,,marketing

1.

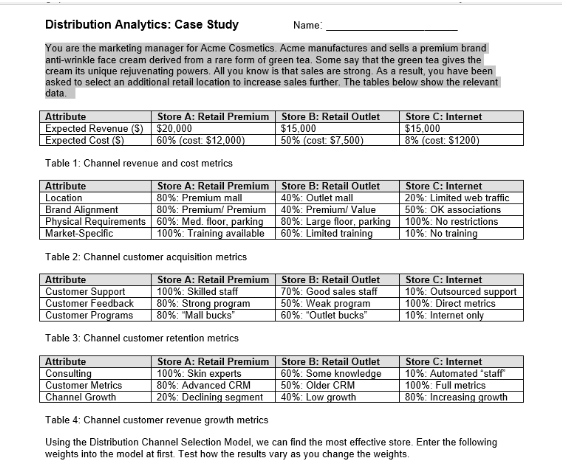

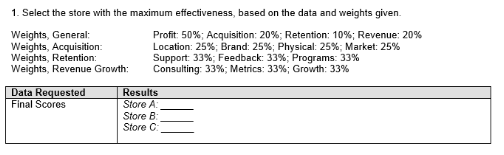

Nike's leadership in athletic shoes was built on cheap Far Eastern labor and massive invest- ments in product development and marketing. Over the last five years, Nike averaged thrice the profitabil ity and four times the growth of the rest of the U.S. TRONIC'S INC shoe industry. But competitors are busy cloning its Boutique strategy. Reebok International, for one, sources 95% of its shoes from South Korea, spends heavily on product styling, and has won endorsements from rock stars as SHOEMAKER well as athletes. Reebok's sales and profits expanded fivefold in 1985, while Nike's actually declined. Piedmont Aviation's hubs at Baltimore, CLOSING! Charlotte, and Dayton tie together dozens of small and mid-sized cities. Since the major airlines had neglected these routes, Piedmont grew three times as fast as the NESS rest of the industry and was six times as profitable. But others are now muscling in: People Express has started to encroach, and American Airlines' planned hub at Raleigh will hurt Piedmont's operations out of Balti- more and Charlotte. Analog Devices, Nike, and Piedmont are very different from one another, yet they face the same threat: copying by competitors. Their competi- "My big mistake was sticking to my last." tive advantages are insecure, or contestable, because each can be duplicated. These examples also show that some success stories do revolve around contestable ad- empt its competitors. Caveat preemptor: first-movers vantages: all of a company's competitors may be stupid have to be especially wary of environmental changes some of the time. But can you count on your competi- that can erode the value of their early investments. tors being stupid all of the time? The historical record Size is an advantage only if, net net, there suggests otherwise. That is why sustainable advan- are compelling economies to being large. Such econo- tages-advantages anchored in industry economics- mies have three possible bases: scale, experience, and command attention. scope. The literature on strategy is crammed with accounts of why a sustainable competitive advan- Scale economies usually summon up a tage is A Good Thing To Have. But all those accounts vision of a global factory running flat out. But it is im- beg two key questions: Which advantages tend to be portant to remember that scale can work on a national, sustainable, and why? regional, or even local level, and that its effects need Sustainable advantages fall into three not be confined to manufacturing. categories: size in the targeted market, superior access Wal-Mart, the discount merchandiser, to resources or customers, and restrictions on competi- illustrates the power of local and regional scale econo- tors' options. Note that these advantages are nonex- mies. Historically, it focused on small Sunbelt towns clusive. They can, and often do, interact. The more of that its competitors had neglected. Most of these towns them, the better. could not support two discounters, so once Wal-Mart made a long-lived, largely unrecoverable investment to service such a town, it gained a local monopoly. The company reinforced this advantage by wrapping Benefits of size its stores in concentric rings around regional distribu- tion centers. By the time competitors realized that this Size advantages exist because markets policy cut distribution costs in half, Wal-Mart had pre- are finite, If a business can commit to being large, com- empted enough store sites to render competing region- petitors may resign themselves to remaining smaller. al warehouses unviable. Now you know why Sam What holds them back is the fear that if they matched Walton is one of the richest men in America. the leader's size, supply might exceed demand by The Wal-Mart story also shows the lim- enough to make the market unprofitable for everyone. its to scale economies. K mart and other discounters Commitment to being large means mak: are beginning to enter some of Wal-Mart's larger loca- ing durable, irreversible investments. To exploit com- tions. The problem, ironically, is market growth: be- mitment opportunities, a business must be able to pre- cause of the boom in the Sunbelt, some of these towns"If a man...make a better mouse-trap to deter imitation. On average, imitation costs a third than his neighbour, tho' he build his house in the less than innovation and is a third quicker.' woods, the world will make a beaten path to his door." 2 Production. New processes are even Attributed to one of Emerson's lectures in the nine- harder to protect than new products. Incremental teenth century, these words seem to have anticipated improvements to old processes are vulnerable too- the exhortations of the twentieth: manage for unique- if consultants are to be believed, 60% to 90% of all ness, develop a distinctive competence, create compet- "learning" ultimately diffuses to competitors. Produc- itive advantage. tion often blurs competitive advantage: recent studies show