Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mark R. and Suzanne N. Hauser (ages 45 and 46) are married and live at 14130 Laramie Lane, Gillette, WY 82717. Mark is a consulting

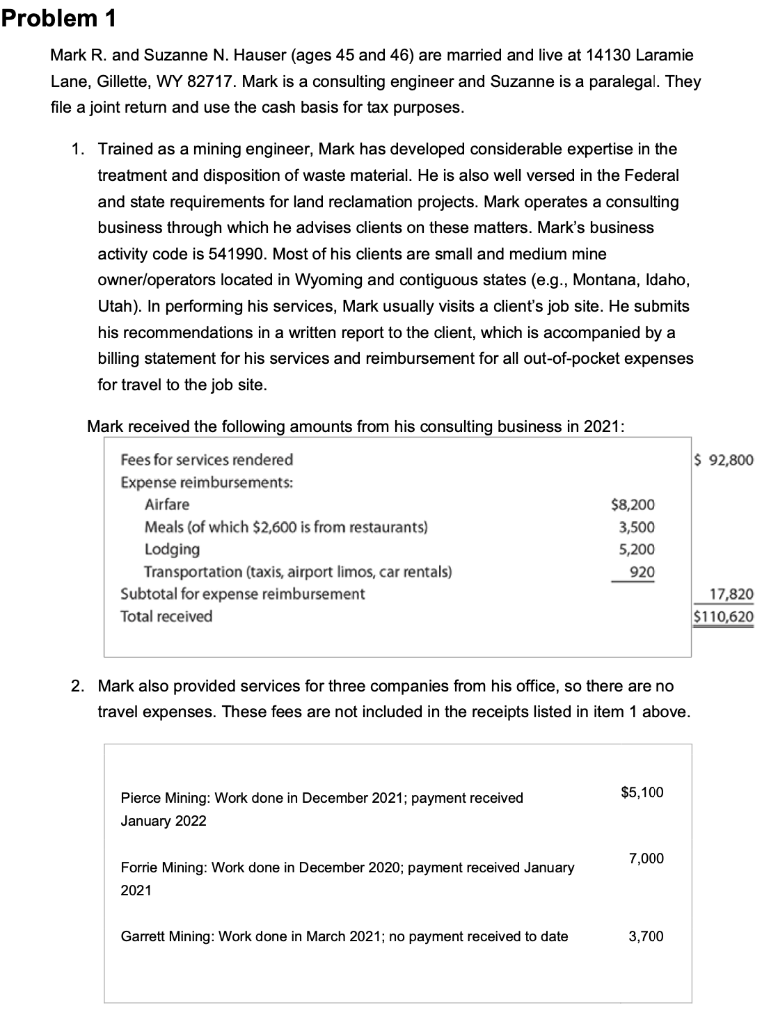

Mark R. and Suzanne N. Hauser (ages 45 and 46) are married and live at 14130 Laramie Lane, Gillette, WY 82717. Mark is a consulting engineer and Suzanne is a paralegal. They file a joint return and use the cash basis for tax purposes. 1. Trained as a mining engineer, Mark has developed considerable expertise in the treatment and disposition of waste material. He is also well versed in the Federal and state requirements for land reclamation projects. Mark operates a consulting business through which he advises clients on these matters. Mark's business activity code is 541990. Most of his clients are small and medium mine owner/operators located in Wyoming and contiguous states (e.g., Montana, Idaho, Utah). In performing his services, Mark usually visits a client's job site. He submits his recommendations in a written report to the client, which is accompanied by a billing statement for his services and reimbursement for all out-of-pocket expenses for travel to the job site. Mark received the following amounts from his consulting business in 2021: 2. Mark also provided services for three companies from his office, so there are no travel expenses. These fees are not included in the receipts listed in item 1 above. Mark R. and Suzanne N. Hauser (ages 45 and 46) are married and live at 14130 Laramie Lane, Gillette, WY 82717. Mark is a consulting engineer and Suzanne is a paralegal. They file a joint return and use the cash basis for tax purposes. 1. Trained as a mining engineer, Mark has developed considerable expertise in the treatment and disposition of waste material. He is also well versed in the Federal and state requirements for land reclamation projects. Mark operates a consulting business through which he advises clients on these matters. Mark's business activity code is 541990. Most of his clients are small and medium mine owner/operators located in Wyoming and contiguous states (e.g., Montana, Idaho, Utah). In performing his services, Mark usually visits a client's job site. He submits his recommendations in a written report to the client, which is accompanied by a billing statement for his services and reimbursement for all out-of-pocket expenses for travel to the job site. Mark received the following amounts from his consulting business in 2021: 2. Mark also provided services for three companies from his office, so there are no travel expenses. These fees are not included in the receipts listed in item 1 above

Mark R. and Suzanne N. Hauser (ages 45 and 46) are married and live at 14130 Laramie Lane, Gillette, WY 82717. Mark is a consulting engineer and Suzanne is a paralegal. They file a joint return and use the cash basis for tax purposes. 1. Trained as a mining engineer, Mark has developed considerable expertise in the treatment and disposition of waste material. He is also well versed in the Federal and state requirements for land reclamation projects. Mark operates a consulting business through which he advises clients on these matters. Mark's business activity code is 541990. Most of his clients are small and medium mine owner/operators located in Wyoming and contiguous states (e.g., Montana, Idaho, Utah). In performing his services, Mark usually visits a client's job site. He submits his recommendations in a written report to the client, which is accompanied by a billing statement for his services and reimbursement for all out-of-pocket expenses for travel to the job site. Mark received the following amounts from his consulting business in 2021: 2. Mark also provided services for three companies from his office, so there are no travel expenses. These fees are not included in the receipts listed in item 1 above. Mark R. and Suzanne N. Hauser (ages 45 and 46) are married and live at 14130 Laramie Lane, Gillette, WY 82717. Mark is a consulting engineer and Suzanne is a paralegal. They file a joint return and use the cash basis for tax purposes. 1. Trained as a mining engineer, Mark has developed considerable expertise in the treatment and disposition of waste material. He is also well versed in the Federal and state requirements for land reclamation projects. Mark operates a consulting business through which he advises clients on these matters. Mark's business activity code is 541990. Most of his clients are small and medium mine owner/operators located in Wyoming and contiguous states (e.g., Montana, Idaho, Utah). In performing his services, Mark usually visits a client's job site. He submits his recommendations in a written report to the client, which is accompanied by a billing statement for his services and reimbursement for all out-of-pocket expenses for travel to the job site. Mark received the following amounts from his consulting business in 2021: 2. Mark also provided services for three companies from his office, so there are no travel expenses. These fees are not included in the receipts listed in item 1 above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started