Answered step by step

Verified Expert Solution

Question

1 Approved Answer

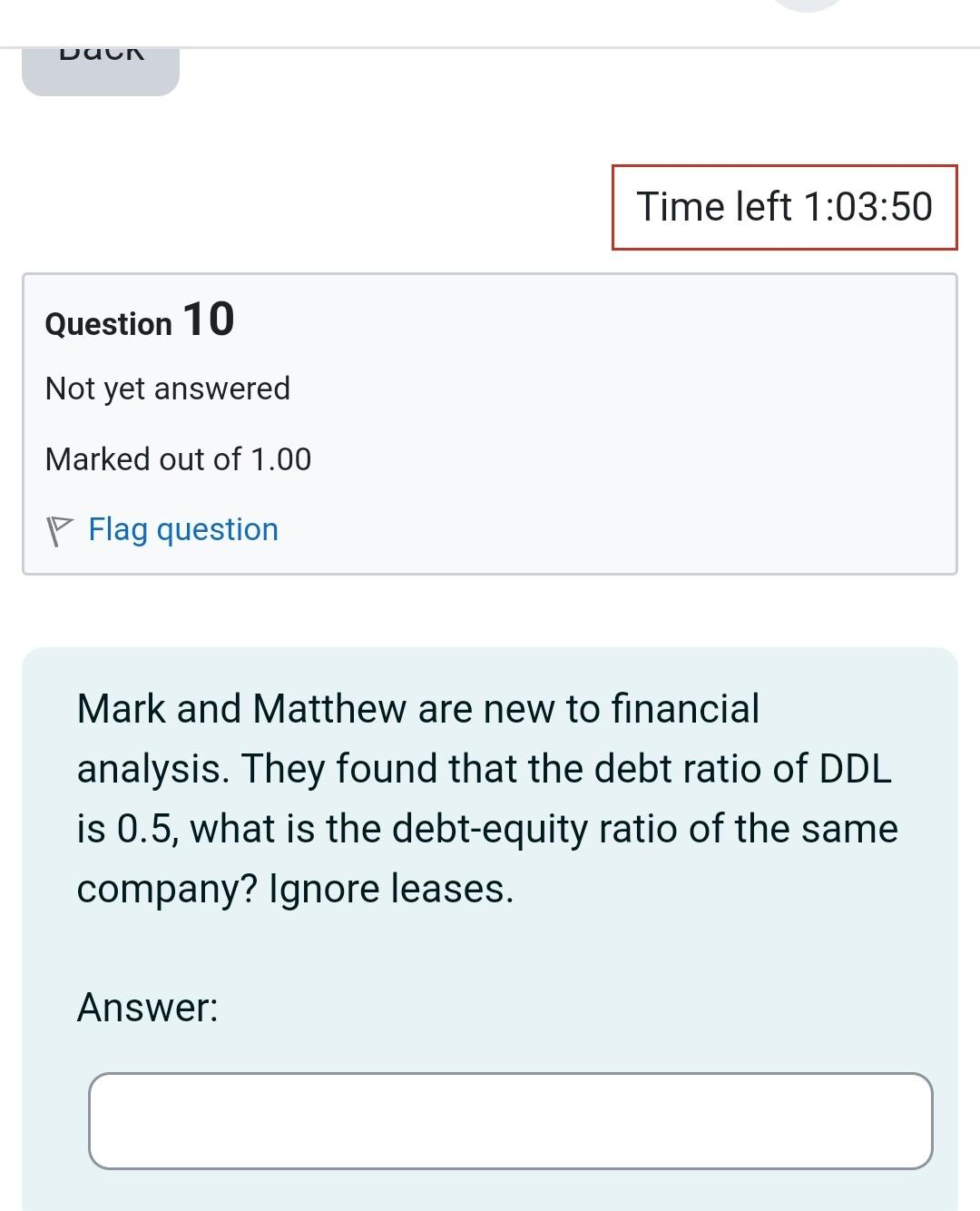

Mark and Matthew are new to financial analysis. They found that the debt ratio of DDL is 0.5, what is the debt-equity ratio of the

