Answered step by step

Verified Expert Solution

Question

1 Approved Answer

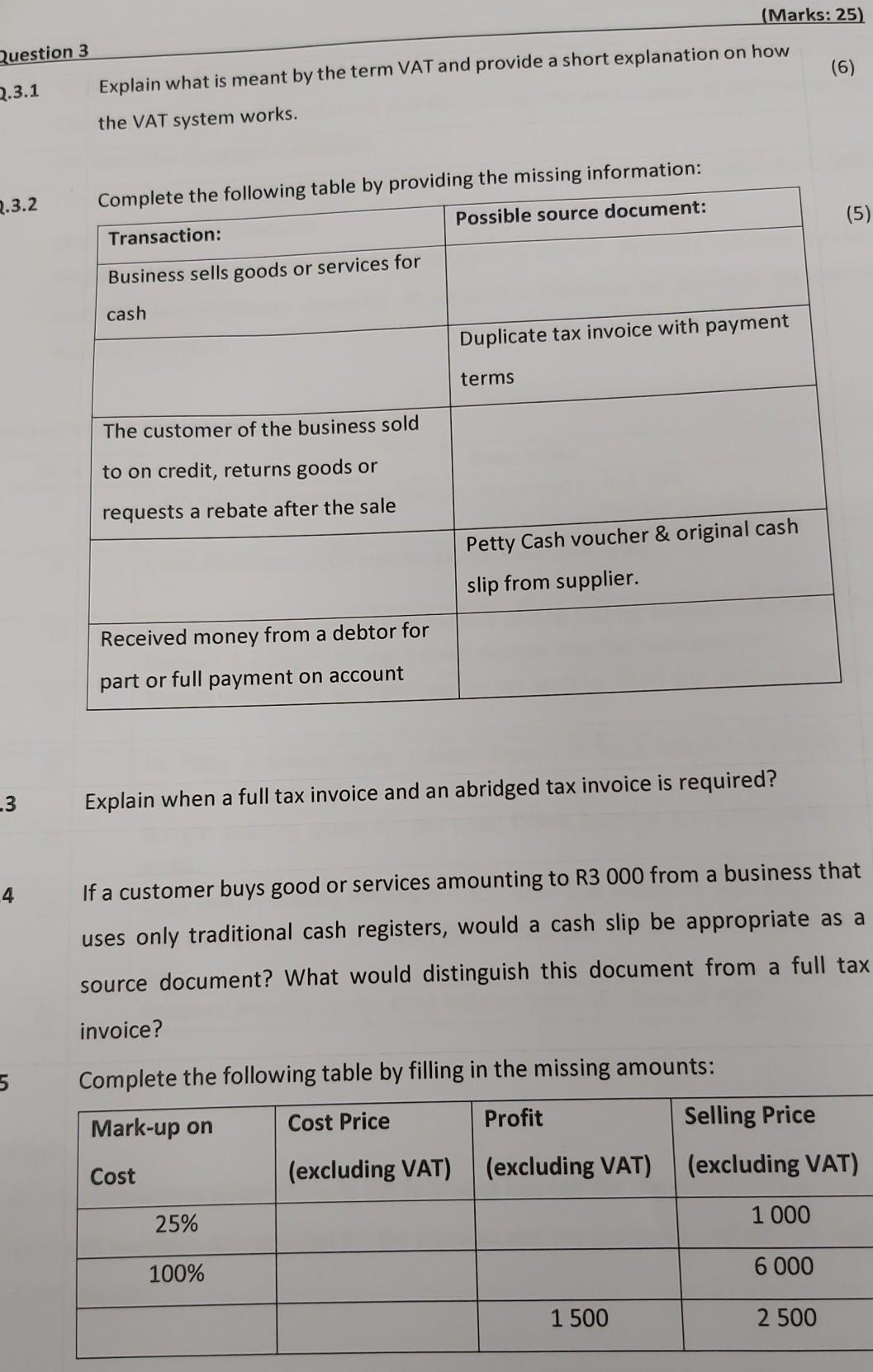

(Marks: 25) (6) 2.3.1 Question 3 Explain what is meant by the term VAT and provide a short explanation on how the VAT system works.

(Marks: 25) (6) 2.3.1 Question 3 Explain what is meant by the term VAT and provide a short explanation on how the VAT system works. 2.3.2 Complete the following table by providing the missing information: Possible source document: (5) Transaction: Business sells goods or services for cash Duplicate tax invoice with payment terms The customer of the business sold to on credit, returns goods or requests a rebate after the sale Petty Cash voucher & original cash slip from supplier. Received money from a debtor for part or full payment on account -3 Explain when a full tax invoice and an abridged tax invoice is required? 4 If a customer buys good or services amounting to R3 000 from a business that uses only traditional cash registers, would a cash slip be appropriate as a source document? What would distinguish this document from a full tax invoice? 5 Complete the following table by filling in the missing amounts: Profit Mark-up on Cost Price Selling Price Cost (excluding VAT) (excluding VAT) (excluding VAT) 25% 1 000 100% 6 000 1 500 2 500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started