Question

ONLY ANSWER QUESTION MARKS ON TABLE (?) Regardless of one's position in a company, it is important to be able to read financial statements and

ONLY ANSWER QUESTION MARKS ON TABLE (?)

Regardless of one's position in a company, it is important to be able to read financial statements and understand how to use them to help determine how a company is performing as it implements its strategy. Using the this spread sheet, complete the tab titled Company using these Financial Actions for WM (Waste Management).

To better understand how to use the Navigating the Financials tool and how to complete the Company tab, watch the video posted below.

Once you have complete the Company tab in the Navigating the Financials tool, answer the questions. Your answers for the quiz will always come from column Q on your completed Navigating the Financials spreadsheet. Open the quiz and report the requested number.

For consistency of reporting numbers and answering the questions on the quiz, use the following guidelines for your answers:

- Items in the Cash section should always be rounded to whole numbers in millions. For example 527,000,000 should be recorded as 527.

- Numbers in the Profit section should be rounded to whole numbers in millions. For example 5,427,000,000 should be recorded as 5,427.

- Percentages in the Profit, Assets, and Growth section should be rounded to whole percents. For example, 6.2% should be rounded to 6% or if you have 6.6%, it would be rounded to 7%.

- Values in the People section should be rounded to two decimals. For example if your answer is 8.141, you should record the answer as 8.14.

