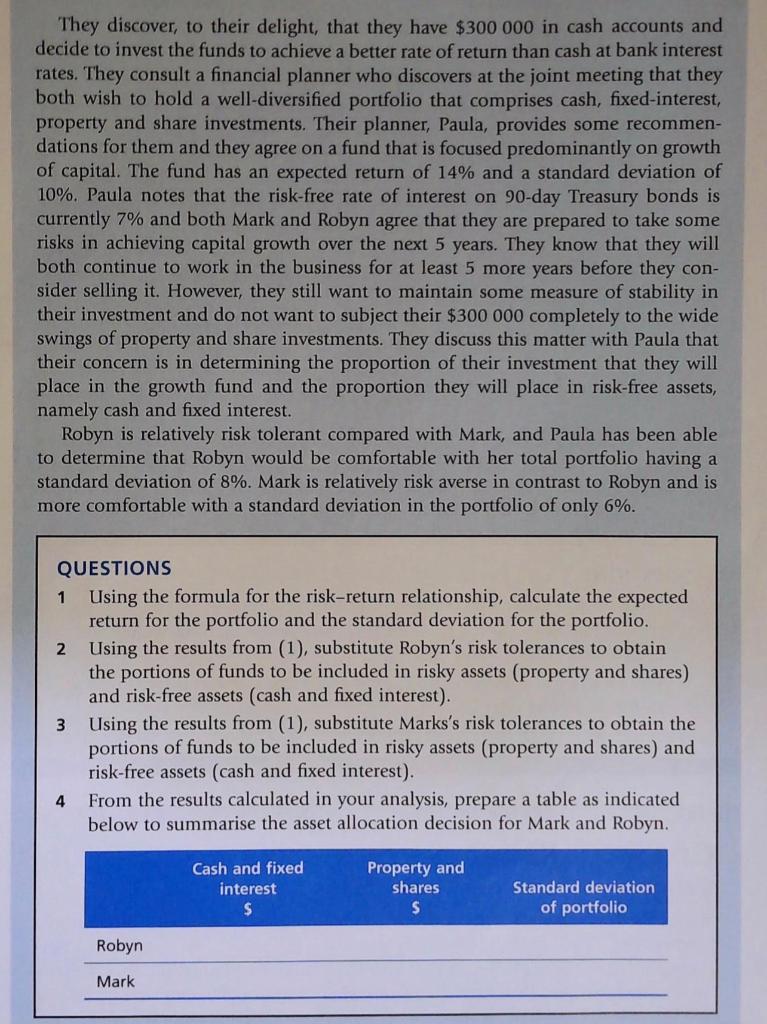

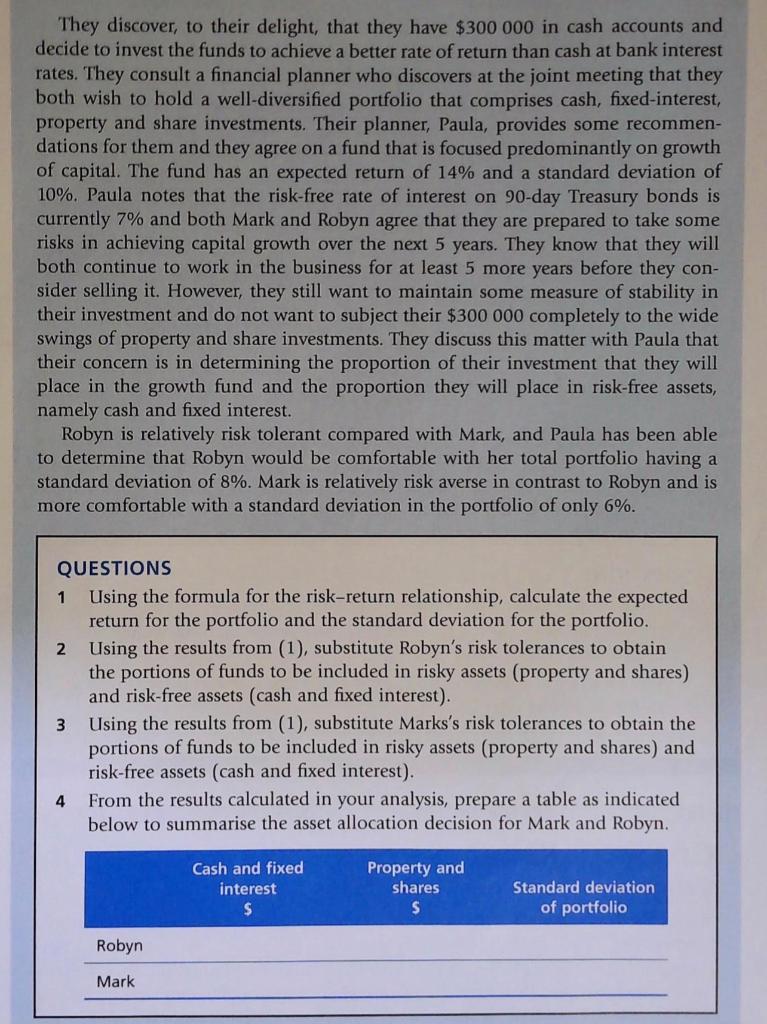

Mark and Robyn construct a portfolio Mark and Robyn are in partnership as psychologists and have built up a sizable practice over 20 years. Mark constantly trawls the newspapers for tenders and new consulting opportunities. Robyn manages the many consultants that they employ both in their city and interstate. They both work exceptionally hard in the business and rarely take a holiday. As they are both now in their mid 40s, a friend has sug- gested that they take stock of their business and their lifestyle and attend to some of the things in life to restore some sense of balance. They decide to take a holiday to Europe for 3 weeks and to take a week to review their personal assets and finan- cial plans. > They discover, to their delight, that they have $300 000 in cash accounts and decide to invest the funds to achieve a better rate of return than cash at bank interest rates. They consult a financial planner who discovers at the joint meeting that they both wish to hold a well-diversified portfolio that comprises cash, fixed-interest, property and share investments. Their planner, Paula, provides some recommen- dations for them and they agree on a fund that is focused predominantly on growth of capital. The fund has an expected return of 14% and a standard deviation of 10%. Paula notes that the risk-free rate of interest on 90-day Treasury bonds is currently 7% and both Mark and Robyn agree that they are prepared to take some risks in achieving capital growth over the next 5 years. They know that they will both continue to work in the business for at least 5 more years before they con- sider selling it. However, they still want to maintain some measure of stability in their investment and do not want to subject their $300 000 completely to the wide swings of property and share investments. They discuss this matter with Paula that their concern is in determining the proportion of their investment that they will place in the growth fund and the proportion they will place in risk-free assets, namely cash and fixed interest. Robyn is relatively risk tolerant compared with Mark, and Paula has been able to determine that Robyn would be comfortable with her total portfolio having a standard deviation of 8%. Mark is relatively risk averse in contrast to Robyn and is more comfortable with a standard deviation in the portfolio of only 6%. 2 QUESTIONS 1 Using the formula for the risk-return relationship, calculate the expected return for the portfolio and the standard deviation for the portfolio. Using the results from (1), substitute Robyn's risk tolerances to obtain the portions of funds to be included in risky assets (property and shares) and risk-free assets (cash and fixed interest). 3 Using the results from (1), substitute Marks's risk tolerances to obtain the portions of funds to be included in risky assets (property and shares) and risk-free assets (cash and fixed interest). From the results calculated in your analysis, prepare a table as indicated below to summarise the asset allocation decision for Mark and Robyn. 