Answered step by step

Verified Expert Solution

Question

1 Approved Answer

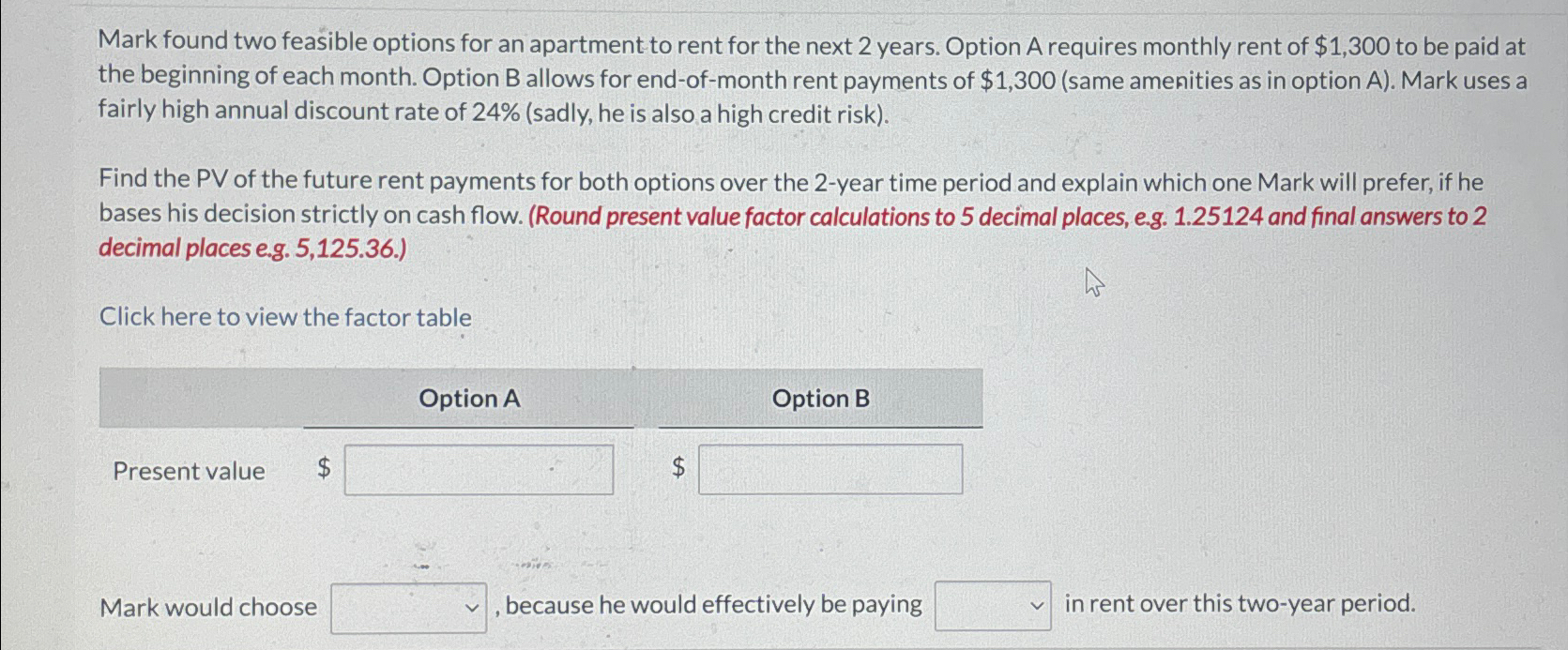

Mark found two feasible options for an apartment to rent for the next 2 years. Option A requires monthly rent of $ 1 , 3

Mark found two feasible options for an apartment to rent for the next years. Option A requires monthly rent of $ to be paid at the beginning of each month. Option B allows for endofmonth rent payments of $same amenities as in option A Mark uses a fairly high annual discount rate of sadly he is also a high credit risk

Find the PV of the future rent payments for both options over the year time period and explain which one Mark will prefer, if he bases his decision strictly on cash flow. Round present value factor calculations to decimal places, eg and final answers to decimal places eg

Click here to view the factor table

tableOption AOption BPresent value $$

Mark would choose because he would effectively be paying in rent over this twoyear period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started