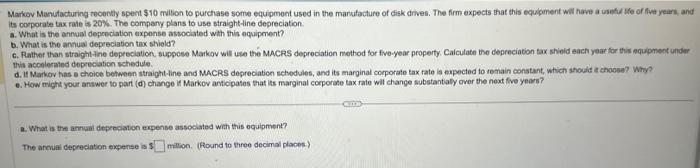

Markov Manutacturing recently speit $10 million to purchase some equpmont used in the manufacture of disk dives. The firm expects that this equipment will have a useful Ife of five yeark, and its corporate tax rate is 20%. The company plans to use straight-line depreciation. a. What is the annual depreciation exponse associated with this equipment? b. What is the annual depreciation tax stield? c. Father than straight Ane depeeciation, suppese Markov will use the MACRS deprociation method for five-year property. Calculate be depreciation tax shioid each year for this aquipment under this acceieraind depreciation schedule. d. If Markov has e cheice between straight-line and MACRS depreciaticn schedules, and its marginal corporate tax rate is expected to remain constant, which should echoose? Why? e. How might your answer to part (d) change if Markov anticipates that iss marginal corporsee tax rate will change substantaby over the next five years? 2. What is the arnual depreciation expense associated with this oquipment? The anchual Gepreciation expense is $ million. (Round to three decimal places:) Markov Manutacturing recently speit $10 million to purchase some equpmont used in the manufacture of disk dives. The firm expects that this equipment will have a useful Ife of five yeark, and its corporate tax rate is 20%. The company plans to use straight-line depreciation. a. What is the annual depreciation exponse associated with this equipment? b. What is the annual depreciation tax stield? c. Father than straight Ane depeeciation, suppese Markov will use the MACRS deprociation method for five-year property. Calculate be depreciation tax shioid each year for this aquipment under this acceieraind depreciation schedule. d. If Markov has e cheice between straight-line and MACRS depreciaticn schedules, and its marginal corporate tax rate is expected to remain constant, which should echoose? Why? e. How might your answer to part (d) change if Markov anticipates that iss marginal corporsee tax rate will change substantaby over the next five years? 2. What is the arnual depreciation expense associated with this oquipment? The anchual Gepreciation expense is $ million. (Round to three decimal places:)