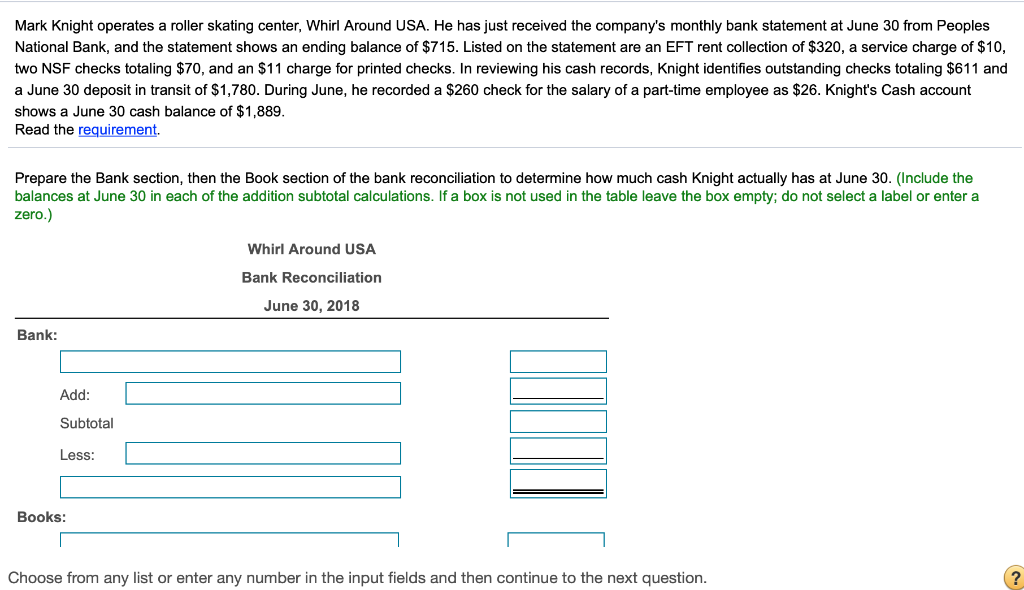

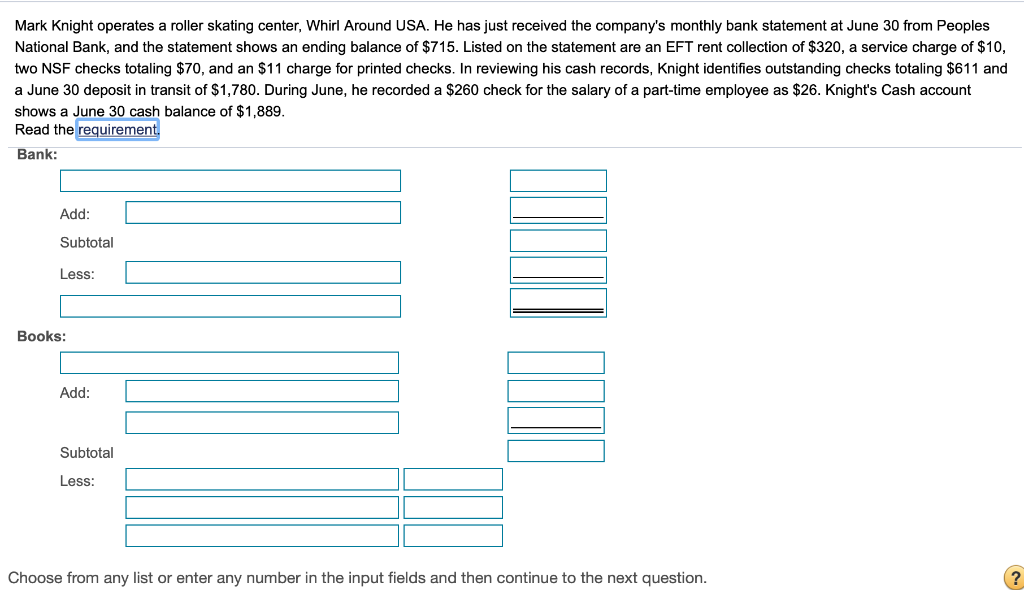

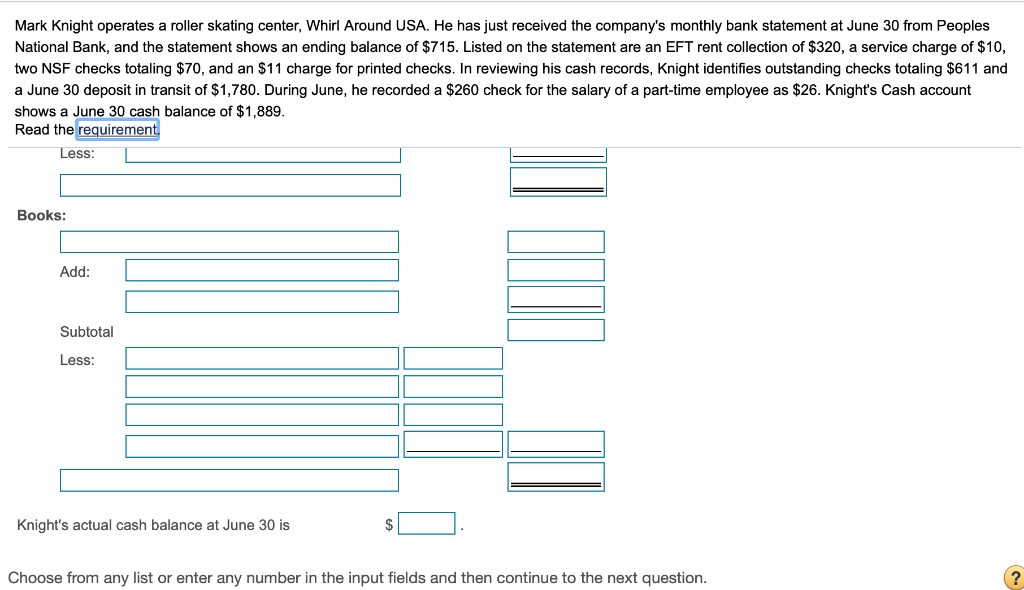

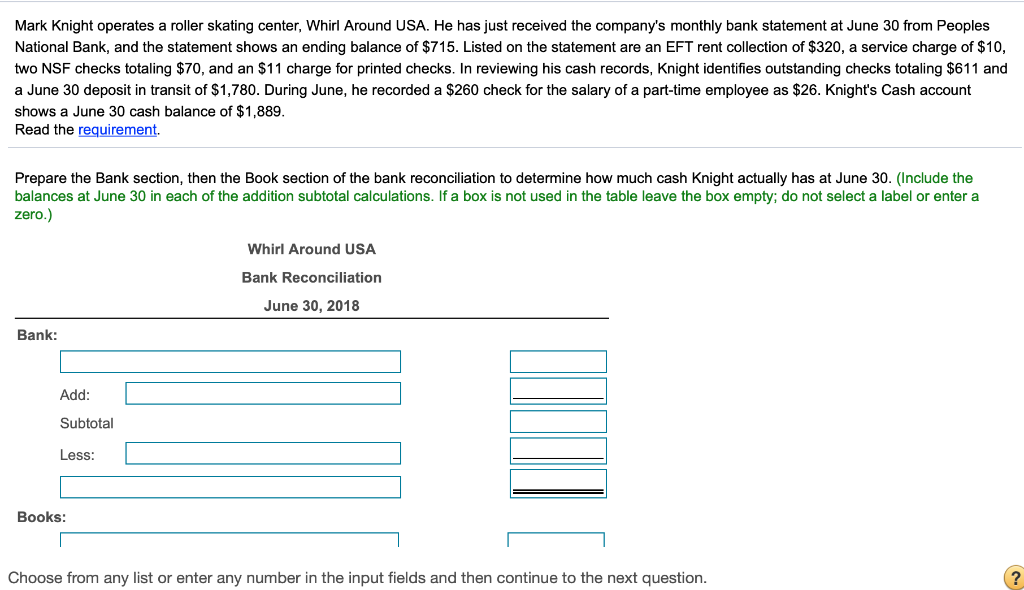

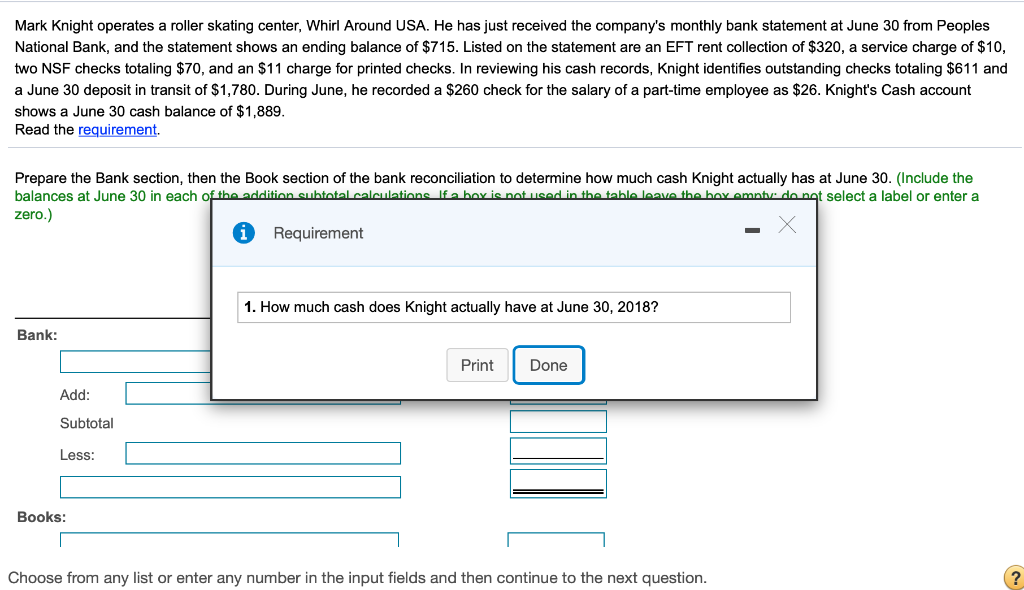

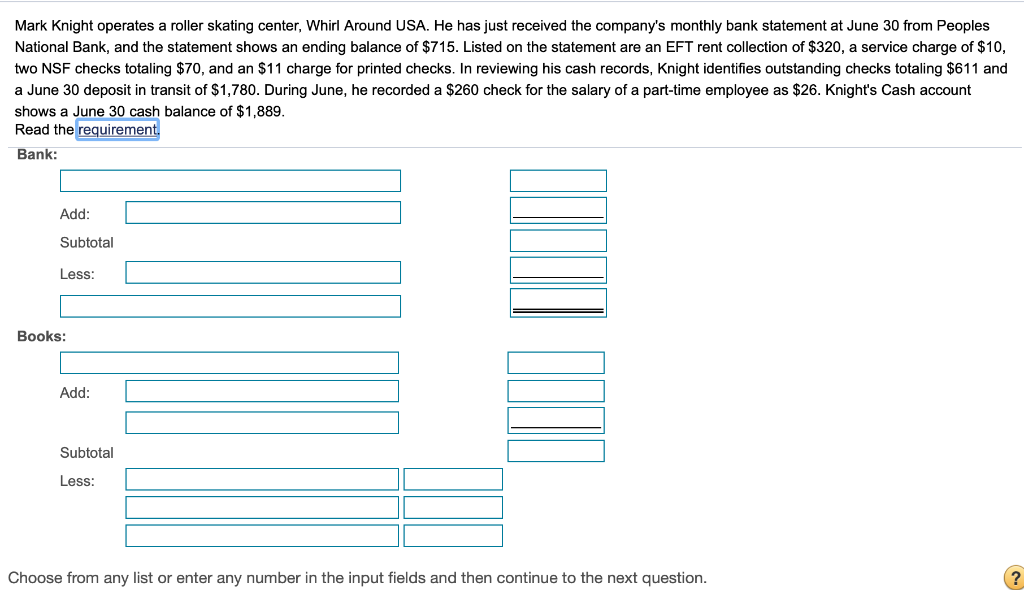

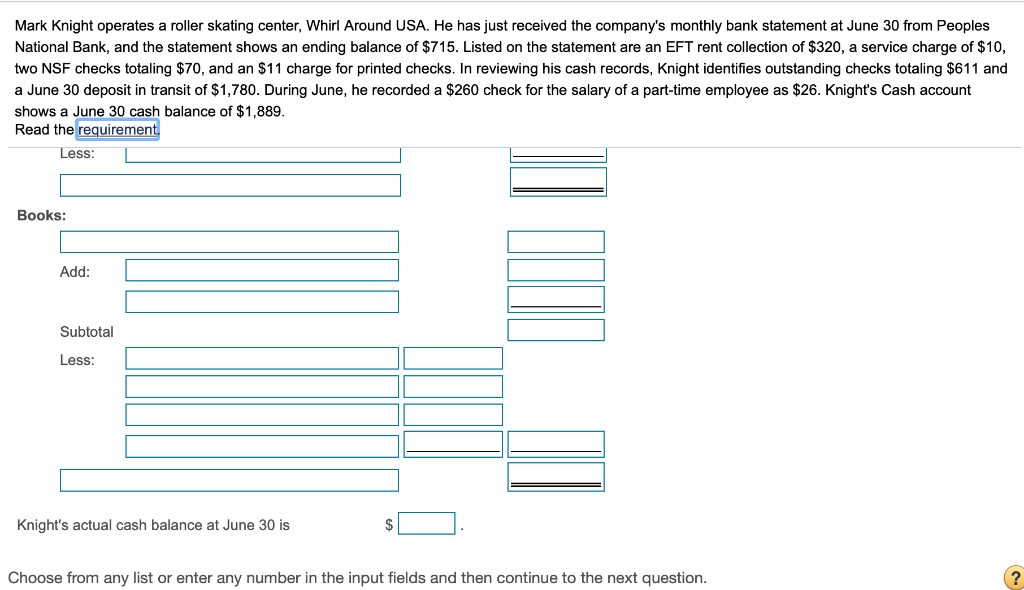

Mark Knight operates a roller skating center, Whirl Around USA. He has just received the company's monthly bank statement at June 30 from Peoples National Bank, and the statement shows an ending balance of $715. Listed on the statement are an EFT rent collection of $320, a service charge of $10, two NSF checks totaling $70, and an $11 charge for printed checks. In reviewing his cash records, Knight identifies outstanding checks totaling $611 and a June 30 deposit in transit of $1,780. During June, he recorded a $260 check for the salary of a part-time employee as $26. Knight's Cash account shows a June 30 cash balance of $1,889. Read the requirement. Prepare the Bank section, then the Book section of the bank reconciliation to determine how much cash