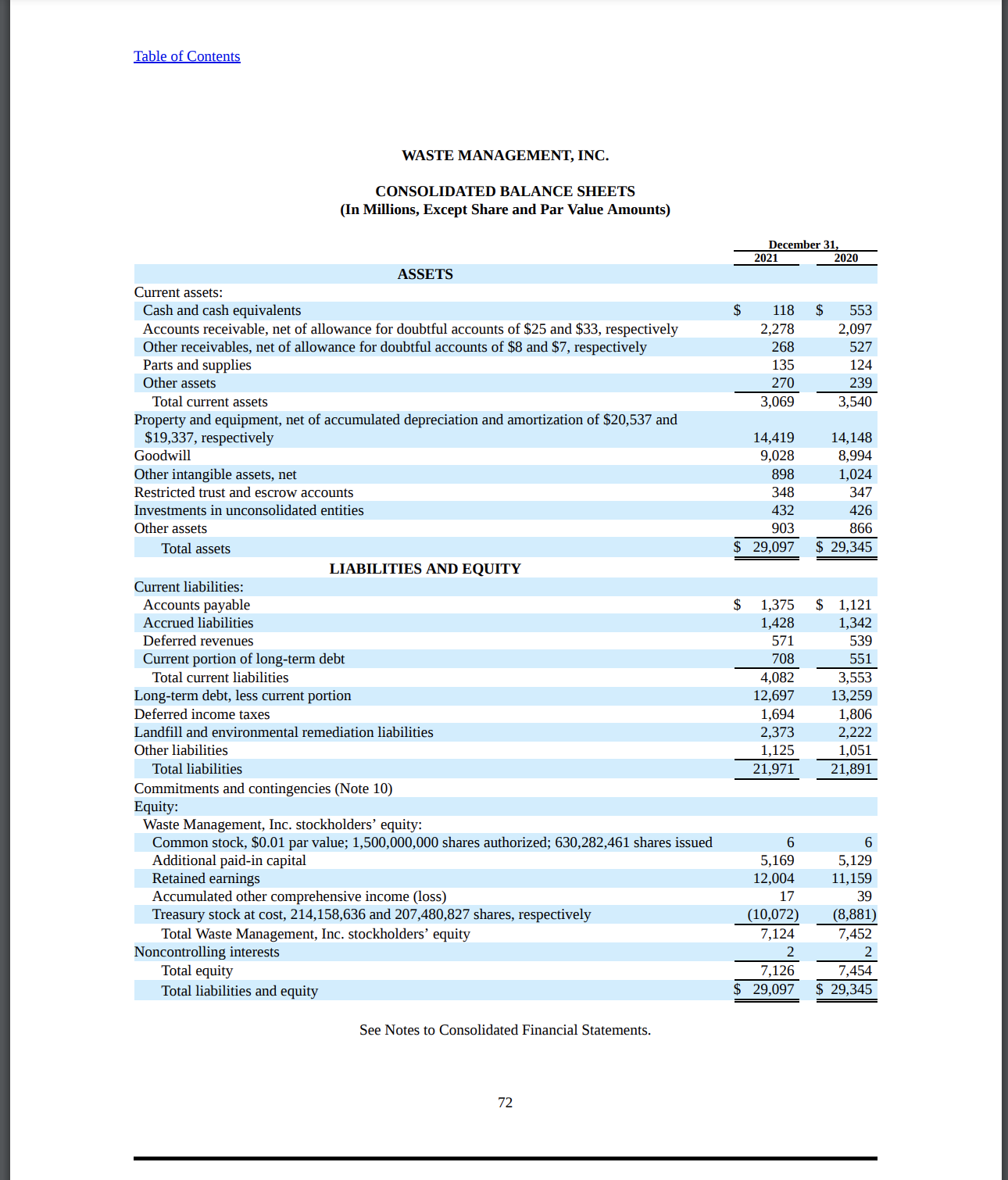

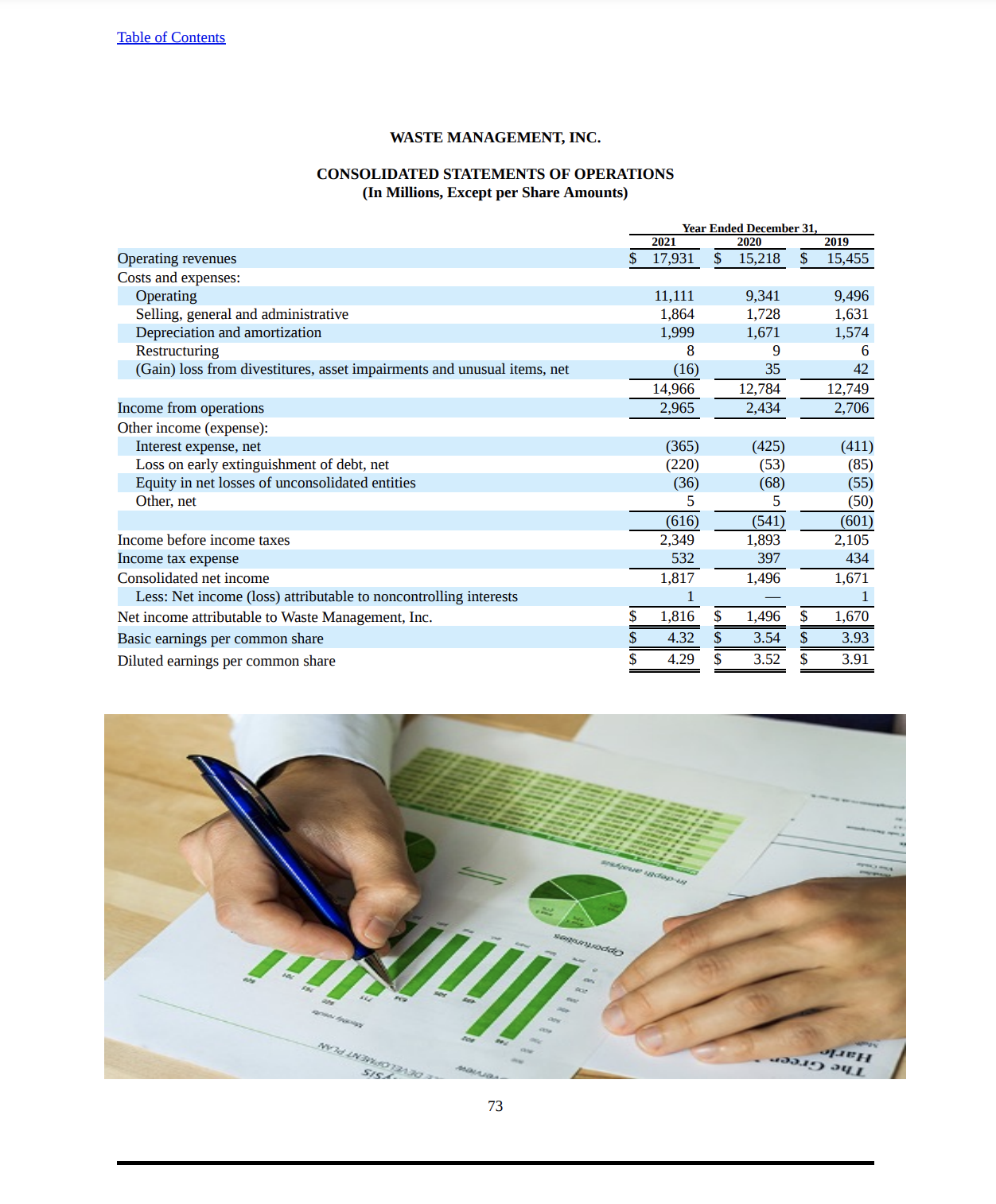

| Key Metric | Statement | Equation & In Millions | Results | ||||||||

| Cash | 1. Cash | Income | Balance | Cash Flow | No Equation | ||||||

| Line Item: Cash&Cash Equivalents | x | $ | ? | ||||||||

| 2. Cash Flow | Income | Balance | Cash Flow | No Equation | |||||||

| Line Item: Net Cash Provided by Operations Activites | x | $ | ? | ||||||||

| 3. Free Cash Flow (FCF) | Income | Balance | Cash Flow | Equation | |||||||

| Line Item: Net Cash Provided by Operations Activites | x | Net Cash Provided by Operating Activities - Capital Expenditures | 0 | minus | ? | $ | 0 | ||||

| Line Item: Capital Expenditures | x | ||||||||||

| Profit | 4. Revenue | Income | Balance | Cash Flow | No Equation | ||||||

| Line Item: Revenue | x | $ | ? | ||||||||

| 5. Gross Profit Margin | Income | Balance | Cash Flow | Equation | |||||||

| Line Item: Revenue | x | (Revenue - COGS / Revenue) * 100 | 0 | minus | ? | % | #DIV/0! | ||||

| Line Item: Costs of Goods Sold (COGS) | x | divided by | 0 | ||||||||

| 6. Income from Operations Before Depreciation, and Amoritization Margin (EBITDA) | Income | Balance | Cash Flow | Equation | |||||||

