Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mark and Val are married and together have $156,000 of AGI. They have 1 child, Cam that is 2 yrs olds. The couple does not

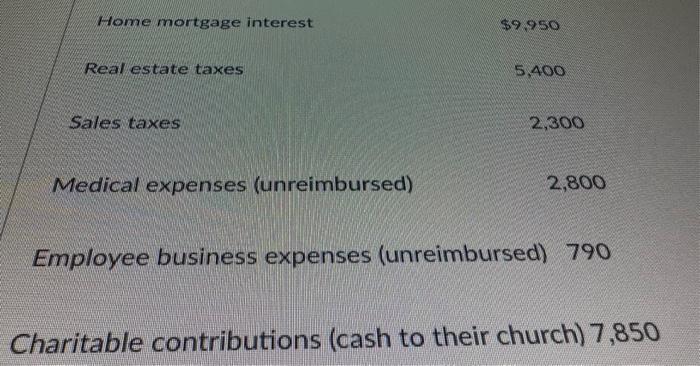

Mark and Val are married and together have $156,000 of AGI. They have 1 child, Cam that is 2 yrs olds. The couple does not have any child care expenses as Mark works from home. This year they have recorded the following expense

The AGI of $156,000 considers $4000 in qualified dividends received $1000 students loans interest and $62 in early withdrawal penalty.

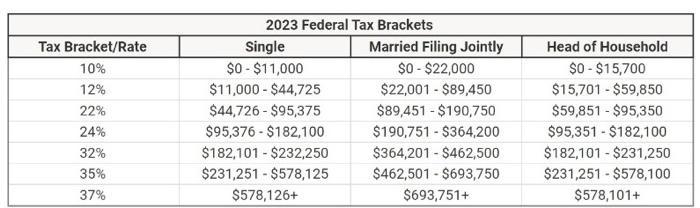

Calculate their taxable income and tax liability using the 2023 tax rate schedule. Standard deduction for MFK is $27,700.

Home mortgage interest Real estate taxes Sales taxes Medical expenses (unreimbursed) $9.950 5,400 2,300 2,800 Employee business expenses (unreimbursed) 790 Charitable contributions (cash to their church) 7,850

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Mark and Vals taxable income and tax liability for 2023 we need to consider their Adjusted Gross Income AGI deductions and the provided t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started