Markowitz Optimization:

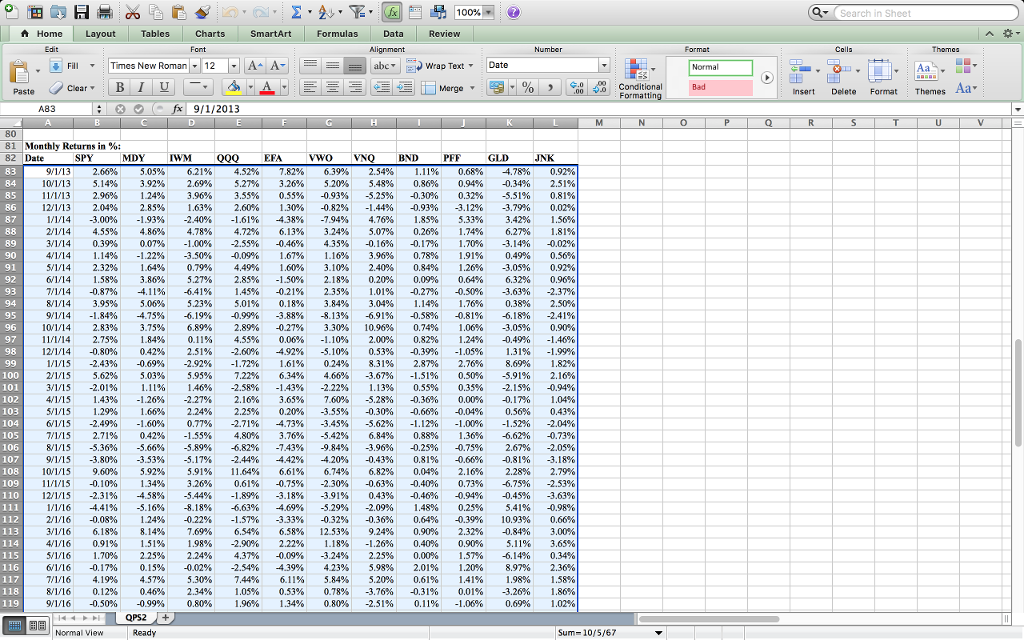

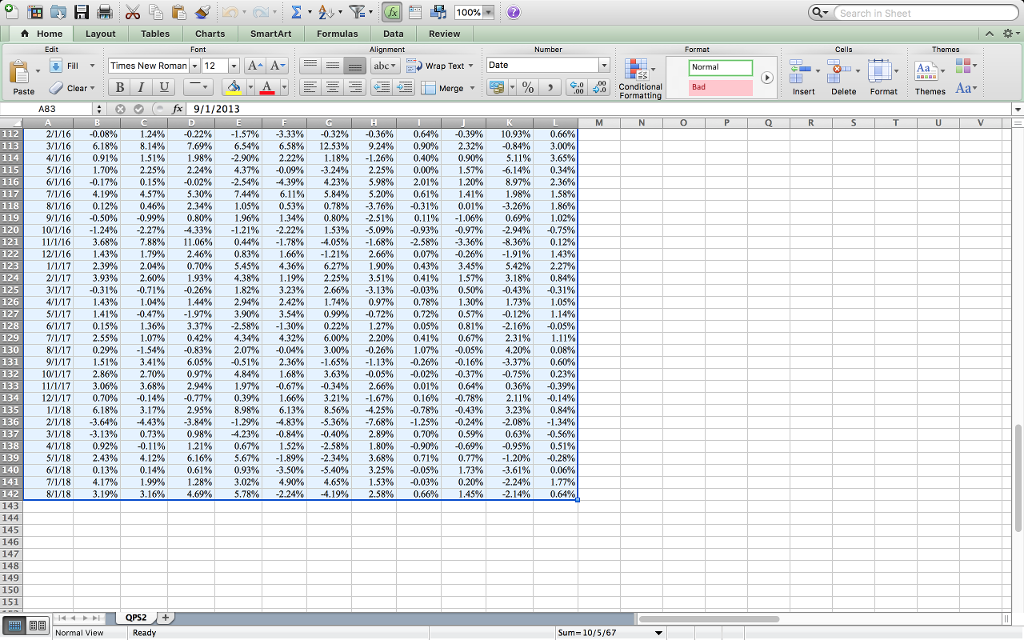

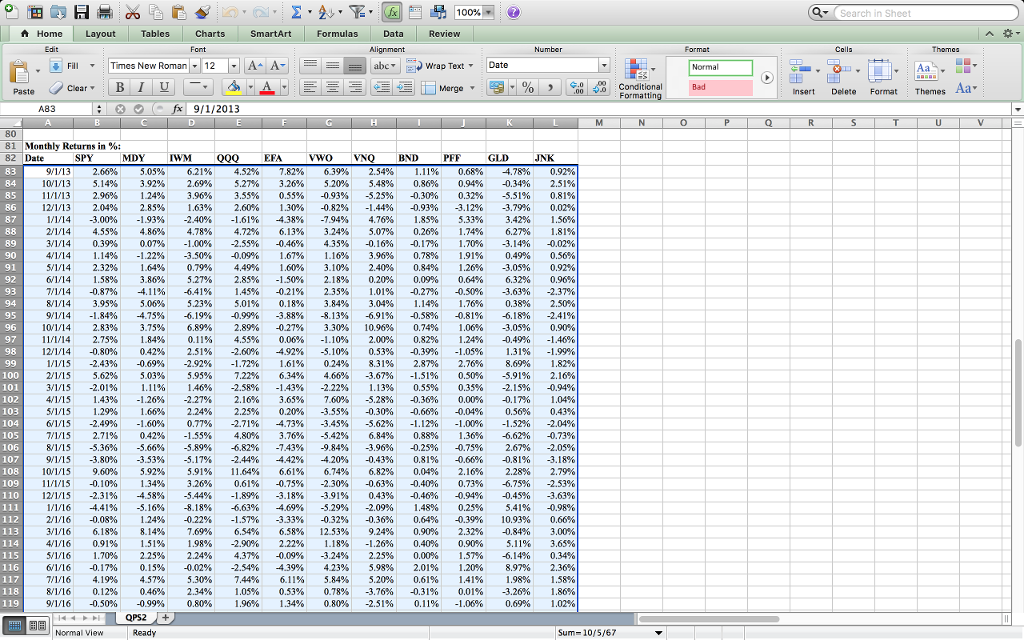

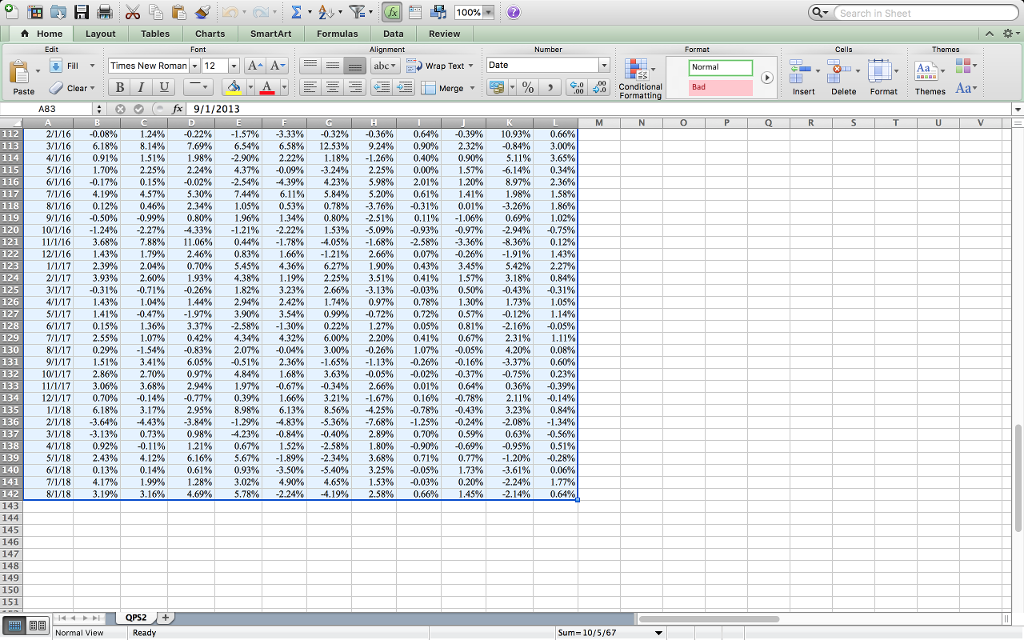

Open the associated Excel file named QPS2 Data Fall I 2018 Problem 2 in the Quantitative Problem Set Spreadsheets Module. The data file includes 60 months of returns for 11 exchange traded funds; their names and ticker symbols follow:

| | Ticker | Name of Exchange Traded Fund | | |

| 1 | SPY | SPDR S&P 500 ETF | | | | |

| 2 | MDY | SPDR S&P MidCap 400 ETF | | | |

| 3 | IWM | iShares Russell 2000 ETF | | | |

| 4 | QQQ | Invesco QQQ Trust ETF | | | |

| 5 | EFA | iShares MSCI EAFE ETF | | | |

| 6 | VWO | Vanguard FTSE Emerging Markets ETF | |

| 7 | VNQ | Vanguard REIT Index ETF | | | |

| 8 | BND | Vanguard Total Bond Market ETF | | |

| 9 | PFF | iShares US Preferred Stock ETF | | |

| 10 | GLD | SPDR Gold Shares ETF | | | |

| 11 | JNK | SPDR Barclays High Yield Bond ETF | | |