| Line Item: EBIT (Income From Operations) | x | (EBIT + Depreciation + Amortization/Revenue)*100 | % | #DIV/0! | |||||||

| Line Item: Depreciation | x | ? | plus | ? | |||||||

| Line Item: Amortization | x | divided by | 0 | ||||||||

| 7. Income From Operations Margin (EBIT) | Income | Balance | Cash Flow | Equation | |||||||

| Line Item: EBIT | x | (Income from Operations (EBIT)/Revenue) * 100 | % | #DIV/0! | |||||||

| Line Item: Revenue | x | 0 | divided by | 0 | |||||||

| 8. Net Income Margin | Income | Balance | Cash Flow | (Net Income / Revenue) * 100 | |||||||

| Line Item: Net Income Attributed to Company | x | ? | divided by | 0 | % | #DIV/0! | |||||

| Assets | 09. Current Ratio | Income | Balance | Cash Flow | Equation | ||||||

| Line Item: Current Assets | x | (Current Assets/Current Liabilities) | #DIV/0! | ||||||||

| Line Item: Current Liabilities | x | ? | divided by | ? | |||||||

| 10.Equity Ratio | Income | Balance | Cash Flow | Equation | |||||||

| Line Item: Total Equity | x | (Total Equity/Total Assets) * 100 | ? | divided by | ? | % | #DIV/0! | ||||

