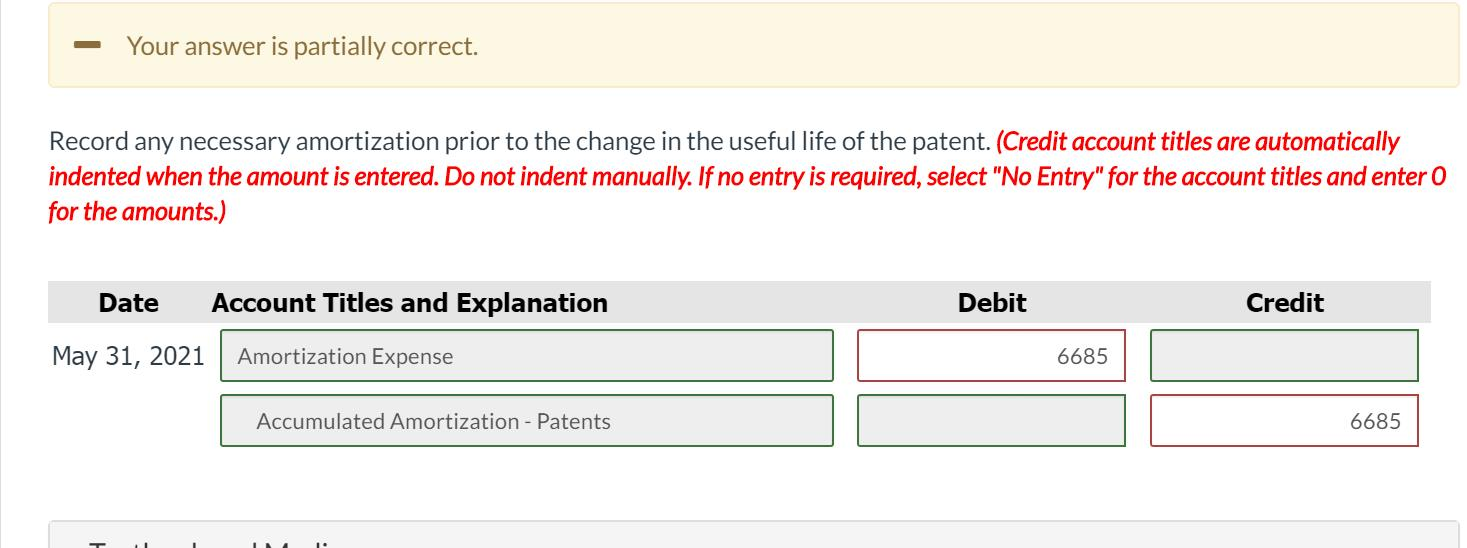

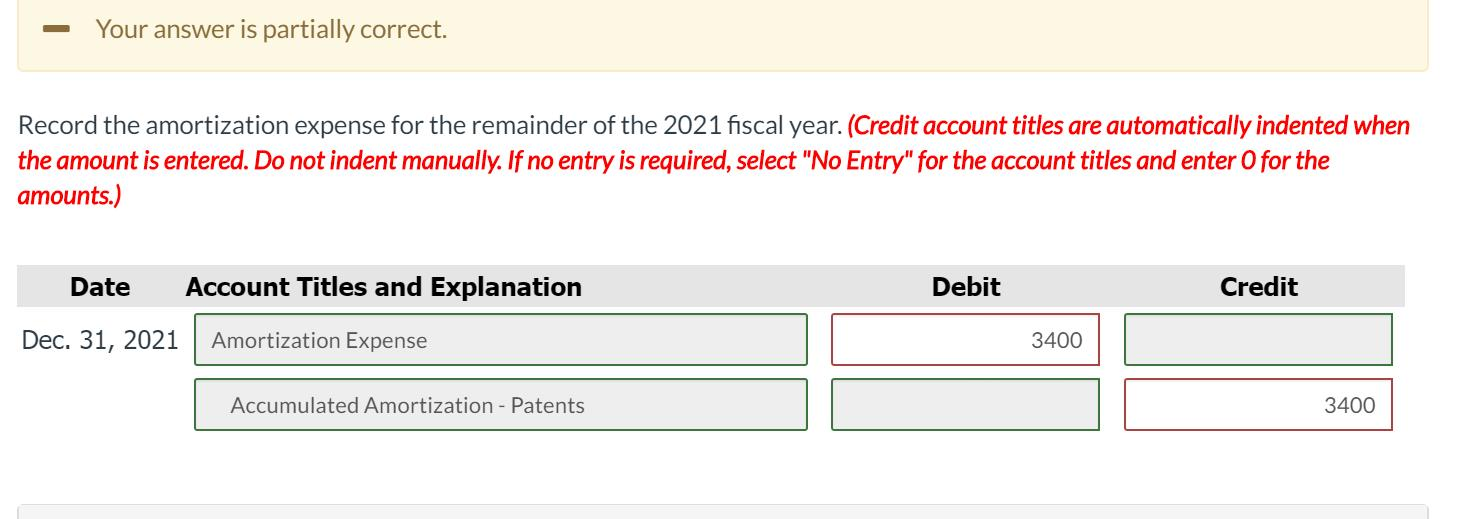

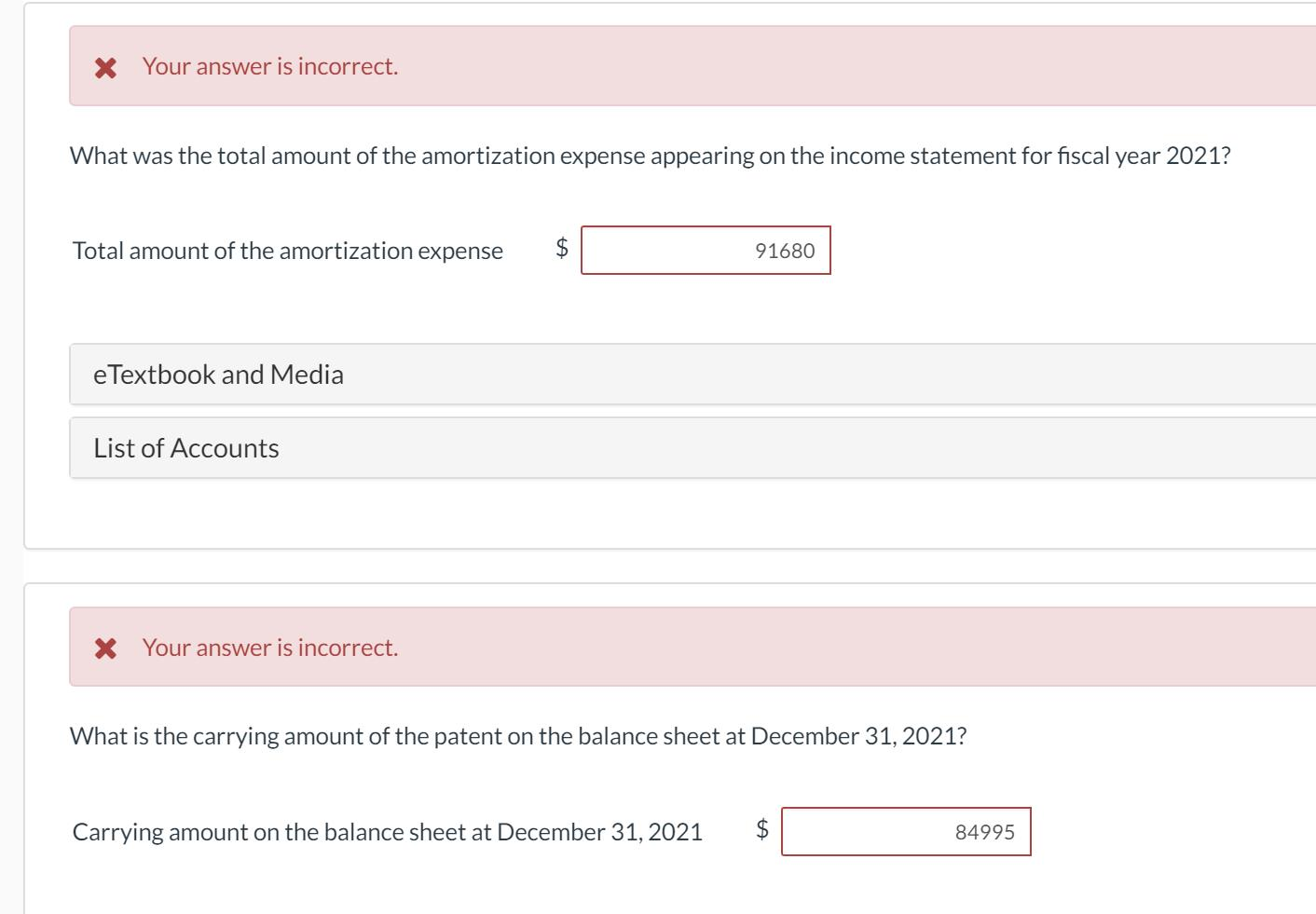

Marin Limited purchased a patent for $81,600 on June 1, 2019. Marin has a calendar fiscal year end. Straight-line amortization is used for the patent, based on a five-year useful life, although the remaining legal life was 10 years. On May 31, 2021, Marin paid $28,800 in legal fees to successfully defend this patent in court and now wants to revise the estimate of the patent's remaining useful life to 8 years, which is the same as its remaining legal life. Your answer is correct. Record the purchase of the patent on June 1, 2019. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit June 1, 2019 Patents 81600 Cash 81600 Your answer is partially correct. Record amortization expense for the fiscal years 2019 and 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2019 Amortization Expense 4760 Accumulated Amortization - Patents 4760 Dec. 31, 2020 Amortization Expense a 8160 Accumulated Amortization - Patents 8160 Your answer is partially correct. Record any necessary amortization prior to the change in the useful life of the patent. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Debit Credit Date Account Titles and Explanation May 31, 2021 Amortization Expense 6685 Accumulated Amortization - Patents 6685 . Your answer is partially correct. Record the amortization expense for the remainder of the 2021 fiscal year. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2021 Amortization Expense 3400 Accumulated Amortization - Patents 3400 * Your answer is incorrect. What was the total amount of the amortization expense appearing on the income statement for fiscal year 2021? Total amount of the amortization expense $ 91680 e Textbook and Media List of Accounts X Your answer is incorrect. What is the carrying amount of the patent on the balance sheet at December 31, 2021? Carrying amount on the balance sheet at December 31, 2021 ta 84995