Marketing Strategy and Economic analysis

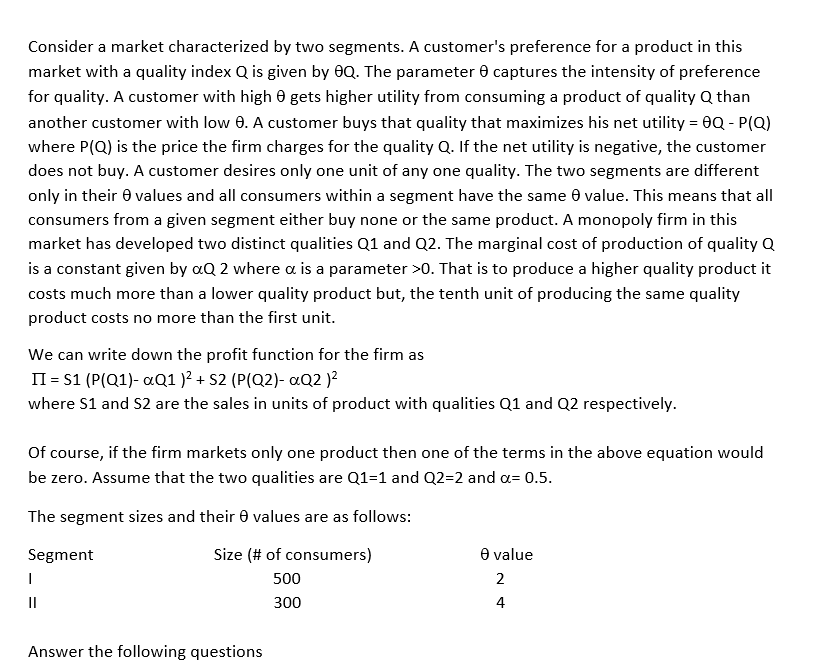

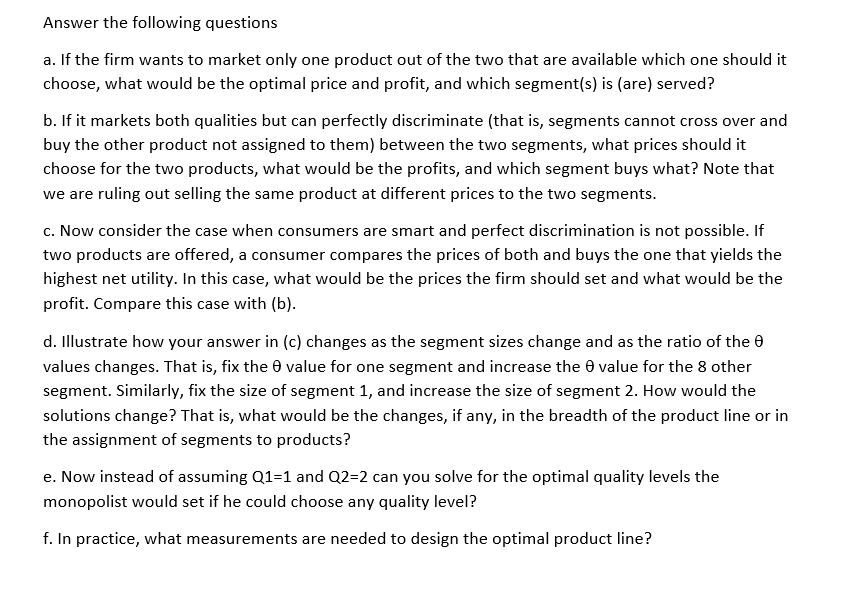

Consider a market characterized by two segments. A customer's preference for a product in this market with a quality index Q is given by HQ. The parameter E' captures the intensity of preference for quality. A customer with high 3 gets higher utility from consuming a product of quality chan another customer with low E'. A customer buys that quality that maximizes his net utility = 3C1 HQ] where Phil] is the price the firm charges for the quality [1. If the net utility is negative, the customer does not buy. A customer desires only one unit ofany one quality. The two segments are different only in their Bvalues and all consumers within a segment have the same 3 value. This means that all consumers from a given segment either buy none or the same product. A monopoly firm in this market has developed two distinct qualities Q1 and Q2. The marginal cost of production of quality [1 is a constant given by otQZ where on is a parameter >0. That is to produce a higher quality product it costs much more than a lower quality product but, the tenth unit of producing the same quality product costs no more than the first unit. We can write down the profit function for the firm as H = 51{P{o1]- {1-211 )2 + 52 (P(o2) {1:12}? where 31 and 82 are the sales in units of product with qualities Q1 and [12 respectively. of course, if the firm markets only one product then one of the terms in the above equation would be zero. Assume that the two qualities are [1121 and (12:2 and a: 0.5. The segment sizes and their 3 values are as follows: Segment Size {ii of consumers] 3 value I 500 2 || 300 4 Answer the following questions Answer the following questions a. If the firm wants to market only one product out of the two that are available which one should it choose, what would be the optimal price and profit, and which segment(s} is {are} served? b. If it markets both qualities but can perfectly discriminate [that is, segments cannot cross over and buy the other product not assigned to them) between the two segments, what prices should it choose for the two products, what would be the profits, and which segment buys what? Note that we are ruling out selling the same product at different prices to the two segments. c. Now consider the case when consumers are smart and perfect discrimination is not possible. If two products are offered, a consumer compares the prices of both and buys the one that yields the highest net utility. In this case, what would be the prices the firm should set and what would be the prot. lCompare this case with (b). d. Illustrate how your answer in (c) changes as the segment sizes change and as the ratio of the 3 values changes. That is, fix the 3 value for one segment and increase the 8 value for the 8 other segment. Similarly, fix the size of segment 1, and increase the size of segment 2. How would the solutions change? That is, what would be the changes, if any, in the breadth of the product line or in the assignment of segments to products? e. Now instead of assuming [11:1 and [1222 can you solve for the optimal quality levels the monopolist would set if he could choose any quality level? f. In practice, what measurements are needed to design the optimal product line