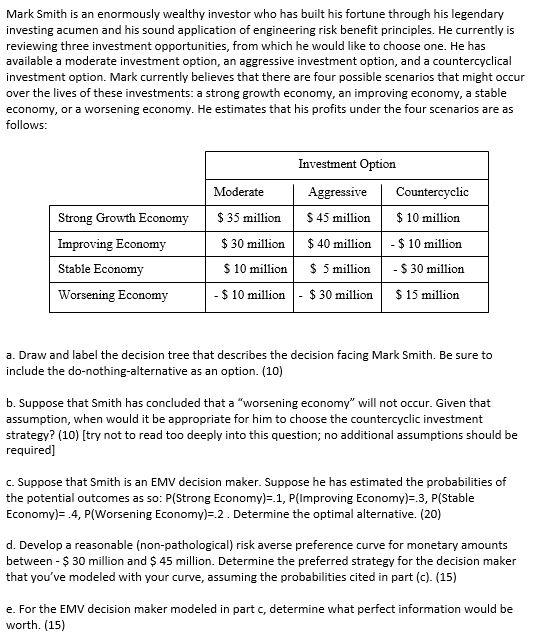

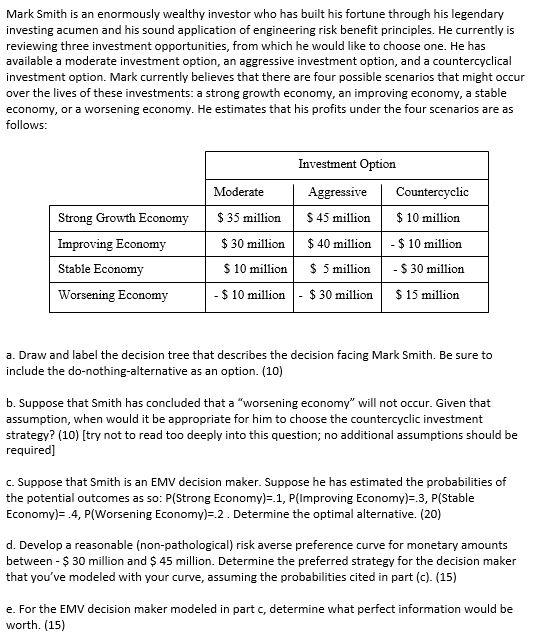

Mark Smith is an enormously wealthy investor who has built his fortune through his legendary investing acumen and his sound application of engineering risk benefit principles. He currently is reviewing three investment opportunities, from which he would like to choose one. He has available a moderate investment option, an aggressive investment option, and a countercyclical investment option. Mark currently believes that there are four possible scenarios that might occur over the lives of these investments: a strong growth economy, an improving economy, a stable economy, or a worsening economy. He estimates that his profits under the four scenarios are as follows: Strong Growth Economy Improving Economy Stable Economy Worsening Economy Investment Option Moderate Aggressive Countercyclic $ 35 million $ 45 million $ 10 million $ 30 million $ 40 million - $ 10 million $ 10 million $ 5 million - $ 30 million - $ 10 million - $ 30 million $ 15 million a. Draw and label the decision tree that describes the decision facing Mark Smith. Be sure to include the do-nothing-alternative as an option. (10) b. Suppose that Smith has concluded that a "worsening economy" will not occur. Given that assumption, when would it be appropriate for him to choose the countercyclic investment strategy? (10) try not to read too deeply into this question; no additional assumptions should be required) c. Suppose that Smith is an EMV decision maker. Suppose he has estimated the probabilities of the potential outcomes as so: P(Strong Economy)=1, P(Improving Economy)=-3, P(Stable Economy)= .4, P(Worsening Economy)= 2. Determine the optimal alternative. (20) d. Develop a reasonable (non-pathological) risk averse preference curve for monetary amounts between - $ 30 million and $ 45 million. Determine the preferred strategy for the decision maker that you've modeled with your curve, assuming the probabilities cited in part (c). (15) e. For the EMV decision maker modeled in partc, determine what perfect information would be worth. (15) Mark Smith is an enormously wealthy investor who has built his fortune through his legendary investing acumen and his sound application of engineering risk benefit principles. He currently is reviewing three investment opportunities, from which he would like to choose one. He has available a moderate investment option, an aggressive investment option, and a countercyclical investment option. Mark currently believes that there are four possible scenarios that might occur over the lives of these investments: a strong growth economy, an improving economy, a stable economy, or a worsening economy. He estimates that his profits under the four scenarios are as follows: Strong Growth Economy Improving Economy Stable Economy Worsening Economy Investment Option Moderate Aggressive Countercyclic $ 35 million $ 45 million $ 10 million $ 30 million $ 40 million - $ 10 million $ 10 million $ 5 million - $ 30 million - $ 10 million - $ 30 million $ 15 million a. Draw and label the decision tree that describes the decision facing Mark Smith. Be sure to include the do-nothing-alternative as an option. (10) b. Suppose that Smith has concluded that a "worsening economy" will not occur. Given that assumption, when would it be appropriate for him to choose the countercyclic investment strategy? (10) try not to read too deeply into this question; no additional assumptions should be required) c. Suppose that Smith is an EMV decision maker. Suppose he has estimated the probabilities of the potential outcomes as so: P(Strong Economy)=1, P(Improving Economy)=-3, P(Stable Economy)= .4, P(Worsening Economy)= 2. Determine the optimal alternative. (20) d. Develop a reasonable (non-pathological) risk averse preference curve for monetary amounts between - $ 30 million and $ 45 million. Determine the preferred strategy for the decision maker that you've modeled with your curve, assuming the probabilities cited in part (c). (15) e. For the EMV decision maker modeled in partc, determine what perfect information would be worth. (15)