Knight actually has at June 30. (Include the balances at June 30 in each of the addition subtotal calculations. If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Whirl Around USA Bank Reconciliation June 30, 2018 Bank: Add: Subtotal Less: Books: Choose from any list or enter any number in the input fields and then continue to the next question. ? Mark Knight operates a roller skating center, Whirl Around USA. He has just received the company's monthly bank statement at June 30 from Peoples National Bank, and the statement shows an ending balance of $715. Listed on the statement are an EFT rent collection of $320, a service charge of $10, two NSF checks totaling $70, and an $11 charge for printed checks. In reviewing his cash records, Knight identifies outstanding checks totaling $611 and a June 30 deposit in transit of $1,780. During June, he recorded a $260 check for the salary of a part-time employee as $26. Knight's Cash account shows a June 30 cash balance of $1,889. Read the requirement. Prepare the Bank section, then the Book section of the bank reconciliation to determine how much cash Knight actually has at June 30. (Include the balances at June 30 in each of the addition suhtotal calculations. If a boy is not used in the table leave the hay emnt do nat select a label or enter a zero.) Requirement 1. How much cash does Knight actually have at June 30, 2018? Bank: Print Done Add: Subtotal Less: Books: Choose from any list or enter any number in the input fields and then continue to the next question. ? Mark Knight operates a roller skating center, Whirl Around USA. He has just received the company's monthly bank statement at June 30 from Peoples National Bank, and the statement shows an ending balance of $715. Listed on the statement are an EFT rent collection of $320, a service charge of $10, two NSF checks totaling $70, and an $11 charge for printed checks. In reviewing his cash records, Knight identifies outstanding checks totaling $611 and a June 30 deposit in transit of $1,780. During June, he recorded a $260 check for the salary of a part-time employee as $26. Knight's Cash account shows a June 30 cash balance of $1,889. Read the requirement Bank: Add: Subtotal Less: Books: Add: Subtotal Less: Choose from any list or enter any number in the input fields and then continue to the next question. ? Mark Knight operates a roller skating center, Whirl Around USA. He has just received the company's monthly bank statement at June 30 from Peoples National Bank, and the statement shows an ending balance of $715. Listed on the statement are an EFT rent collection of $320, a service charge of $10, two NSF checks totaling $70, and an $11 charge for printed checks. In reviewing his cash records, Knight identifies outstanding checks totaling $611 and a June 30 deposit in transit of $1,780. During June, he recorded a $260 check for the salary of a part-time employee as $26. Knight's Cash account shows a June 30 cash balance of $1,889. Read the requirement Less: Books: Add: Subtotal Less: Knight's actual cash balance at June 30 is Choose from any list or enter any number in the input fields and then continue to the next