that unionized workers pocket two-thirds of the potential profits in U.S. manufacturing. "For outstanding performance, 3 Marketing. Nonprice instruments are usually ascribed more potency than price changes, part- a company has to beat the competition. ly because they are harder to match. Rivals often react The trouble is the to a particular move, however, by adjusting their entire competition has heard marketing mix. Such reactions tend to be intense, lim- ited data on advertising suggest that the moves and the same message." countermoves frequently cancel out." In principle, threats like these have al- ways been part of doing business. In practice, they have But that's not all Emerson had to say multiplied with the intensification of domestic and in- about investment in better mousetraps; he also re- ternational competition. How should a business cope marked, "Invention breeds invention." What will re- with such competitive pressure? For guidance, we can strain rivals from imitating or even improving on an turn from cross-industry findings to cases. invention? That question preoccupies the real mouse- trap industry as it staggers from imported copies of its innovative glueboards and repeating traps. That question is also central to compet- itive strategy. Strategists insist that for outstanding Keeping the edge performance, a company has to beat out the competi- tion. The trouble is that the competition has heard the same message. Deadlocks ensue. Look at the cross- This study of sustainable success grew industry findings about three competitive hot spots: out of a sample of 100 businesses that far outperformed their industries in the recent past. Not all of them Product innovation. Competitors secure promise to be as successful in the coming decade. The detailed information on 70% of all new products with- vulnerable ones have a lesson to impart. in a year of their development. Patenting usually fails Analog Devices, which focuses on spe- cialized applications for analog semiconductors, has Mr. Gherawat is an assistant professor of invested countercyclically to cash in on business up- business administration at the Harvard Business School, turns. The results: 80% faster growth and 50% higher where he teaches courses on industry and competitive profitability than the rest of the semiconductor indus- analysis. His research and consulting focus on competitive try. But existing competitors seem set to copy Analog's dynamics and strategic investments. This is his second ar- investment policy, and new ones-notably the Japanese ticle for HBR. - are invading its profitable niches.can now accommodate two discounters. And even the industry. In the 1980s it has pushed hard into robotics, warehousing advantages look insecure in the regions with good reason. Its cumulative R&D experience into which Wal-Mart is expanding, it probably won't gives the company such a big lead in the machine tool be able to blanket these areas with stores before com- segment that no domestic challenger can rationally petitors move in. commit to matching its R&.D, sales-force, or service expenditures. Furthermore, the technologies and cus- Experience effects are based on size over tomers for its computerized, numerically controlled time, rather than size at a particular point in time. If machine tools overlap with those for robotics. And the you think about it, experience is a kind of irreversible, company's R&D, sales, and service activities are all market-specific investment. While it is usually cited in very volume sensitive, which slashes the incremental the context of the experience curve-the inverse rela- costs of moving into robotics. These factors make it a tion between cumulative production and average formidable contender in the industry. cost-its ambit is actually much broader. For example, A company pursuing a sustainable experience has been shown to increase the operating scope advantage cannot afford to run its businesses as reliability of processing plants, the success rate of prod- isolated units. Activities have to be coordinated and al- uct introductions, and the marketability of high-tech lowances must be made for contributions from one products. business to the success of another. This makes scope Experience effects- especially experi- economies especially hard to implement. ence curves-have come under heavy fire recently be- cause they were oversold in the 1970s. Yet some com- panies have parlayed them into competitive success. Take Lincoln Electric's experience in the electric weld- Access advantages ing industry. Ever since John Lincoln developed the portable arc welder in 1895, Lincoln Electric has out- Preferred access to resources or custom- raced its competition down the experience curve. In its ers can award a business a sustainable advantage that ninth decade it still commands a 7% to 15% cost ad- is independent of size. The advantage persists because vantage over its four largest rivals. competitors are held back by an investment asymme Lincoln is an object lesson about when try: they