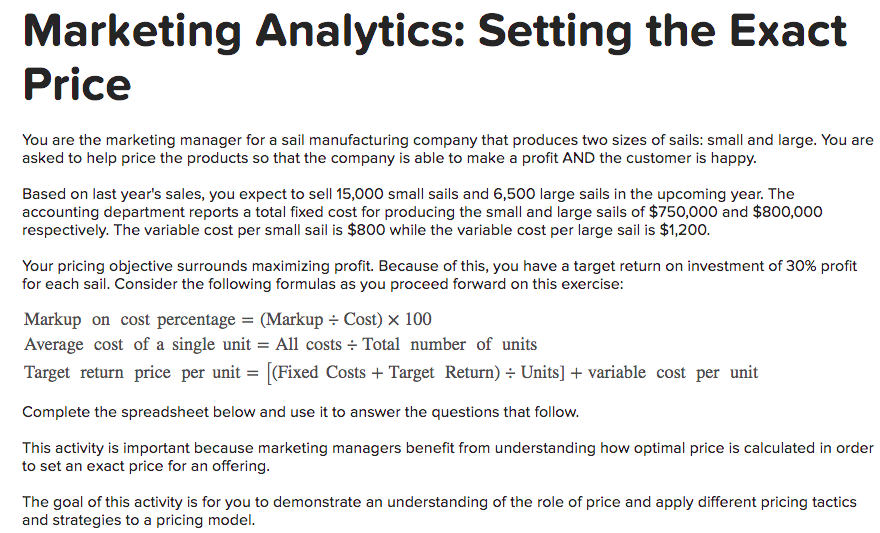

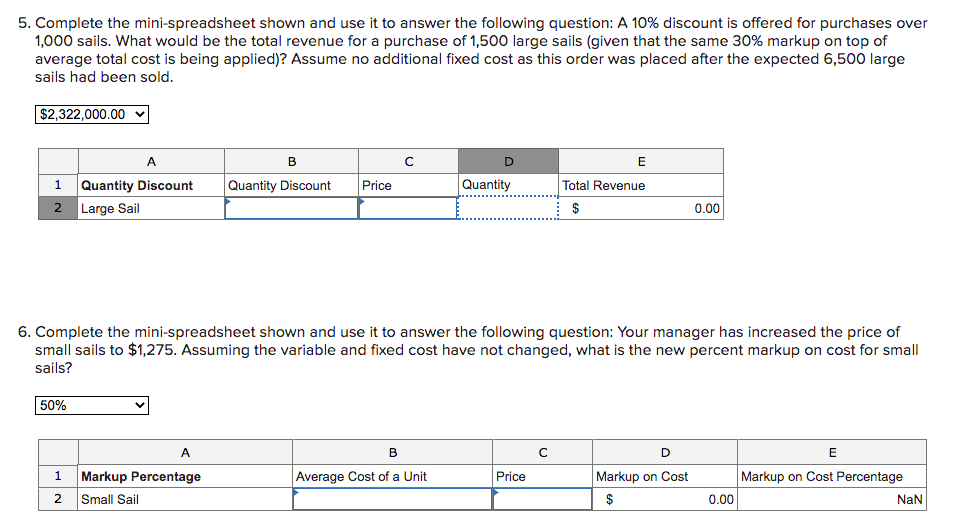

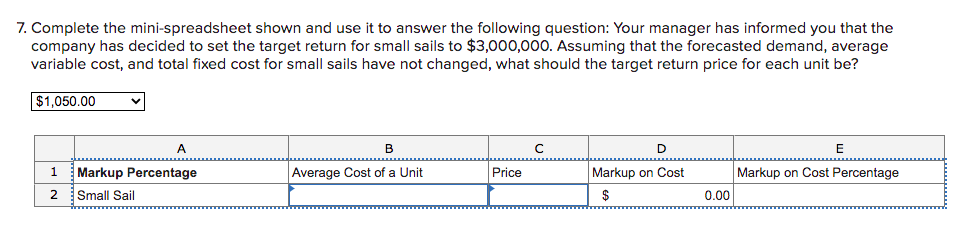

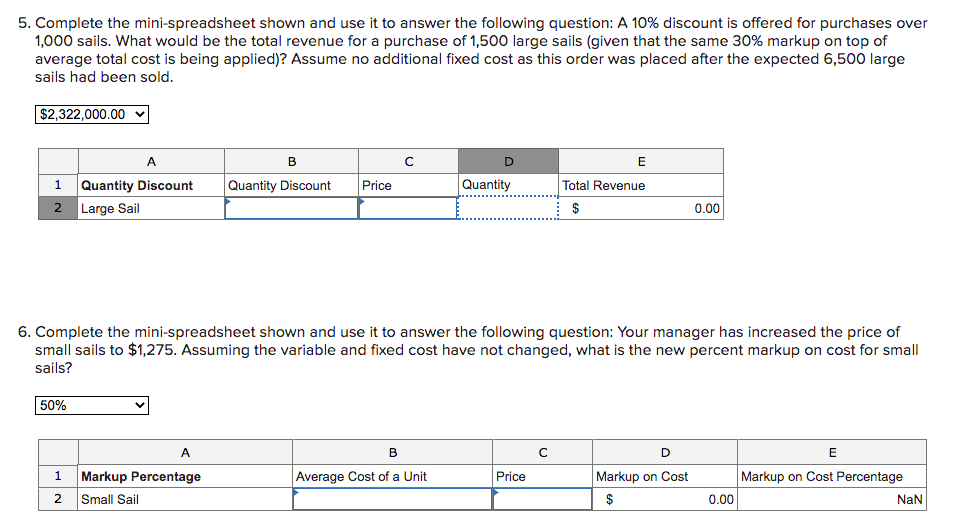

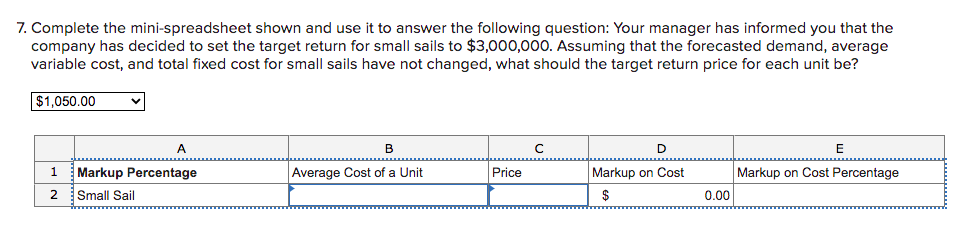

Marketing Analytics: Setting the Exact Price You are the marketing manager for a sail manufacturing company that produces two sizes of sails: small and large. You are asked to help price the products so that the company is able to make a profit AND the customer is happy. Based on last year's sales, you expect to sell 15,000 small sails and 6,500 large sails in the upcoming year. The accounting department reports a total fixed cost for producing the small and large sails of $750,000 and $800,000 respectively. The variable cost per small sail is $800 while the variable cost per large sail is $1,200. Your pricing objective surrounds maximizing profit. Because of this, you have a target return on investment of 30% profit for each sail. Consider the following formulas as you proceed forward on this exercise: Markup on cost percentage = (Markup + Cost) x 100 Average cost of a single unit = All costs + Total number of units Target return price per unit = [(Fixed Costs + Target Return) Units] + variable cost per unit Complete the spreadsheet below and use it to answer the questions that follow. This activity is important because marketing managers benefit from understanding how optimal price is calculated in order to set an exact price for an offering. The goal of this activity is for you to demonstrate an understanding of the role of price and apply different pricing tactics and strategies to a pricing model. 5. Complete the mini-spreadsheet shown and use it to answer the following question: A 10% discount is offered for purchases over 1,000 sails. What would be the total revenue for a purchase of 1,500 large sails (given that the same 30% markup on top of average total cost is being applied)? Assume no additional fixed cost as this order was placed after the expected 6,500 large sails had been sold. $2,322,000.00 A B E Price Quantity Discount Quantity 1 Quantity Discount 2 Large Sail Total Revenue $ 0.00 6. Complete the mini-spreadsheet shown and use it to answer the following question: Your manager has increased the price of small sails to $1,275. Assuming the variable and fixed cost have not changed, what is the new percent markup on cost for small sails? 50% A B D E 1 Markup Percentage Average Cost of a Unit Markup on Cost Markup on Cost Percentage 0.00 NaN 2 Small Sail $ Price 7. Complete the mini-spreadsheet shown and use it to answer the following question: Your manager has informed you that the company has decided to set the target return for small sails to $3,000,000. Assuming that the forecasted demand, average variable cost, and total fixed cost for small sails have not changed, what should the target return price for each unit be? $1,050.00 A B D E 1 