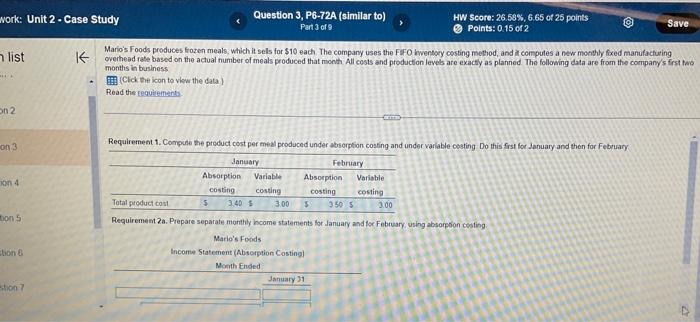

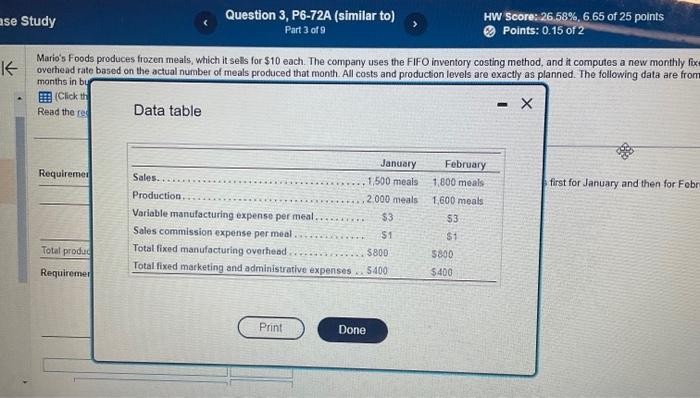

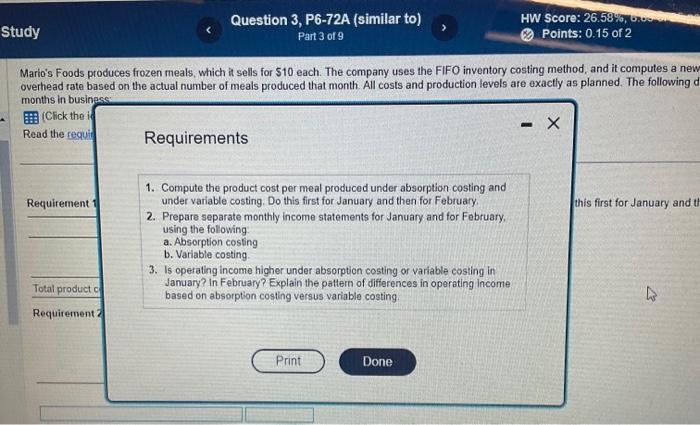

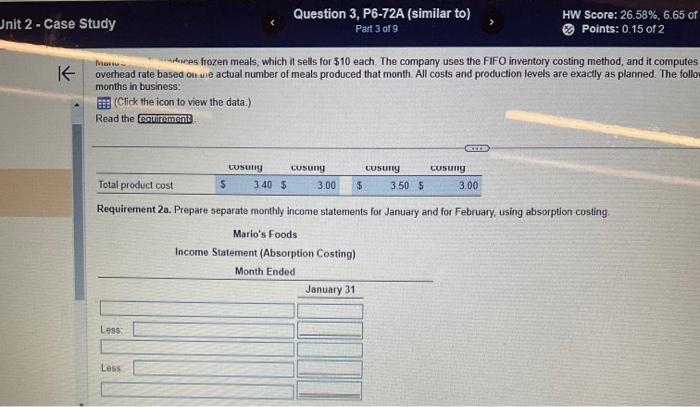

Mario's Foods produces frozen meals, which it sels for $10 each. The company uses the Fy 0 lwentory costing method, and it computes a new morthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and producfion levels are exacticy as planned The following data are from the company's first ter months in business (Clek the icon to view the data) Read the reguitements. Requirement 1. Compuste the preduct cost per meal produced under abserption costing and under variable coating Do this frst lor January and then for Feberary Requirement Za. Prepare separate monthly hoome statements for danuary and for Fobruary, using absorpoon costing. Mario's Foods produces frozen meals, which it sells for $10 each. The company uses the FIFO inventory costing method, and it computes a new monthly fix overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are from months in by E (Click the Read the res Data table Requiremet first for January and then for Fobr Mario's Foods produces frozen meals, which it sells for $10 each. The company uses the FIFO inventory costing method, and it computes a new overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following d months in business: int (Click the if Read the requil Requirements 1. Compute the product cost per meal produced under absorption costing and under variable costing. Do this first for January and then for February. 2. Prepare separate monthly income statements for January and for February. using the following: a. Absorption costing b. Variable costing. this first for January and t 15 operating income higher under absorption costing or variable costing in Jamuary? In February? Explain the pattern of differences in operating income based on absorption costing versus variable costing. Manw - whices frozen meals, which it sells for $10 each. The company uses the FIFO inventory costing method, and it computes overhead rate based ou wie actual number of meals produced that month. All costs and production levels are exactly as planned. The follo months in business: (Click the icon to view the data.) Read the Requirement 2a. Prepare separate monthly income statements for January and for February, using absorption costing