All students will do problem 2 using 9 of the above ETFs; all students will include the first 8 ETFs listed above: SPY, MDY, IWM, QQQ, EFA, VWO, VNQ, and BND. All students will include one of the last 3 ETFs: PFF, GLD, and JNK as instructed on your version.

Version C: Include JNK and exclude PFF and GLD.

Use the data on your 9 ETFs to answer the following questions:

What is the average return for each of the nine indexes?

Show the covariance matrix of returns. Briefly describe how you constructed the covariance matrix.

Consider the simple case where short sales are allowed, but short positions must be greater than or equal to 75% and long positions must be less than or equal to 75%. Use Excel Solver to find the Minimum Variance Portfolio (MVP).

What is the expected portfolio return for the MVP portfolio?

What is the portfolio standard deviation for the MVP portfolio?

What is the portfolio composition (i.e., what are the weights for the nine ETFs)?

Consider the simple case where short sales are allowed, but short positions must be greater than or equal to 50% and long positions must be less than or equal to 50%. Use Excel Solver to find the Maximum return portfolio with a standard deviation of exactly 2.50%.

What is the expected portfolio return for this portfolio?

What is the portfolio composition (i.e., what are the weights for the nine ETFs)?

Consider the more realistic case where short sales are NOT allowed and no more than 35% of the portfolio and no less than 3% is invested in any ETF. Use Excel Solver to find the Minimum Variance Portfolio (MVP).

What is the expected portfolio return for the MVP portfolio?

What is the portfolio standard deviation for the MVP portfolio?

What is the portfolio composition (i.e., what are the weights for the nine ETFs)?

Consider the simple case where short sales are NOT allowed and no more than 40% and no less than 7% of the portfolio is invested in any ETF. Use Excel Solver to find the Market Portfolio if the risk-free rate is 0.20%/month (2.40%/year).

What is the expected portfolio return for this portfolio?

What is the portfolio standard deviation for this portfolio?

What is the portfolio composition (i.e., what are the weights for the nine ETFs)?

What is the maximum Sharpe ratio?