| Line Item: Total Assets | x | times | 100 | ||||||||

| 11. Return on Assets (ROA) | Income | Balance | Cash Flow | Equation | |||||||

| Line Item: Net Income | x | (Net Income/Total Assets) * 100 | 0 | divided by | 0 | % | #DIV/0! | ||||

| Line Item: Total Assets | x | times | 100 | ||||||||

| Growth | 12. Revenue Growth | Income | Balance | Cash Flow | Equation | ||||||

| Line Item: Revenue | x | ((This Year's Revenue/Last Year's Revenue)-1)*100 | 0 | divided by | ? | % | #DIV/0! | ||||

| minus | 1 | *100 | |||||||||

| 13. Gross Profit Growth | Income | Balance | Cash Flow | Equation | |||||||

| Line Item: Gross Profit | x | ((This Year's Gross Profit/Last Year's Gross Profit)-1)*100 | ? | divided by | ? | % | #DIV/0! | ||||

| minus | 1 | *100 | |||||||||

| 14. EBITDA Growth | Income | Balance | Cash Flow | Equation | |||||||

| Line Item: EBITDA | See Above | ((This Year's EBITDA/Last Year's EBITDA)-1)*100 | ? | divided by | ? | % | #DIV/0! | ||||

| minus | 1 | *100 | |||||||||

| 15. EBIT Growth | Income | Balance | Cash Flow | Equation | |||||||

| Line Item: Income From Operations (EBIT) | x | ((This Year's EBIT/Last Year's EBIT)-1)*100 | 0 | divided by | ? | % | #DIV/0! | ||||

| minus | 1 | *100 | |||||||||

| 16. Net Income Growth | Income | Balance | Cash Flow | Equation | |||||||

| Line Item: Net Income Attributed to Company | x | ((This Year's Net Income/Last Year's Net Income)-1)*100 | 0 | divided by | ? | % | #DIV/0! | ||||

| minus | 1 | *100 | |||||||||

| 17. Earnings Per Share (EPS) Growth | Income | Balance | Cash Flow | Equation | |||||||

| Line Item: Diluted Earnings per Common Share | x | ((This Year's EPS/Last Year's EPS)-1)*100 | ? | divided by | ? | % | #DIV/0! | ||||

| minus | 1 | *100 | |||||||||

| People | 18. Revenue Per Employee | Income | Balance | Cash Flow | Equation | ||||||

| Line Item: Revenue | X | Revenue / Number of Employees | 0 | divided by | ? | ||||||

| Line Item: Number of Employees | Yahoo Finance Company "Profile" Tab | $ | #DIV/0! | ||||||||

| 19. Cash Flow Per Employee | Income | Balance | Cash Flow | Equation | |||||||

| Line Item: Cash Flow | X | Cash Flow / Number of Employees | 0 | divided by | - | ||||||

| Line Item: Number of Employees | Yahoo Finance Company "Profile" Tab | $ | #DIV/0! | ||||||||

| 20. Net Income Per Employee | Income | Balance | Cash Flow | Equation | |||||||

| Line Item: Net Income | X | Net Income / Number of Employees | - | divided by | - | ||||||

| Line Item: Number of Employees | Yahoo Finance Company "Profile" Tab | $ | #DIV/0! | ||||||||

| Stock Prices | 21. Company Stock Prices | Income | Balance | Cash Flow | No Equation - Use Yahoo Finance or Another Source | ||||||

| Line Item: Stock Prices | Yahoo Finance | $ | ? | ||||||||

WASTE MANAGEMENT, INC. CONSOLIDATED BALANCE SHEETS (In Millions, Except Share and Par Value Amounts) WASTE MANAGEMENT, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In Millions, Except per Share Amounts) Table of Contents WASTE MANAGEMENT, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In Millions) See Notes to Consolidated Financial Statements. 74

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started