Answered step by step

Verified Expert Solution

Question

1 Approved Answer

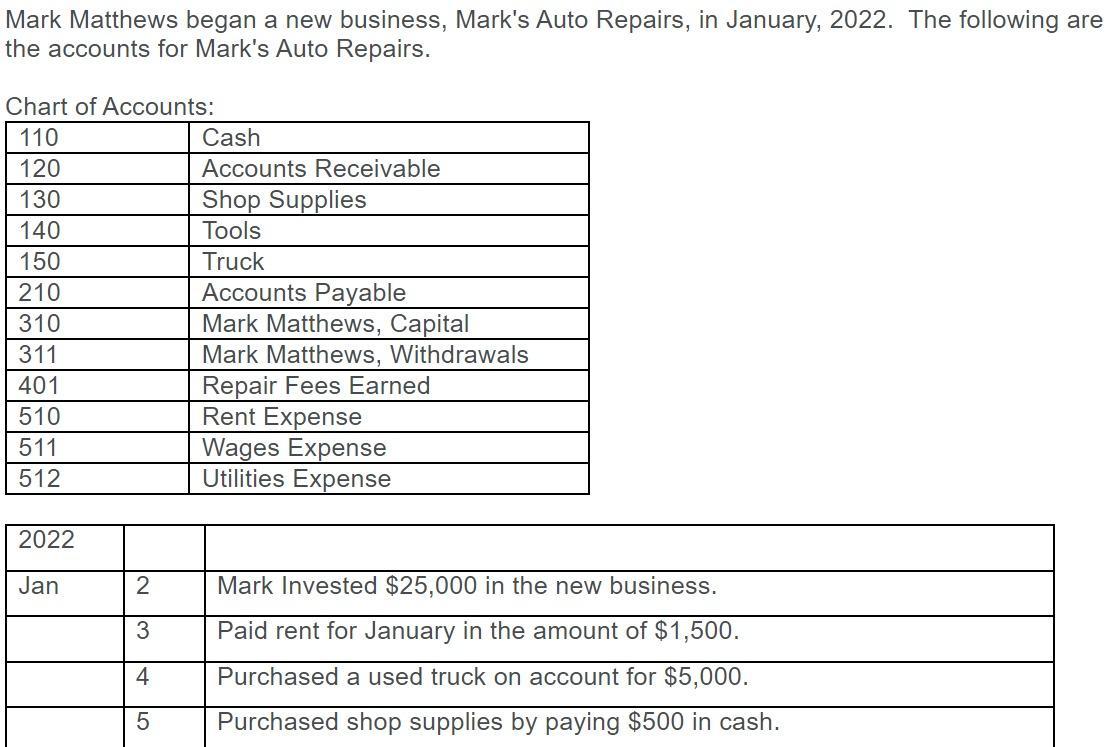

Mark Matthews began a new business, Mark's Auto Repairs, in January, 2022. The following are the accounts for Mark's Auto Repairs. Chart of Accounts:

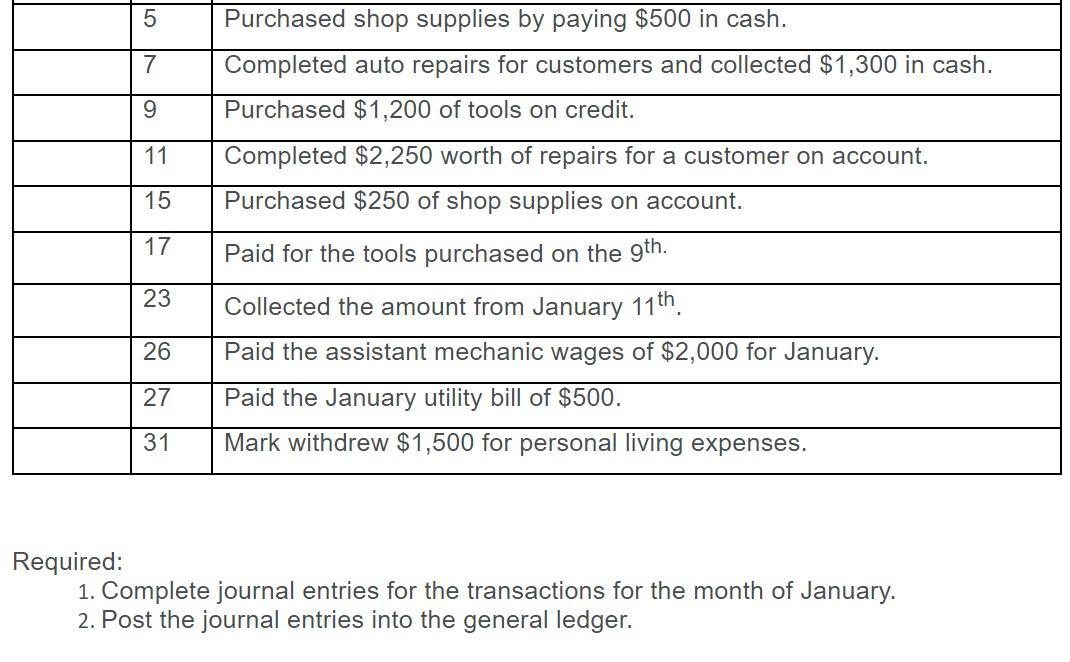

Mark Matthews began a new business, Mark's Auto Repairs, in January, 2022. The following are the accounts for Mark's Auto Repairs. Chart of Accounts: 110 120 130 140 150 210 310 311 401 510 511 512 2022 Jan 2 3 4 5 Cash Accounts Receivable Shop Supplies Tools Truck Accounts Payable Mark Matthews, Capital Mark Matthews, Withdrawals Repair Fees Earned Rent Expense Wages Expense Utilities Expense Mark Invested $25,000 in the new business. Paid rent for January in the amount of $1,500. Purchased a used truck on account for $5,000. Purchased shop supplies by paying $500 in cash. 5 Purchased shop supplies by paying $500 in cash. 7 Completed auto repairs for customers and collected $1,300 in cash. 9 Purchased $1,200 of tools on credit. 11 Completed $2,250 worth of repairs for a customer on account. 15 Purchased $250 of shop supplies on account. 17 Paid for the tools purchased on the 9th. Collected the amount from January 11th. Paid the assistant mechanic wages of $2,000 for January. Paid the January utility bill of $500. Mark withdrew $1,500 for personal living expenses. 23 26 27 31 Required: 1. Complete journal entries for the transactions for the month of January. 2. Post the journal entries into the general ledger.

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries On January 2 Mark invested 25000 in the business Debit Cash 110 25000 Credit Mark Matthews Capital 310 25000 On January 3 paid rent for January Debit Rent Expense 510 1500 Credit Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started