Search in Sheet A HomeLayout Tables Charts SmartArt Formulas DataReview Cells :Times New Roman-12 -A A- abel ) wrap Text. : Date Fill Aa Paste Cler Aa Insert Delete Format Themes Formattin 9/1/2013 81 Monthly Returns in %; 82 Date MDY IWM Q0Q EFA VWO VNQ BND 2.54% 5.48% -5.25% -1.44% 4.76% 5.07% -0.16% 3.96% 2.40% 0.20% 1.01% 3.04% -6.91% 10.96% 2.00% 0.53% 8.31% -3.67% 1.13% -5.28% -0.30% -5.62% 6.84% -3.96% -0.43% 6.82% -0.63% 0.43% -2.09% -0.36% 9.24% -1.26% 2.25% 5.98% 5.20% -3.76% -2.51% PFF 1.11% 0.86% -0.30% -0.93% 1.85% 0.26% -0.17% 0.78% 0.84% 0.09% -0.27% 1.14% -0.58% 0.74% 0.82% -0.39% 2.87% -1.51% 0.55% -0.36% -0.66% -1.12% 0.88% -0.25% 0.81% 0.04% -0.40% -0.46% 1.48% 0.64% 0.90% 0.40% 0.00% 2.01% 0.61% -0.31% 0.11% GLD 5.05% 3.92% 1.24% 2.85% -1.93% 4.86% 0.07% -1.22% 1.64% 3.86% -4.11% 5.06% -4.75% 3.75% 1.84% 0.42% -0.69% 5.03% 196 -1.26% 1.66% -1.60% 0.42% -5.66% -3.53% 5.92% 4.52% 5.27% 3.55% 2.60% -1.61% 4.72% -2.55% -0.09% 4.49% 2.85% 1.45% 5.01% -0.99% 2.89% 4.55% -2.60% -1.72% 7.22% -2.58% 2.16% 2.25% -2.71% 4.80% -6.82% -2.44% 11.64% 0.61% -1.89% -6.63% -1.57% 6.54% -2.90% 4.37% -2.54% 7.44% 1.05% 1.96% 7.82% 3.26% 0.55% 1.30% -4.38% 6.13% -0.46% 1.67% 1.60% -1.50% -0.21% 0.18% -3.88% -0.27% 0.06% -4.92% 1.61% 6.34% -1.43% 3.65% 0.20% -4.73% 3.76% -7.43% -4.42% 6.61% -0.75% -3.18% -4.69% -3.33% 6.58% 2.22% -0.09% -4.39% 6.11% 0.53% 1.34% 6.39% 5.20% -0.93% -0.82% -7.94% 3.24% 4.35% 1.16% 3.10% 2.18% 2.35% 3.84% -8.13% 3.30% -1.10% -5.10% 0.24% 4.66% -2.22% 7.60% -3.55% -3.45% -5.42% -9.84% -4.20% 6.74% -2.30% -3.91% -5.29% -0.32% 12.53% 1.18% -3.24% 4.23% 5.84% 0.78% 0.80% 0.68% 0.94% 0.32% -3.12% 5.33% 1.74% 1.70% 1.91% 1.26% 0.64% -0.50% 1.76% -0.81% 1.06% 1.24% -1.05% 2.76% 0.50% 0.35% 0.00% -0.04% -1.00% 1.36% -0.75% -0.60% 2.16% 0.73% -0.94% 0.25% -0.39% 2.32% 0.9090 1.57% 1.20% 1.41% 0.01% -1.06% JNK -4.78% -0.34% -5.51% -3.79% 3.42% 6.27% -3.14% 0.49% -3.05% 6.32% -3.63% 0.38% -6.18% -3.05% -0.49% 1.31% 8.69% -5.91% -2.15% -0.17% 0.56% -1.52% -6.62% 2.6 -0.81% 2.28% -6.75% -0.45% 5.41% 10.93% -0.84% 5.11% -6.14% 8.97% 