Markup Percentage Average Cost of a Unit Price Markup on Cost Markup on Cost Percentage 2 Small Sail $ 0.00 Marketing Analytics: Setting the Exact Price You are the marketing manager for a sail manufacturing company that produces two sizes of sails: small and large. You are asked to help price the products so that the company is able to make a profit AND the customer is happy. Based on last year's sales, you expect to sell 15,000 small sails and 6,500 large sails in the upcoming year. The accounting department reports a total fixed cost for producing the small and large sails of $750,000 and $800,000 respectively. The variable cost per small sail is $800 while the variable cost per large sail is $1,200. Your pricing objective surrounds maximizing profit. Because of this, you have a target return on investment of 30% profit for each sail. Consider the following formulas as you proceed forward on this exercise: Markup on cost percentage = (Markup + Cost) x 100 Average cost of a single unit = All costs + Total number of units Target return price per unit = [(Fixed Costs + Target Return) Units] + variable cost per unit Complete the spreadsheet below and use it to answer the questions that follow. This activity is important because marketing managers benefit from understanding how optimal price is calculated in order to set an exact price for an offering. The goal of this activity is for you to demonstrate an understanding of the role of price and apply different pricing tactics and strategies to a pricing model. 5. Complete the mini-spreadsheet shown and use it to answer the following question: A 10% discount is offered for purchases over 1,000 sails. What would be the total revenue for a purchase of 1,500 large sails (given that the same 30% markup on top of average total cost is being applied)? Assume no additional fixed cost as this order was placed after the expected 6,500 large sails had been sold. $2,322,000.00 A B E Price Quantity Discount Quantity 1 Quantity Discount 2 Large Sail Total Revenue $ 0.00 6. Complete the mini-spreadsheet shown and use it to answer the following question: Your manager has increased the price of small sails to $1,275. Assuming the variable and fixed cost have not changed, what is the new percent markup on cost for small sails? 50% A B D E 1 Markup Percentage Average Cost of a Unit Markup on Cost Markup on Cost Percentage 0.00 NaN 2 Small Sail $ Price 7. Complete the mini-spreadsheet shown and use it to answer the following question: Your manager has informed you that the company has decided to set the target return for small sails to $3,000,000. Assuming that the forecasted demand, average variable cost, and total fixed cost for small sails have not changed, what should the target return price for each unit be? $1,050.00 A B D E 1 Markup Percentage Average Cost of a Unit Price Markup on Cost Markup on Cost Percentage 2 Small Sail $ 0.00