Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mark Sun Ranch is a 40-room hotel with a 30-seat restaurant. Bennett, the owner of the hotel, has asked you to use your knowledge of

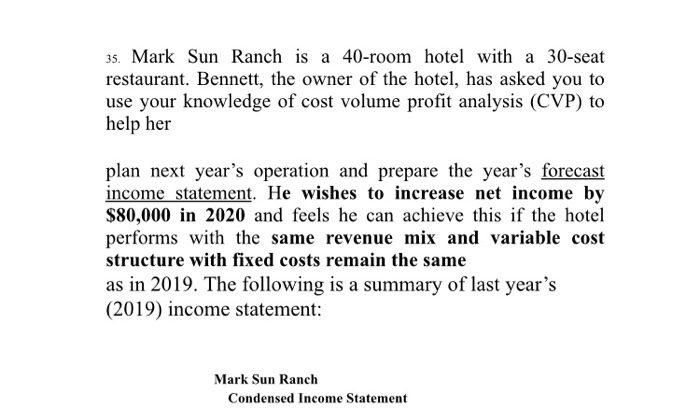

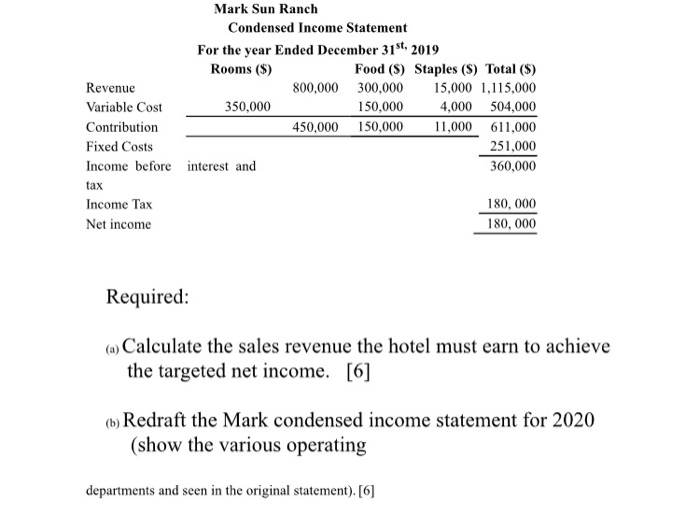

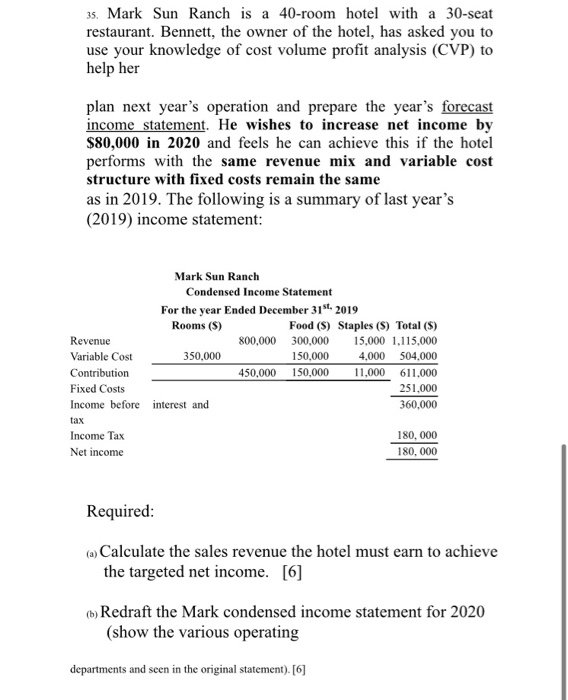

Mark Sun Ranch is a 40-room hotel with a 30-seat restaurant. Bennett, the owner of the hotel, has asked you to use your knowledge of cost volume profit analysis (CVP) to help her

plan next years operation and prepare the years forecast income statement. He wishes to increase net income by $80,000 in 2020 and feels he can achieve this if the hotel performs with the same revenue mix and variable cost structure with fixed costs remain the same

as in 2019. The following is a summary of last years (2019) income statement:

Mark Sun Ranch

Condensed Income Statement

For the year Ended December 31st, 2019

Rooms ($)

Food ($)

Staples ($)

Total ($)

Revenue

800,000

300,000

15,000

1,115,000

Variable Cost

350,000

150,000

4,000

504,000

Contribution

450,000

150,000

11,000

611,000

Fixed Costs

251,000

Income before

interest and

360,000

tax

Income Tax

180, 000

Net income

180, 000

Required:

(a) Calculate the sales revenue the hotel must earn to achieve the targeted net income. [6]

(b) Redraft the Mark condensed income statement for 2020 (show the various operating

departments and seen in the original statement).

[6]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started