Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mark for follow up Question 2 5 of 3 0 . Which taxpayer is required to use the general rule for calculating the taxable amount

Mark for follow up

Question of

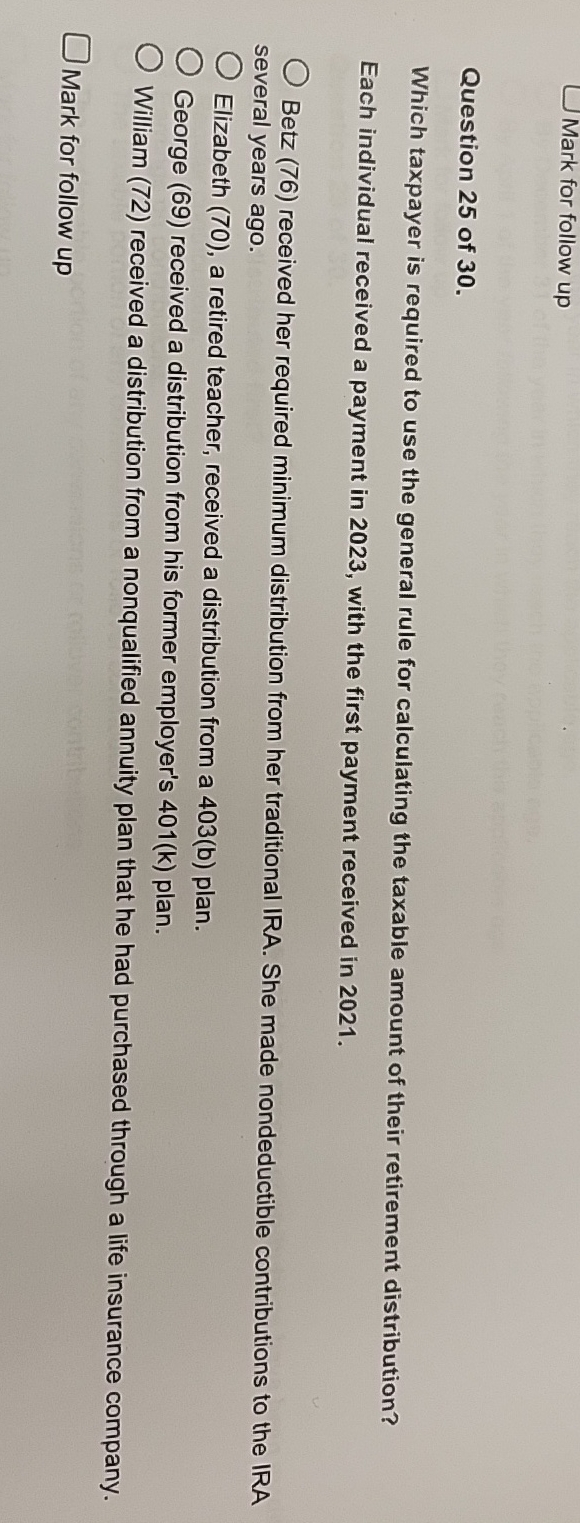

Which taxpayer is required to use the general rule for calculating the taxable amount of their retirement distribution?

Each individual received a payment in with the first payment received in

Betz received her required minimum distribution from her traditional IRA. She made nondeductible contributions to the IRA several years ago.

Elizabeth a retired teacher, received a distribution from a b plan.

George received a distribution from his former employer's k plan.

William received a distribution from a nonqualified annuity plan that he had purchased through a life insurance company.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started