Answered step by step

Verified Expert Solution

Question

1 Approved Answer

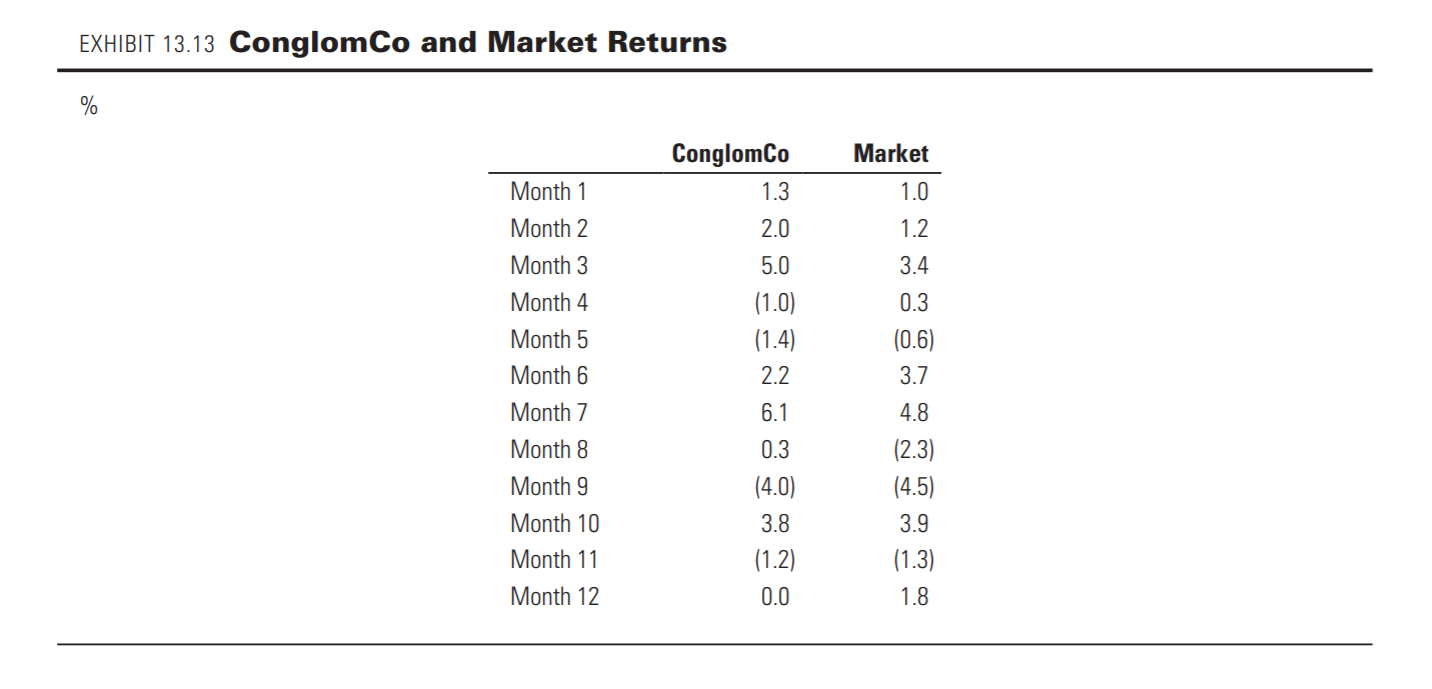

Market betas are typically computed with five years of monthly data or two years of weekly data. For computational simplicity, we present only 12 data

Market betas are typically computed with five years of monthly data or two years of weekly data. For computational simplicity, we present only 12 data points in Exhibit 13.13 for ConglomCo, a large conglomerate firm. Using a spreadsheet regression package or other software tool, compute a regression beta for ConglomCo.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started