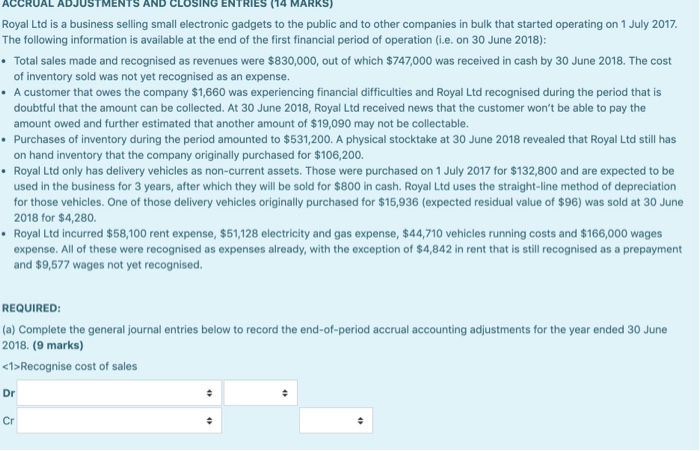

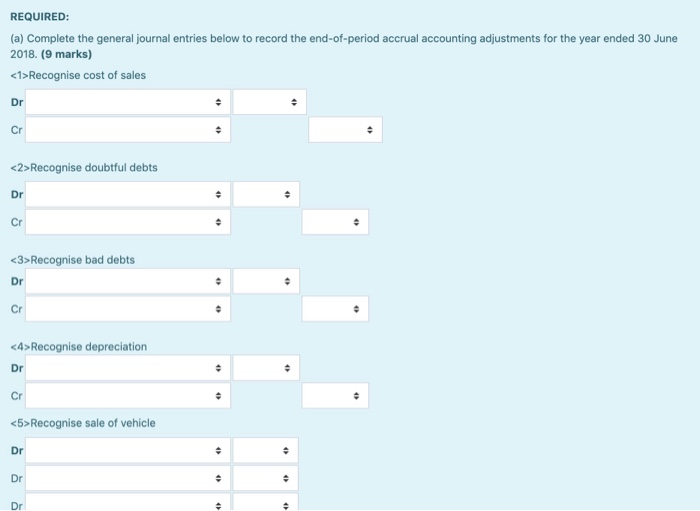

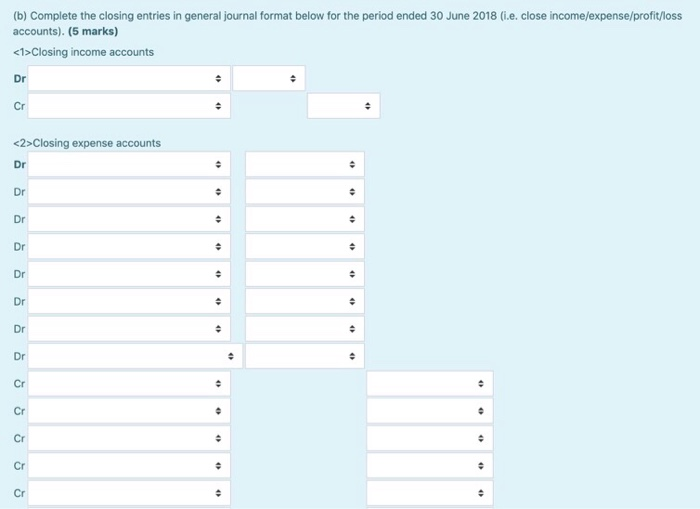

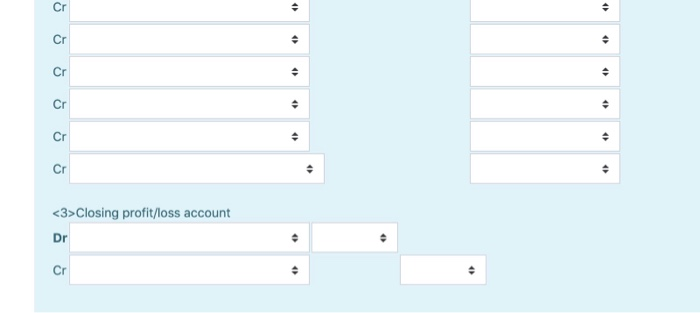

MARK Royal Ltd is a business selling small electronic gadgets to the public and to other companies in bulk that started operating on 1 July 2017. The following information is available at the end of the first financial period of operation (i.e. on 30 June 2018): Total sales made and recognised as revenues were $830,000, out of which $747,000 was received in cash by 30 June 2018. The cost of inventory sold was not yet recognised as an expense. A customer that owes the company $1,660 was experiencing financial difficulties and Royal Ltd recognised during the period that is doubtful that the amount can be collected. At 30 June 2018, Royal Ltd received news that the customer won't be able to pay the amount owed and further estimated that another amount of $19,090 may not be collectable. Purchases of inventory during the period amounted to $531,200. A physical stocktake at 30 June 2018 revealed that Royal Ltd still has on hand inventory that the company originally purchased for $106,200. Royal Ltd only has delivery vehicles as non-current assets. Those were purchased on 1 July 2017 for $132,800 and are expected to be used in the business for 3 years, after which they will be sold for $800 in cash. Royal Ltd uses the straight-line method of depreciation for those vehicles. One of those delivery vehicles originally purchased for $15,936 (expected residual value of $96) was sold at 30 June 2018 for $4,280. Royal Ltd incurred $58,100 rent expense, $51,128 electricity and gas expense, $44,710 vehicles running costs and $166,000 wages expense. All of these were recognised as expenses already, with the exception of $4,842 in rent that is still recognised as a prepayment and $9,577 wages not yet recognised. REQUIRED: (a) Complete the general journal entries below to record the end-of-period accrual accounting adjustments for the year ended 30 June 2018. (9 marks) Recognise cost of sales Dr > Cr REQUIRED: (a) Complete the general journal entries below to record the end-of-period accrual accounting adjustments for the year ended 30 June 2018. (9 marks) Recognise cost of sales Dr Cr Recognise doubtful debts > Dr + Cr . Recognise bad debts Dr Cr Recognise depreciation Dr 40 Cr . Recognise sale of vehicle Dr . Dr . . Dr (b) Complete the closing entries in general journal format below for the period ended 30 June 2018 (i.e. close income/expense/profit/loss accounts). (5 marks) Closing income accounts Dr . Cr Closing expense accounts > Dr 0 Dr . . Dr 4) Dr . Dr 4 . Dr Dr . . > Dr Cr . . Cr Cr Cr 0 Cr Cr Cr Cr Cr Cr . Cr Closing profit/loss account Dr Cr . 0