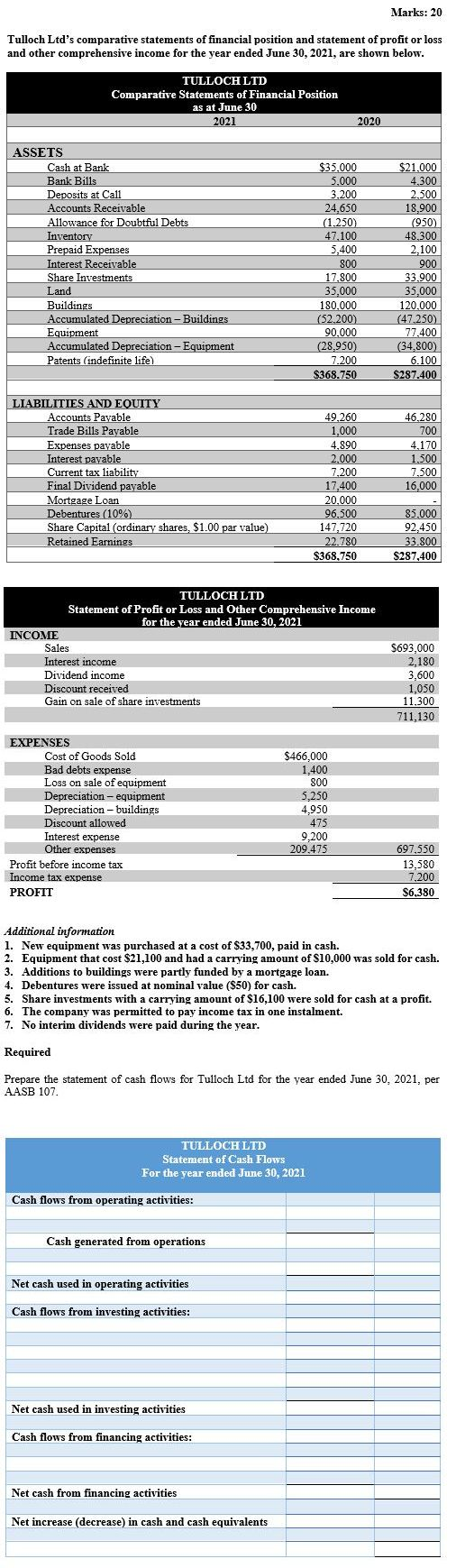

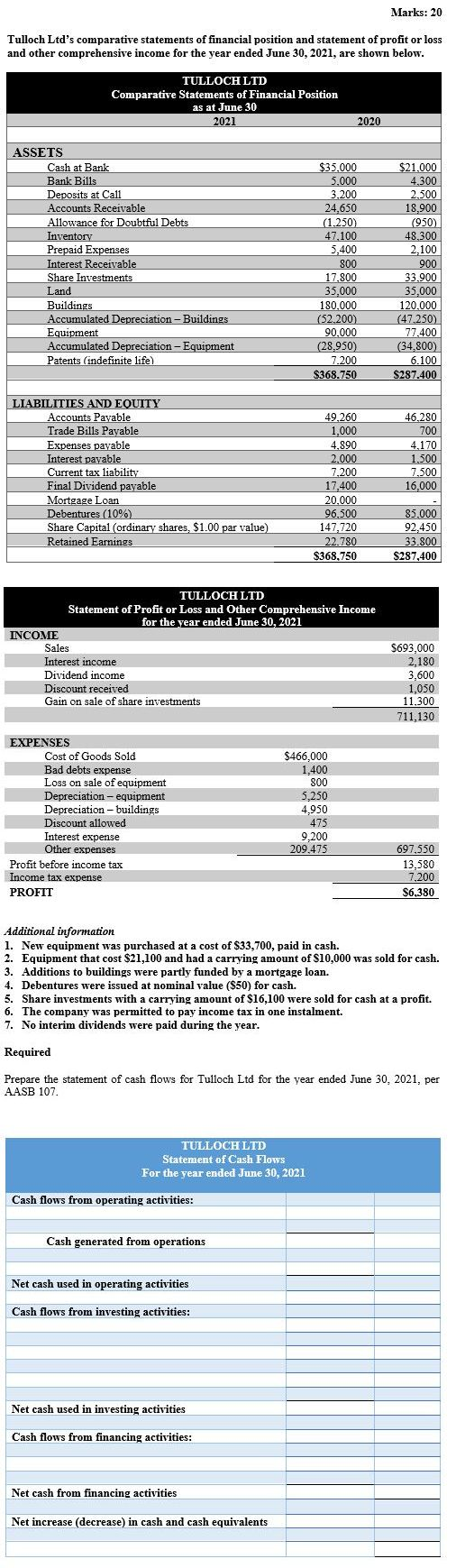

Marks: 20 Tulloch Ltd's comparative statements of financial position and statement of profit or loss and other comprehensive income for the year ended June 30, 2021, are shown below. TULLOCH LTD Comparative Statements of Financial Position as at June 30 2021 2020 $35.000 5.000 3.200 $21.000 4,300 2.500 24,650 (1.250 18,900 ASSETS Cash at Bank Bank Bills Deposits at Call Accounts Receivable Allowance for Doubtful Debts Inventory Prepaid Expenses Interest Receivable Share Investments Land Buildings Accumulated Depreciation - Buildings Equipment Accumulated Depreciation - Equipment Patents (indefinite life) (950) 48.300 2,100 900 33.900 35,000 47.100 5,400 800 17,800 35,000 180.000 (52.200) 90.000 (28,950) 7.200 120.000 (47.250) 77.400 (34,800) 6.100 $368.750 $287.400 49.260 1,000 4.890 2.000 46.280 700 4,170 1.500 LIABILITIES AND EQUITY Accounts Payable Trade Bills Payable Expenses payable Interest payable Current tax liability Final Dividend payable Mortgage Loan Debentures (10%) Share Capital (ordinary shares, $1.00 par value) Retained Earnings 7,200 7.500 16,000 17,400 20,000 96.500 147,720 22.780 $368,750 85.000 92.450 33.800 $287,400 TULLOCH LTD Statement of Profit or Loss and Other Comprehensive Income for the year ended June 30, 2021 INCOME Sales Interest income Dividend income Discount received Gain on sale of share investments $693,000 2,180 3,600 1,050 11.300 711,130 EXPENSES Cost of Goods Sold Bad debts expense Loss on sale of equipment Depreciation - equipment Depreciation - buildings Discount allowed Interest expense Other expenses Profit before income tax Income tax expense PROFIT $466,000 1.400 800 5,250 4.950 475 9.200 209.475 697,550 13.580 7.200 $6,380 Additional information 1. New equipment was purchased at a cost of $33,700, paid in cash. 2. Equipment that cost $21,100 and had a carrying amount of $10,000 was sold for cash. 3. Additions to buildings were partly funded by a mortgage loan. 4. Debentures were issued at nominal value ($50) for cash. 5. Share investments with a carrying amount of $16,100 were sold for cash at a profit. 6. The company was permitted to pay income tax in one instalment. 7. No interim dividends were paid during the year. Required Prepare the statement of cash flows for Tulloch Ltd for the year ended June 30, 2021, per AASB 107. TULLOCH LTD Statement of Cash Flows For the year ended June 30, 2021 Cash flows from operating activities: Cash generated from operations Net cash used in operating activities Cash flows from investing activities: Net cash used in investing activities Cash flows from financing activities: Net cash from financing activities Net increase (decrease) in cash and cash equivalents Marks: 20 Tulloch Ltd's comparative statements of financial position and statement of profit or loss and other comprehensive income for the year ended June 30, 2021, are shown below. TULLOCH LTD Comparative Statements of Financial Position as at June 30 2021 2020 $35.000 5.000 3.200 $21.000 4,300 2.500 24,650 (1.250 18,900 ASSETS Cash at Bank Bank Bills Deposits at Call Accounts Receivable Allowance for Doubtful Debts Inventory Prepaid Expenses Interest Receivable Share Investments Land Buildings Accumulated Depreciation - Buildings Equipment Accumulated Depreciation - Equipment Patents (indefinite life) (950) 48.300 2,100 900 33.900 35,000 47.100 5,400 800 17,800 35,000 180.000 (52.200) 90.000 (28,950) 7.200 120.000 (47.250) 77.400 (34,800) 6.100 $368.750 $287.400 49.260 1,000 4.890 2.000 46.280 700 4,170 1.500 LIABILITIES AND EQUITY Accounts Payable Trade Bills Payable Expenses payable Interest payable Current tax liability Final Dividend payable Mortgage Loan Debentures (10%) Share Capital (ordinary shares, $1.00 par value) Retained Earnings 7,200 7.500 16,000 17,400 20,000 96.500 147,720 22.780 $368,750 85.000 92.450 33.800 $287,400 TULLOCH LTD Statement of Profit or Loss and Other Comprehensive Income for the year ended June 30, 2021 INCOME Sales Interest income Dividend income Discount received Gain on sale of share investments $693,000 2,180 3,600 1,050 11.300 711,130 EXPENSES Cost of Goods Sold Bad debts expense Loss on sale of equipment Depreciation - equipment Depreciation - buildings Discount allowed Interest expense Other expenses Profit before income tax Income tax expense PROFIT $466,000 1.400 800 5,250 4.950 475 9.200 209.475 697,550 13.580 7.200 $6,380 Additional information 1. New equipment was purchased at a cost of $33,700, paid in cash. 2. Equipment that cost $21,100 and had a carrying amount of $10,000 was sold for cash. 3. Additions to buildings were partly funded by a mortgage loan. 4. Debentures were issued at nominal value ($50) for cash. 5. Share investments with a carrying amount of $16,100 were sold for cash at a profit. 6. The company was permitted to pay income tax in one instalment. 7. No interim dividends were paid during the year. Required Prepare the statement of cash flows for Tulloch Ltd for the year ended June 30, 2021, per AASB 107. TULLOCH LTD Statement of Cash Flows For the year ended June 30, 2021 Cash flows from operating activities: Cash generated from operations Net cash used in operating activities Cash flows from investing activities: Net cash used in investing activities Cash flows from financing activities: Net cash from financing activities Net increase (decrease) in cash and cash equivalents