..marketing

1.

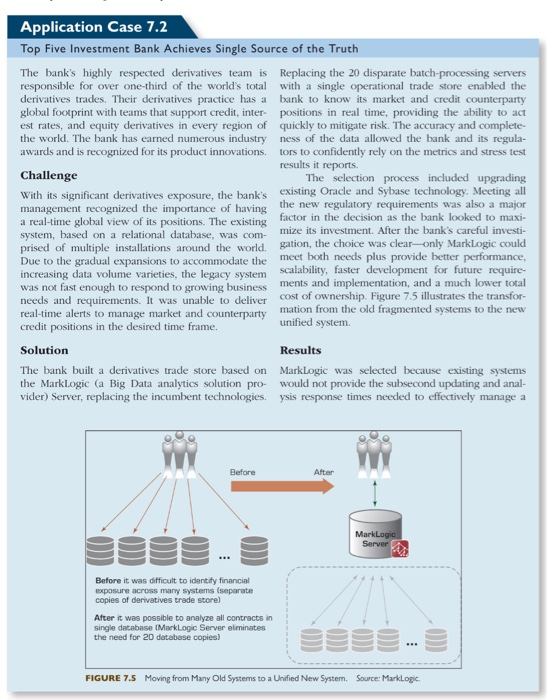

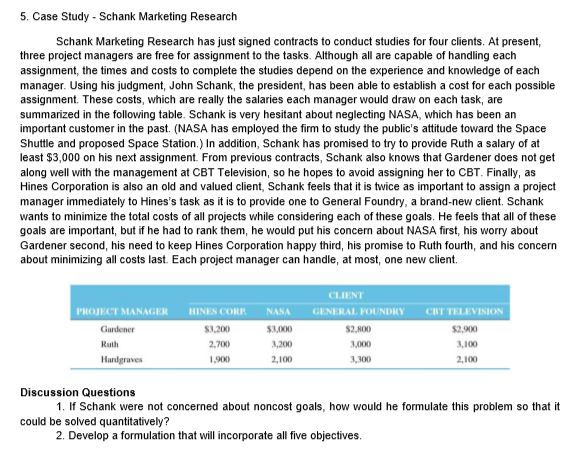

Application Case 7.2 Top Five Investment Bank Achieves Single Source of the Truth The bank's highly respected derivatives team is Replacing the 20 disparate batch-processing servers responsible for over one-third of the world's total with a single operational trade store enabled the derivatives trades. Their derivatives practice has a bank to know its market and credit counterparty global footprint with teams that support credit, inter- positions in real time, providing the ability to act est rates, and equity derivatives in every region of quickly to mitigate risk. The accuracy and complete- the world. The bank has earned numerous industry ness of the data allowed the bank and its regula- awards and is recognized for its product innovations. tors to confidently rely on the metrics and stress test results it reports. Challenge The selection process included upgrading With its significant derivatives exposure, the bank's existing Oracle and Sybase technology. Meeting all management recognized the importance of having the new regulatory requirements was also a major a real-time global view of its positions. The existing factor in the decision as the bank looked to maxi- system, based on a relational database, was com- mize its investment. After the bank's careful investi- prised of multiple installations around the world. gation, the choice was clear-only MarkLogic could Due to the gradual expansions to accommodate the meet both needs plus provide better performance, increasing data volume varieties, the legacy system scalability, faster development for future require- was not fast enough to respond to growing business ments and implementation, and a much lower total needs and requirements. It was unable to deliver cost of ownership. Figure 7.5 illustrates the transfor- real-time alerts to manage market and counterparty mation from the old fragmented systems to the new credit positions in the desired time frame. unified system. Solution Results The bank built a derivatives trade store based on MarkLogic was selected because existing systems the MarkLogic (a Big Data analytics solution pro- would not provide the subsecond updating and anal- vider) Server, replacing the incumbent technologies. ysis response times needed to effectively manage a Before After MarkLogic Server Before it was difficult to identify financial exposure across many systems (separate copies of derivatives trade scored After it was possible to analyze all contracts in single database (MarkLogic Server eliminates the need for 20 database copies) FIGURE 7.5 Moving from Many Old Systems to a Unified New System. Source: MarkLogic.5. Case Study - Schank Marketing Research Schank Marketing Research has just signed contracts to conduct studies for four clients. At present, three project managers are free for assignment to the tasks. Although all are capable of handling each assignment, the times and costs to complete the studies depend on the experience and knowledge of each manager. Using his judgment, John Schank, the president, has been able to establish a cost for each possible assignment. These costs, which are really the salaries each manager would draw on each task, are summarized in the following table. Schank is very hesitant about neglecting NASA, which has been an important customer in the past. (NASA has employed the firm to study the public's attitude toward the Space Shuttle and proposed Space Station.) In addition, Schank has promised to try to provide Ruth a salary of at least $3,000 on his next assignment. From previous contracts, Schank also knows that Gardener does not get along well with the management at CBT Television, so he hopes to avoid assigning her to CBT. Finally, as Hines Corporation is also an old and valued client, Schank feels that it is twice as important to assign a project manager immediately to Hines's task as it is to provide one to General Foundry, a brand-new client, Schank wants to minimize the total costs of all projects while considering each of these goals. He feels that all of these goals are important, but if he had to rank them, he would put his concern about NASA first, his worry about Gardener second, his need to keep Hines Corporation happy third, his promise to Ruth fourth, and his concern about minimizing all costs last. Each project manager can handle, at most, one new client. CLIENT PROJECT MANAGER HINES CORP NANA GENERAL FOUNDRY ERT TELEVISION Gardener $1.200 $3,000 $2.800 $2.900 Ruth 2,700 2,200 3,000 3,100 Hardgraves 1.900 2,100 3,300 2,100 Discussion Questions 1. If Schank were not concerned about noncost goals, how would he formulate this problem so that it could be solved quantitatively? 