1.98% -3.26% 0.69% 0.92% 2.51% 0.81% 0.02% 1.56% 1.81% -0.02% 0.56% 0.92% 0.96% -2.37% 2.50% -2.41% 0.90% -1.46% -1.99% 1.82% 2.16% -0.94% 1.04% 0.43% -2.04% -0.73% -2.05% -3.18% 2.79% -2.53% -3.63% -0.98% 0.66% 3.00% 3.65% 0.34% 2.36% 1.58% 1.86% 1.02% 10/1/13 5.14% 2.69% 2.96% 12/1/13 2.04% 1/1/14-3.00% 2/1/14 4.55% 3/1/14 0.39% 4/1/14 1.14% 5/1/14 2.32% 6/1/14 1.58% 7/1/14-0.87% 8/1/14 3.95% 14-1.84% 10/1/14 2.83% 11/1/14 2.75% 12/1/14-0.80% 1/1/15-2.43% 2/1/15 5.62% 3/1/15-2.01% 4/1/15 1.43% 5/1/15 1.29% 6/1/15-2.49% 196 1.63% -2.40% 4.78% -1.00% -3.50% 0.79% 5.27% -6.41% 5.23% -6.19% 6.89% 0.11% 2.51% -2.92% 5.95% 1.46% -2.27% 2.24% 0.77% -1.55% -5.89% -5.17% 5.91% 103 105 107 7/1/15 2.71% 8/1/15-5.36% 9/1/15-3.80% 10/1/15 9.60% 11/1/15-01096 12/1/15-2.31% 1/1/16-4.41% 2/1/16-0.08% 3/1/16 6.18% 4/1/16 0.91% 5/1/16 1.70% 6/1/16-0.17% 7/1/16 4.19% 8/1/16 0.12% 9/1/16-0.50% 7% -4.58% -5.16% 1.24% 8.14% 1.51% 2.25% 0.15% 4.57% 0.46% -0.99% -5.44% -8.18% -0.22% 7.69% 1.98% 2.24% -0.02% 5.30% 2.34% Normal View Ready Sum-10/5/67 Search in Sheet A HomeLayout Tables Charts SmartArt Formulas DataReview Cells :Times New Roman-12 -A A- abel ) wrap Text. : Date Fill Aa Paste Cler Aa Insert Delete Format Themes Formattin 9/1/2013 81 Monthly Returns in %; 82 Date MDY IWM Q0Q EFA VWO VNQ BND 2.54% 5.48% -5.25% -1.44% 4.76% 5.07% -0.16% 3.96% 2.40% 0.20% 1.01% 3.04% -6.91% 10.96% 2.00% 0.53% 8.31% -3.67% 1.13% -5.28% -0.30% -5.62% 6.84% -3.96% -0.43% 6.82% -0.63% 0.43% -2.09% -0.36% 9.24% -1.26% 2.25% 5.98% 5.20% -3.76% -2.51% PFF 1.11% 0.86% -0.30% -0.93% 1.85% 0.26% -0.17% 0.78% 0.84% 0.09% -0.27% 1.14% -0.58% 0.74% 0.82% -0.39% 2.87% -1.51% 0.55% -0.36% -0.66% -1.12% 0.88% -0.25% 0.81% 0.04% -0.40% -0.46% 1.48% 0.64% 0.90% 0.40% 0.00% 2.01% 0.61% -0.31% 0.11% GLD 5.05% 3.92% 1.24% 2.85% -1.93% 4.86% 0.07% -1.22% 1.64% 3.86% -4.11% 5.06% -4.75% 3.75% 1.84% 0.42% -0.69% 5.03% 196 -1.26% 1.66% -1.60% 0.42% -5.66% -3.53% 5.92% 4.52% 5.27% 3.55% 2.60% -1.61% 4.72% -2.55% -0.09% 4.49% 2.85% 1.45% 5.01% -0.99% 2.89% 4.55% -2.60% -1.72% 7.22% -2.58% 2.16% 2.25% -2.71% 