would suffer a penalty if they tried to imitate and how to exploit experience effects. As the product the leader. pioneer it had a first-mover advantage, and that lead Access will lead to a sustainable advan- has proved durable because of the incrementalism of tage if two conditions are met: it must be secured un- technological change. Lincoln has also kept its experi- der better terms than competitors will be able to get ence proprietary by integrating backward, customizing later, and the advantage has to be enforceable over the its production machinery, and holding annual worker long run. Enforceability can come from ownership, turnover under 3%. Finally, it has continued to invest binding contracts, or self-enforcing mechanisms such in experience by sharing cost reductions with custom- as switching costs. Without enforceability, the terms ers. Competitors complain publicly that they have of access shift in line with overall market conditions, trouble matching Lincoln's prices, let alone undercut- wiping out any competitive differences. ting them. Enforceability can be a two-edged sword, however. The risk of pursuing sustainable access ad- Scope economies are derived from active vantages is that they may saddle a business with worse ities in interrelated markets. If they are strong, a sus: terms than those available to its rivals. tainable advantage in one market can be used to build sustainability in another. The term scope economies Know-how. Superior access to informa- isn't just a newfangled name for synergy; it actually tion may reflect the benefits of scale or experience. defines the conditions under which synergy works. To Boeing, for instance, has acquired superior know-how achieve economies of scope, a company must be able to about commercial jet aircraft through billions of dol- share resources across markets, while making sure that lars of cumulative investments in R&D. More often, the cost of those resources remains largely fixed. Only though, sustainability hinges on hidden know-how- then can economies be effected by spreading assets what your rivals don't see. For example, IBM's size and over a greater number of markets. the complexity of its operating environment make it Cincinnati Milacron, the largest U.S. hard for competitors to figure out exactly what makes machine tool manufacturer, shows how companies can it tick. If the cost of surmounting that kind of informa- capitalize on scope economies. For the last two decades tional barrier exceeds the payoffs, rivals may not even it has led the U.S. machine tool industry in both R&D attempt imitation. and the size of its sales and service networks-activi- Consider Du Pont's preemption of all ties that account for a third of the value added by the the capacity expansion in the U.S. titanium dioxide in-In both cases, the supply of the preferred input is limit- Research method ed; as a result, tying it up can be very profitable. This description covers a wide range of phenomena. Courtaulds' 10% to 15% cost advantage I have drawn many of my examples from research over its competitors in the viscose industry can be reports prepared by MBA students for the Industry and Competitive Analysis (ICA) course at the Har- traced to its backward integration into dissolving pulp, vard Business School. Constraints of space pre- which accounts for a third of the finished product's clude individual citations; I should, however, emphas cost. Courtaulds gets its pulp from a well-located sub- size the collective contribution of ICA students to this article. sidiary for half what its competitors pay. James River Corporation has averaged a 24% ROE by buying obso- In fall 1984 and 1985, we asked our students to ana- lete commodity paper machines at fire-sale prices and lyze companies identified as outstanding perform- ers in their industries. The purpose was threefold: converting them to specialty products, a stratagem to understand the sources of competitive advan- that has held its assets-to-sales ratio to two-thirds the tage on which these companies relied, to determine industry average. In diamonds, the Central Selling Or- why the advantages had proved sustainable, and to assess their future security. ganization (controlled by De Beers] has built up its marketing muscle by tying up contracts to market Our students submitted reports on well over 150 80% of the western hemisphere's supply. companies. Some, obviously, dealt with companies that had been canonized publicly; many others, Companies can also secure preferred ac- however, were unfamiliar to the ICA teaching group. cess through their reputations or established relation- ships. In the record industry, for example, CBS has at- Even more important, the quality of the reports sur- passed our expectations. Taken together, they sug- tracted promising artists because of its reputation for gest answers to some of the most fundamental being able to take them to the top-at least partially a questions about strategy formulation. To give these self-fulfilling prophecy. reports the broader circulation