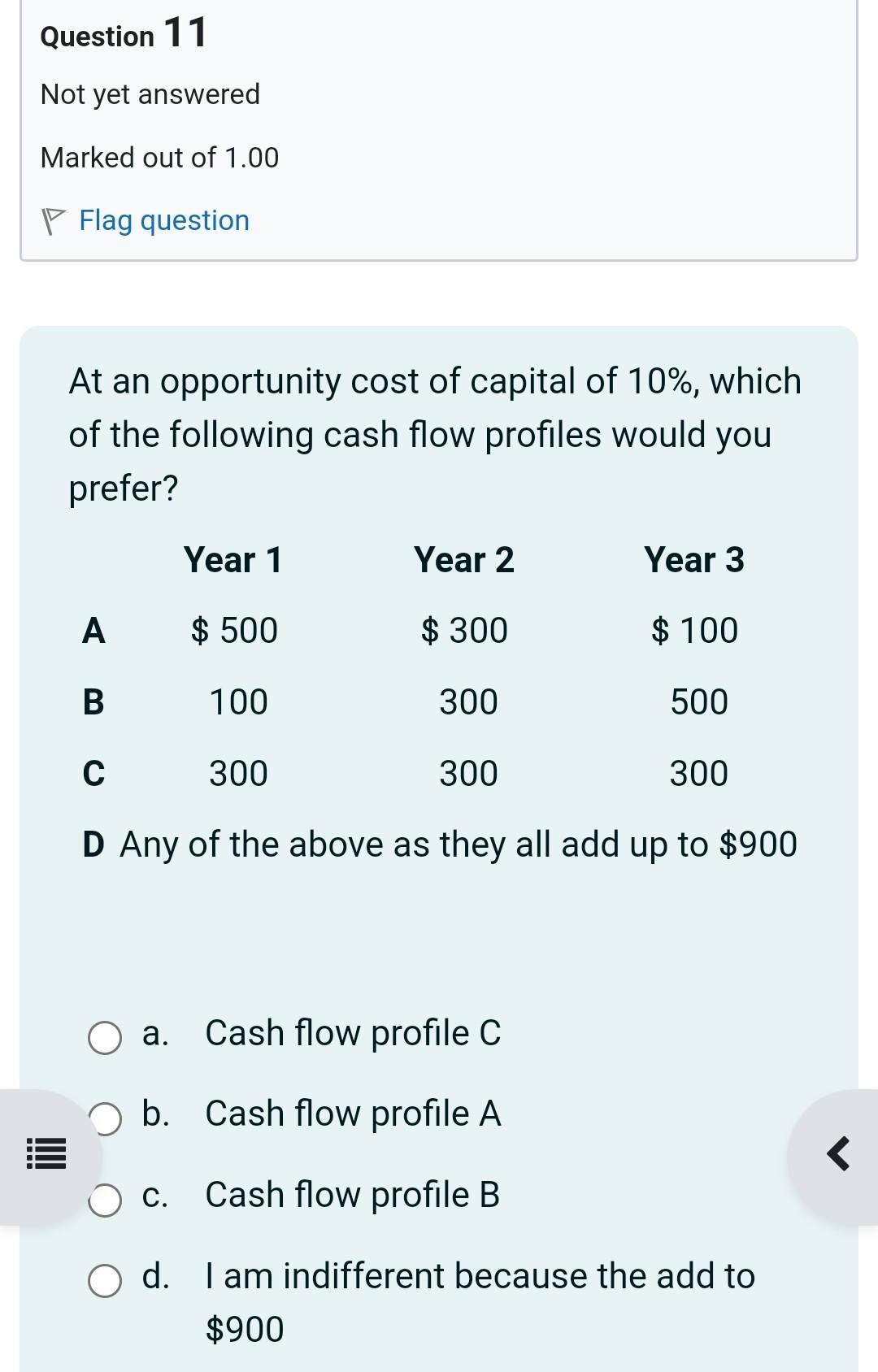

Mark and Matthew are new to financial analysis. They found that the debt ratio of DDL is 0.5, what is the debt-equity ratio of the same company? Ignore leases. Answer: Question 11 Not yet answered Marked out of 1.00 Flag question At an opportunity cost of capital of 10%, which of the following cash flow profiles would you prefer? D Any of the above as they all add up to $900 a. Cash flow profile C b. Cash flow profile A c. Cash flow profile B d. I am indifferent because the add to $900 Question 12 Not yet answered Marked out of 1.00 Flag question Jen will earn $250 this year and next year she will be unemployed. She can invest her funds and earn a fair return of 12%. She is offered a chance to invest 50% of her current year's earnings and receive $175 next year. Further, she consumes $75 on her much desired boat ride. It her desired vacation next year is to Rome, who much will she have to spend

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started