4.80% -6.82% -2.44% 11.64% 0.61% -1.89% -6.63% -1.57% 6.54% -2.90% 4.37% -2.54% 7.44% 1.05% 1.96% 7.82% 3.26% 0.55% 1.30% -4.38% 6.13% -0.46% 1.67% 1.60% -1.50% -0.21% 0.18% -3.88% -0.27% 0.06% -4.92% 1.61% 6.34% -1.43% 3.65% 0.20% -4.73% 3.76% -7.43% -4.42% 6.61% -0.75% -3.18% -4.69% -3.33% 6.58% 2.22% -0.09% -4.39% 6.11% 0.53% 1.34% 6.39% 5.20% -0.93% -0.82% -7.94% 3.24% 4.35% 1.16% 3.10% 2.18% 2.35% 3.84% -8.13% 3.30% -1.10% -5.10% 0.24% 4.66% -2.22% 7.60% -3.55% -3.45% -5.42% -9.84% -4.20% 6.74% -2.30% -3.91% -5.29% -0.32% 12.53% 1.18% -3.24% 4.23% 5.84% 0.78% 0.80% 0.68% 0.94% 0.32% -3.12% 5.33% 1.74% 1.70% 1.91% 1.26% 0.64% -0.50% 1.76% -0.81% 1.06% 1.24% -1.05% 2.76% 0.50% 0.35% 0.00% -0.04% -1.00% 1.36% -0.75% -0.60% 2.16% 0.73% -0.94% 0.25% -0.39% 2.32% 0.9090 1.57% 1.20% 1.41% 0.01% -1.06% JNK -4.78% -0.34% -5.51% -3.79% 3.42% 6.27% -3.14% 0.49% -3.05% 6.32% -3.63% 0.38% -6.18% -3.05% -0.49% 1.31% 8.69% -5.91% -2.15% -0.17% 0.56% -1.52% -6.62% 2.6 -0.81% 2.28% -6.75% -0.45% 5.41% 10.93% -0.84% 5.11% -6.14% 8.97% 1.98% -3.26% 0.69% 0.92% 2.51% 0.81% 0.02% 1.56% 1.81% -0.02% 0.56% 0.92% 0.96% -2.37% 2.50% -2.41% 0.90% -1.46% -1.99% 1.82% 2.16% -0.94% 1.04% 0.43% -2.04% -0.73% -2.05% -3.18% 2.79% -2.53% -3.63% -0.98% 0.66% 3.00% 3.65% 0.34% 2.36% 1.58% 1.86% 1.02% 10/1/13 5.14% 2.69% 2.96% 12/1/13 2.04% 1/1/14-3.00% 2/1/14 4.55% 3/1/14 0.39% 4/1/14 1.14% 5/1/14 2.32% 6/1/14 1.58% 7/1/14-0.87% 8/1/14 3.95% 14-1.84% 10/1/14 2.83% 11/1/14 2.75% 12/1/14-0.80% 1/1/15-2.43% 2/1/15 5.62% 3/1/15-2.01% 4/1/15 1.43% 5/1/15 1.29% 6/1/15-2.49% 196 1.63% -2.40% 4.78% -1.00% -3.50% 0.79% 5.27% -6.41% 5.23% -6.19% 6.89% 0.11% 2.51% -2.92% 5.95% 1.46% -2.27% 2.24% 0.77% -1.55% -5.89% -5.17% 5.91% 103 105 107 7/1/15 2.71% 8/1/15-5.36% 9/1/15-3.80% 10/1/15 9.60% 11/1/15-01096 12/1/15-2.31% 1/1/16-4.41% 2/1/16-0.08% 3/1/16 6.18% 4/1/16 0.91% 5/1/16 1.70% 6/1/16-0.17% 7/1/16 4.19% 8/1/16 0.12% 9/1/16-0.50% 7% -4.58% -5.16% 1.24% 8.14% 1.51% 2.25% 0.15% 4.57% 0.46% -0.99% -5.44% -8.18% -0.22% 7.69% 1.98% 2.24% -0.02% 5.30% 2.34% Normal View Ready Sum-10/5/67