they deserve, Douglas Anderson, Michael Porter, and I are editing Access advantages are vulnerable to 20 of them for publication. The compendium will be shifts in input availability or prices. Courtaulds' cost available in 1987. advantage in dissolving pulp will wither as infrastruc tural development opens up more tropical and subtrop- ical forests. And James River's competitors, particu- larly Hammermill, have begun to bid up the prices of the second-hand paper machines that it traditionally bought for a song. This constrains James River's dustry in the 1970s. Thanks to a production process growth, even though its cheap asset base will prop up based on low-cost feedstock, Du Pont enjoyed a 20% profitability for years to come. cost advantage over competitors' processes. Mastering the cheaper feedstock technology was a black art-it Markets. In many ways, preferred access could be accomplished only by investing $50 million to markets is the mirror image of preferred access to in- to $100 million and several years of testing time in an puts. But access to markets relies less on vertical inte- efficiently scaled plant. The cost and risk of this alter- gration or contracts and more on self-enforcing mecha- native kept Du Pont's competitors from trying to imi- nisms such as reputation, relationships, switching tate its demonstrably superior technology. costs, and product complementarities. An obvious but important point: know- That is not to say that vertical integra- how must be kept secret if it is to yield an advantage. tion and contracts are entirely missing from the pic- Many high-tech and service companies have been ture. Tele-Communications' strategy in cable televi- devastated by the defection of key personnel in whom sion systems shows otherwise. While competitors their know-how is vested. The Boston Consulting outbid each other in their scramble to secure big fran- Group, for instance, has suffered more than a dozen chises, Tele-Communications concentrated on ac- spin-offs, eroding its competitive advantage in manage- quiring small, contiguous systems in areas that were ment consulting and its client base. Other sources of poorly served because they were hard to get to or far leaks include suppliers, customers, reverse engineer- from large population centers. Tele-Communications' ing, and even patent documents. current network faces no serious threats from substi tutes or competitors, limits its exposure to the whims Inputs. Tying up inputs will lead to a of any one regulatory authority, and allows the com- sustainable advantage only if the commodity's supply pany to spread the costs of its microwave common- is bounded and the company has the right to use it on carrier network over several communities. favorable terms. Boundedness here is interpreted broad- Still, self-enforcing mechanisms for ly: it may imply either a strictly limited supply of the market access crop up far more frequently. Let us look input or a supply that is elastic but of varying quality. at just two examples. Tandem, which pioneered expan-sible, fault-tolerant computers for processing transac- Remember that what the government tions, has gained preferred access to demand for up- gives, the government can take away. Treat an advan- grades and replacements because changeovers from tage based on public policy as sustainable only if you one system to another are very costly. And Borden's are sure you will continue to be on the right side. If not, brand of processed lemon juice, ReaLemon, attained a try a different route. 50% premium over identical competing brands be- cause as the pioneer, it benefited from consumer risk- Defense. A business can also sustain an aversion: lemon juice doesn't cost very much and you advantage if its competitors are restricted by past in- don't buy it very often, so why take a chance with an vestments. If imitation threatens the cash flow from untried brand? those investments, disadvantaged competitors may ra- You have probably already figured out tionally stay put and defend them, thereby giving the that market access advantages are very sensitive to innovator an opportunity to take the lead. customer preferences. Even slight, apparently innocu- Examples of defensiveness are legion. ous shifts in preferences can weaken an entrenched Bic used its 19-cent Crystal to wrest leadership from brand, dispel accumulated switching costs, or undercut Gillette in the U.S. pen market in the 1950s, when Bic's long-standing relationships. aggression went unmatched because Gillette did not want to decimate the sales of its more expensive Paper Mate line. In plain-paper copying, a number of compet- itors successfully attacked Xerox in the 1970s. Recog- Exercising options nizing that its multibillion-dollar rental base was be- coming obsolete, Xerox milked it by dragging its feet Sometimes the sustainability of an ad- on price cuts and product innovation - even though vantage cannot be pinned on either size or access. In- these lags caused its share of new placements to fall stead, competitors' options