2. Develop a formulation that will incorporate all five objectives.derivatives trade book that represents nearly one-third Next Steps of the global market. Trade data is now aggregated accurately across the bank's entire derivatives portfo- The successful implementation and performance of the lio, allowing risk management stakeholders to know new system resulted in the bank's examination of other the true enterprise risk profile, to conduct predictive areas where it could extract more value from its Big analyses using accurate data, and to adopt a forward- Data-structured, unstructured, and/or polystructured. looking approach. Not only are hundreds of thou- Two applications are under active discussion. Its equity sands of dollars of technology costs saved each year, research business sees an opportunity to significantly but the bank does not need to add resources to meet boost revenue with a platform that provides real-time regulators' escalating demands for more transparency research, repurposive, and content delivery. The bank and stress-testing frequency. Here are the highlights: also sees the power of centralizing customer data to improve onboarding, increase cross-selling opportuni- . An alerting feature keeps users appraised of up- ties, and support know-your-customer requirements. to-the-minute market and counterparty credit changes so they can take appropriate actions. QUESTIONS FOR DISCUSSION . Derivatives are stored and traded in a single MarkLogic system requiring no downtime for 1. How can Big Data benefit large-scale trading banks? maintenance, a significant competitive advantage. 2. How did the MarkLogic infrastructure help ease . Complex changes can be made in hours ver- the leveraging of Big Data? sus days, weeks, and even months needed by 3. What were the challenges, the proposed solu- competitors. tion, and the obtained results? . Replacing Oracle and Sybase significantly reduced operations costs: one system versus Source: MarkLogic. (2012). Top 5 investment bank achieves sin- 20, one database administrator instead of up to gle source of truth. marklogic.com/resources/top-5-derivatives- trading-bank-achieves-single-source-of-truth (accessed July 2016). 10, and lower costs per trade.Marketing in Action Case Real Choices at Ford Ford Motor Company has committed to investing $1.6 billion company facilities. " Over the past 90 years Ford has provided to construct a small car plant in the San Luis Potosi State in more than $8 billion to build and develop its production capa- Mexico. This will result in the creation of more than 2,800 jobs bilities in the country. Currently, Ford has two assembly plants, in the country, The Center for Automotive Research states that two stamping plants, and an engine plant in Mexico. Increas U.S. automotive labor costs average around $30 per hour and ing production output in the country is consistent with Ford's are substantially higher than those in Mexico which average long-term manufacturing plans. around $5 per hour. This means that moving production to The additional investment in Mexico is not without its crit- Mexico will allow Ford to lower its cost for small cars and make ics. The issue of jobs leaving the country has always been a part Ford more competitive in the global auto marketplace. The of political debate in Washington, D.C. The announcement of move will, in turn, allow Ford to reallocate its U.S. facilities to- Ford's plans was made during the most recent presidential ward larger vehicles with higher profit margins, like SUVs and campaign and created dissent among the candidates. One can- F-Series trucks. Furthermore, Mexico has the necessary trans- didate called for increased tariffs and penalties for U.S. firms, portation infrastructure to efficiently export the cars back to like Ford, that choose to relocate manufacturing to foreign the U.S. and other markets. markets to lower costs. Ford has reacted with a vigorous de- Mexico has been a part of Ford's manufacturing history fense of its business practices. As per CEO Mark Fields, "more since 1925 when the company became the first automobile than 80 percent of our North American investment annually is manufacturer in the country. According to Gabriel Lopez, pres- in the U.S., and 97 percent of our North American engineering ident and CEO of Ford of Mexico, "Ford of Mexico is the fourth is conducted in the U.S." largest producer of vehicles, the fourth largest producer of en- Dennis Williams, President of the United Auto Work- gines and the second country in the global auto parts supply ers (UAW) union, is another voice of dissent to the move.CHAPTER 2 | GLOBAL, ETHICAL, AND SUSTAINABLE MARKETING 65 He states that as production moves outside of the U.S. to its dependence on foreign production? In the current political low-wage countries, American workers suffer at home. This climate should the company rethink its plans? is a serious issue for the company, but it is projected that UAW members will see their wages grow domestically. This will make Ford's move to Mexico even more advantageous for You Make the Call the company. Moreover, top management at the company 2-35. What is the decision facing Ford? explained that over the next few years, Ford will spend more 2-36. What factors are important in understanding this dedi- than $9 billion in the U.S., which is expected to create or sion situation? maintain 8,500 jobs. 2-37. What are the alternatives? Increasing its presence in Mexico is not the only initiative 2-38. What decision(s) do you recommend? Ford is implementing. As a part of its strategic "One Ford" 2-39. What are some ways to implement your recommen plan the company has allocated billions of dollars to expand dation? it's global production capabilities in places like Spain, Germany, China, the Middle East, and Africa. While Ford's improves its financial outlook, how will it deal with the negative attention generated by moving jobs outside the United States? Is it pos- sible for the company to increase its profitability and reduce