4 Cash and fixed interest $ Property and shares $ Standard deviation of portfolio Robyn Mark Mark and Robyn construct a portfolio Mark and Robyn are in partnership as psychologists and have built up a sizable practice over 20 years. Mark constantly trawls the newspapers for tenders and new consulting opportunities. Robyn manages the many consultants that they employ both in their city and interstate. They both work exceptionally hard in the business and rarely take a holiday. As they are both now in their mid 40s, a friend has sug- gested that they take stock of their business and their lifestyle and attend to some of the things in life to restore some sense of balance. They decide to take a holiday to Europe for 3 weeks and to take a week to review their personal assets and finan- cial plans. > They discover, to their delight, that they have $300 000 in cash accounts and decide to invest the funds to achieve a better rate of return than cash at bank interest rates. They consult a financial planner who discovers at the joint meeting that they both wish to hold a well-diversified portfolio that comprises cash, fixed-interest, property and share investments. Their planner, Paula, provides some recommen- dations for them and they agree on a fund that is focused predominantly on growth of capital. The fund has an expected return of 14% and a standard deviation of 10%. Paula notes that the risk-free rate of interest on 90-day Treasury bonds is currently 7% and both Mark and Robyn agree that they are prepared to take some risks in achieving capital growth over the next 5 years. They know that they will both continue to work in the business for at least 5 more years before they con- sider selling it. However, they still want to maintain some measure of stability in their investment and do not want to subject their $300 000 completely to the wide swings of property and share investments. They discuss this matter with Paula that their concern is in determining the proportion of their investment that they will place in the growth fund and the proportion they will place in risk-free assets, namely cash and fixed interest. Robyn is relatively risk tolerant compared with Mark, and Paula has been able to determine that Robyn would be comfortable with her total portfolio having a standard deviation of 8%. Mark is relatively risk averse in contrast to Robyn and is more comfortable with a standard deviation in the portfolio of only 6%. 2 QUESTIONS 1 Using the formula for the risk-return relationship, calculate the expected return for the portfolio and the standard deviation for the portfolio. Using the results from (1), substitute Robyn's risk tolerances to obtain the portions of funds to be included in risky assets (property and shares) and risk-free assets (cash and fixed interest). 3 Using the results from (1), substitute Marks's risk tolerances to obtain the portions of funds to be included in risky assets (property and shares) and risk-free assets (cash and fixed interest). From the results calculated in your analysis, prepare a table as indicated below to summarise the asset allocation decision for Mark and Robyn. 4 Cash and fixed interest $ Property and shares $ Standard deviation of portfolio Robyn Mark