may differ fundamentally from nearly 100% in 1972 to 14% by 1976. from yours, hamstringing their ability to imitate your Time often erodes defensiveness, how- company's strategy. Rivals may be frozen into their ever, as it depreciates the value of past investments. current positions for several reasons: In 1970, Gillette introduced a low-priced line of Write Bros. pens to arrest Bic's advance. And since 1977, Public policy. Government intervention Xerox has restored its share of new copier placements always affects the workings of markets; that is its to the 40% to 50% range by matching competitors' avowed purpose. Sometimes its actions percolate so far prices and product features. as to affect competitive positions within an industry. The examples are familiar: patents (try to) protect in- novators from imitators, antitrust laws prevent large businesses from being as aggressive as smaller compet- itors, some companies get handouts while others do "All of your competitors may not. The lesson, strategically, is that a company that is be stupid some of the time- on the right side of public policy can exploit its posi- but can you count on them being tion to build sustainability against companies that are not. stupid all of the time!" Heileman Brewing exemplifies both the leverage from this source of sustainability and its lim- its. The shakeout in the U.S. brewing industry during the 1970s endangered many small, regional brewers. Response lags. The final restriction on Antitrust laws prevented the national brewers- rivals' options comes from response lags. One business Anheuser-Busch, Miller, and Schlitz-from acquiring can be every bit as efficient as another in terms of po- them. Heileman, then one of the larger regional brew- tential size or access without being equally prepared to ers, faced no such constraints. It grew throughout the make a specific move. In that event, the nimbler of the decade by buying out numerous smaller brewers lock, two can count on a lag in its competitor's response, or a stock, and barrel. These cheap assets fed right through period of sustainability. to the bottom line: with an average ROE of 29% over The longer the response lag the better, the last five years, Heileman is still ahead of its com- as existing advantages stretch out and opportunities to petitors. But the bloom on this particular strategy is create new ones multiply. Lag times vary enormously, fading. By 1982, Heileman's market share had tripled, of course, but I can make some broad generalizations. and the Justice Department blocked its proposed ac- Responses to most pricing moves come in weeks if not quisitions of Schlitz and Pabst. Other takeovers by days, while responses to nonprice competition and to Heileman are improbable. R&D usually take a few years. And it may take a de-cade or more to match a competitor's scope economies actively. If you notice any changes, see whether they or superior organization.* play to your particular strengths. Kodak vividly illustrates how you can sustain a lead by exploiting competitors' response lags. Ultimately, the search for sustainability In the late 1950s, Du Pont and Bell & Howell formed a involves a series of decisions about the degree to which joint venture to challenge Kodak's dominance of the you are willing to commit your business to a particular color film market. They found product development ex- way of doing things. You have to pick the relative em- asperating, however, because each time they improved phasis you are going to place on two things: commit- their film, Kodak seemed, as if by magic, to make its ment to competing a particular way and retaining the film even better. When the Du Pont-Bell & Howell flexibility to compete effectively in other ways. film was finally ready, Kodak administered the coup de grace by introducing the vastly superior Kodachrome II slide film. The competing entry never reached the References market. 1 Edwin Mansfield, Jean-Jacques Lambin, "How Rapidly Does New Industrial Advertising, Competition, and Market Technology Leak Out!" Conduct in Oligopoly Over Time Journal of Industrial Economics, (Amsterdam: North-Holland, 1976), and December 1985, p. 217, Jeffrey M. Netter, Guidelines for strategy Richard C. Levin et al., "Excessive Advertising "Survey Research on RAD Appropriability An Empirical Analysis," and Technological Opportunity, Part I," Journal of Industrial Economics, Yale University Working Paper June 1982, p. 361. (New Haven: July 19841, and I have outlined a set of factors that af- Edwin Mansfield, Mark Schwartz, and 4 See, for example, fect the sustainability of competitive advantages. How Samuel Wagner, David |. Trece, Imitation Costs and Patents: "The Diffusion of should these factors-and the broad notion of sustain- An Empirical Study" an Administrative Innovation," Management Science, ability-be integrated into strategy formulation? Here Economic Journal, December 1981, p. 907. May 1980, p. 46-4. are several points to remember: 1 Michael A. Salinger, "Tobin's q, Unionization, and the