Answered step by step

Verified Expert Solution

Question

1 Approved Answer

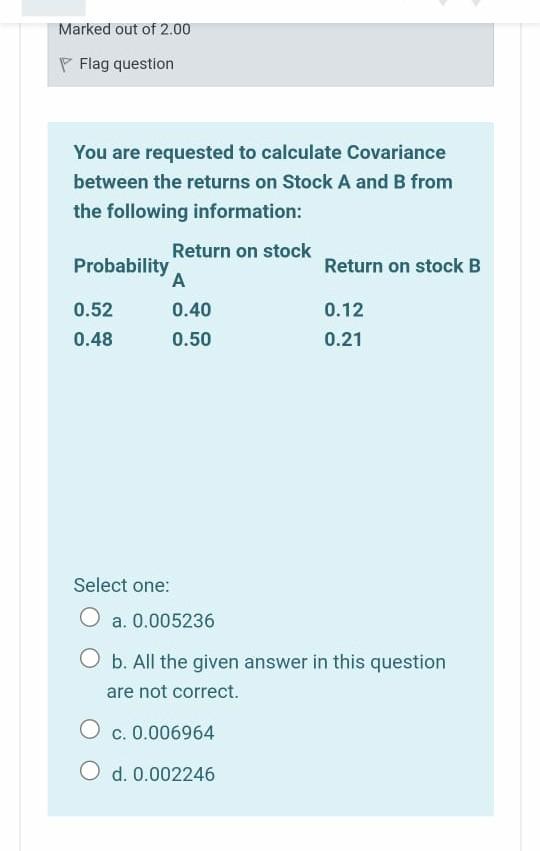

Marked out of 2.00 Flag question You are requested to calculate Covariance between the returns on Stock A and B from the following information: Return

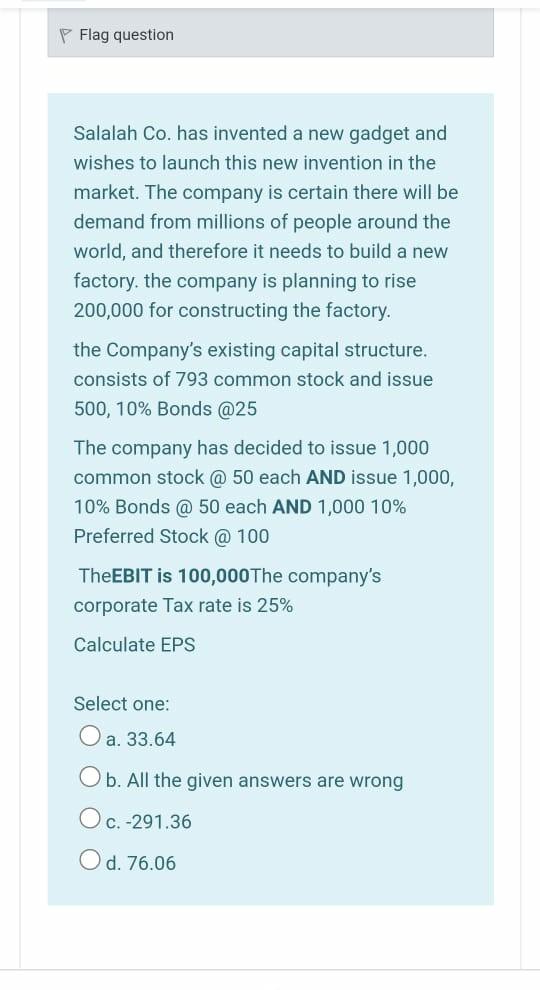

Marked out of 2.00 Flag question You are requested to calculate Covariance between the returns on Stock A and B from the following information: Return on stock B Return on stock Probability A 0.52 0.40 0.48 0.50 0.12 0.21 Select one: O a. 0.005236 O b. All the given answer in this question are not correct. c. 0.006964 O d. 0.002246 Flag question Salalah Co. has invented a new gadget and wishes to launch this new invention in the market. The company is certain there will be demand from millions of people around the world, and therefore it needs to build a new factory, the company is planning to rise 200,000 for constructing the factory. the Company's existing capital structure. consists of 793 common stock and issue 500, 10% Bonds @25 The company has decided to issue 1,000 common stock @ 50 each AND issue 1,000, 10% Bonds @ 50 each AND 1,000 10% Preferred Stock @ 100 TheEBIT is 100,000 The company's corporate Tax rate is 25% Calculate EPS Select one: O a. 33.64 O b. All the given answers are wrong O c.-291.36 O d. 76.06

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started