Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Markowitz portfolio optimization: Harry Markowitz received the 1990 Nobel Prize for his path-breaking work in portfolio optimization. One version of the Markowitz model is

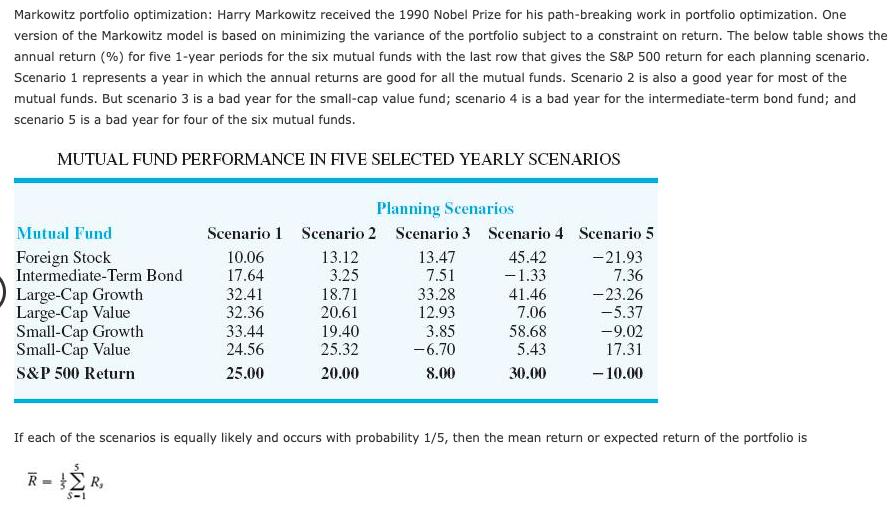

Markowitz portfolio optimization: Harry Markowitz received the 1990 Nobel Prize for his path-breaking work in portfolio optimization. One version of the Markowitz model is based on minimizing the variance of the portfolio subject to a constraint on return. The below table shows the annual return (%) for five 1-year periods for the six mutual funds with the last row that gives the S&P 500 return for each planning scenario. Scenario 1 represents a year in which the annual returns are good for all the mutual funds. Scenario 2 is also a good year for most of the mutual funds. But scenario 3 is a bad year for the small-cap value fund; scenario 4 is a bad year for the intermediate-term bond fund; and scenario 5 is a bad year for four of the six mutual funds. MUTUAL FUND PERFORMANCE IN FIVE SELECTED YEARLY SCENARIOS Planning Scenarios Mutual Fund Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 Foreign Stock 10.06 13.12 13.47 45.42 -21.93 Intermediate-Term Bond 17.64 3.25 7.51 -1.33 7.36 Large-Cap Growth 32.41 18.71 33.28 41.46 -23.26 Large-Cap Value 32.36 20.61 12.93 7.06 -5.37 Small-Cap Growth 33.44 19.40 3.85 58.68 -9.02 Small-Cap Value 24.56 25.32 -6.70 5.43 17.31 S&P 500 Return 25.00 20.00 8.00 30.00 -10.00 If each of the scenarios is equally likely and occurs with probability 1/5, then the mean return or expected return of the portfolio is R, S-1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the mean return or expected return of the portfolio using the equal probability assumpt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started