Editor's note: Additional references Concentration-Profits Relationship," are available from the author Managers cannot afford to ignore con- Rand Journal of Economics, Summer 1984, p. 159, and testable advantages. For one thing, even moves that of- Thomas Karier, fer ephemeral advantages may be worth making, if Unions and Monopoly Profits," Review of Economics and Statistics, only to avoid a competitive disadvantage. For another, February 1985, p. 34. some contestable advantages may survive uncon- 3 M.M. Metwally tested: disadvantaged competitors may be tied up try- "Advertising and Competitive Behavior ing to meet their profit targets, constrained by their of Selected Australian Firms," Review of Economics and Statistics, corporate strategies, or just ineptly managed. November 1975, p. 417, 2 The distinction between contestable and sustainable advantages is a matter of degree. Sus- tainability is greatest when based on several kinds of advantages rather than one, when the advantage is large, and when few environmental threats to it exist. 3 Not all industries offer equal opportuni ties to sustain an advantage. First-mover advantages tend to be most potent in industries characterized by durable, irreversible, market-specific assets, either tan- gible or intangible. Industries that evolve gradually of- fer more room to sustain advantages than those that are regularly rocked by drastic changes in technology or demand. And sustainability is more accessible in industries with more than one dominant strategy because competitors may not have the same options you do. 4 To create a sustainable advantage, you must either be blessed with competitors that have a re- stricted menu of options or be able to preempt them. Propitious times to preempt occur when an industry is undergoing wrenching changes in technology, demand patterns, or input availability. Scan the environmentDistribution Analytics: Case Study Name: You are the marketing manager for Acme Cosmetics. Acme manufactures and sells a premium brand anti-wrinkle face cream derived from a rare form of green tea. Some say that the green tea gives the cream its unique rejuvenating powers, All you know is that sales are strong As a result, you have been asked to select an additional retail location to increase sales further. The tables below show the relevant data. Attribute Store A: Retail Premium Store B: Retail Outlet Store C: Internet Expected Revenue (S) $20,000 $15,000 $15,000 Expected Cost (S) 60% (cost: $12,000) 50% (cost $7.500) 8% (cost: $1200) Table 1: Channel revenue and cost metrics Attribute Store A: Retail Premium Store B: Retail Outlet Store C: Internet Location 80%: Premium mall 40%: Outlet mall 20%: Limited web traffic Brand Alignment 80%: Premium/ Premium 40%: Premium/ Value 50%: OK associations Physical Requirements | 60%: Med. floor, parking 80%: Large floor, parking 100%: No restrictions Market-Specific 100%: Training available 60%: Limited training 10%: No training Table 2: Channel customer acquisition metrics Attribute Store A: Retail Premium Store B: Retail Outlet Store C: Internet Customer Support 100%: Skilled staff 70%: Good sales staff 10%: Outsourced support Customer Feedback 80%: Strong program 50%: Weak program 100%: Direct metrics Customer Programs 80%: "Mall bucks' 60%: "Outlet bucks' 10%: Internet only Table 3: Channel customer retention metrics Attribute Store A: Retail Premium Store B: Retail Outlet Store C: Internet Consulting 100%: Skin experts 60%: Some knowledge 10%: Automated 'staff Customer Metrics 80%: Advanced CRM 50%: Older CRM 100%: Full metrics Channel Growth 20%: Declining segment 40%: Low growth 80%: Increasing growth Table 4: Channel customer revenue growth metrics Using the Distribution Channel Selection Model, we can find the most effective store. Enter the following weights into the model at first Test how the results vary as you change the weights.1. Select the store with the maximum effectiveness, based on the data and weights given. Weights, General: Profit: 50%; Acquisition: 20%; Retention: 10%; Revenue: 20% Weights, Acquisition: Location: 25%; Brand: 25%; Physical: 25%; Market: 25% Weights, Retention: Support: 33%; Feedback: 33%; Programs: 33% Weights, Revenue Growth: Consulting: 33%; Metrics: 33%; Growth: 33% Data Requested Results Final Scores Store A: Store B: Store CShort Answer Questions (7 points each) 1. In Ghamawat's article titled "Sustainable Advantage," he mentions three categories in which companies can achieve sustainable competitive advantage. Which one (1) do you think is the most sure-fire way to achieve such advantage? Why? 2. What does it mean when strategists say that one of the worst mistakes a company or leader can make is getting "stuck in the middle?"3. Disruptions in an industry can occur through the development of new technologies, novel re-combinations of assets, or successful initial targeting of narrow market segments that are underserved by current product or service offerings. What industry do you believe is most primed for a disruptive new entrant? Why