Answered step by step

Verified Expert Solution

Question

1 Approved Answer

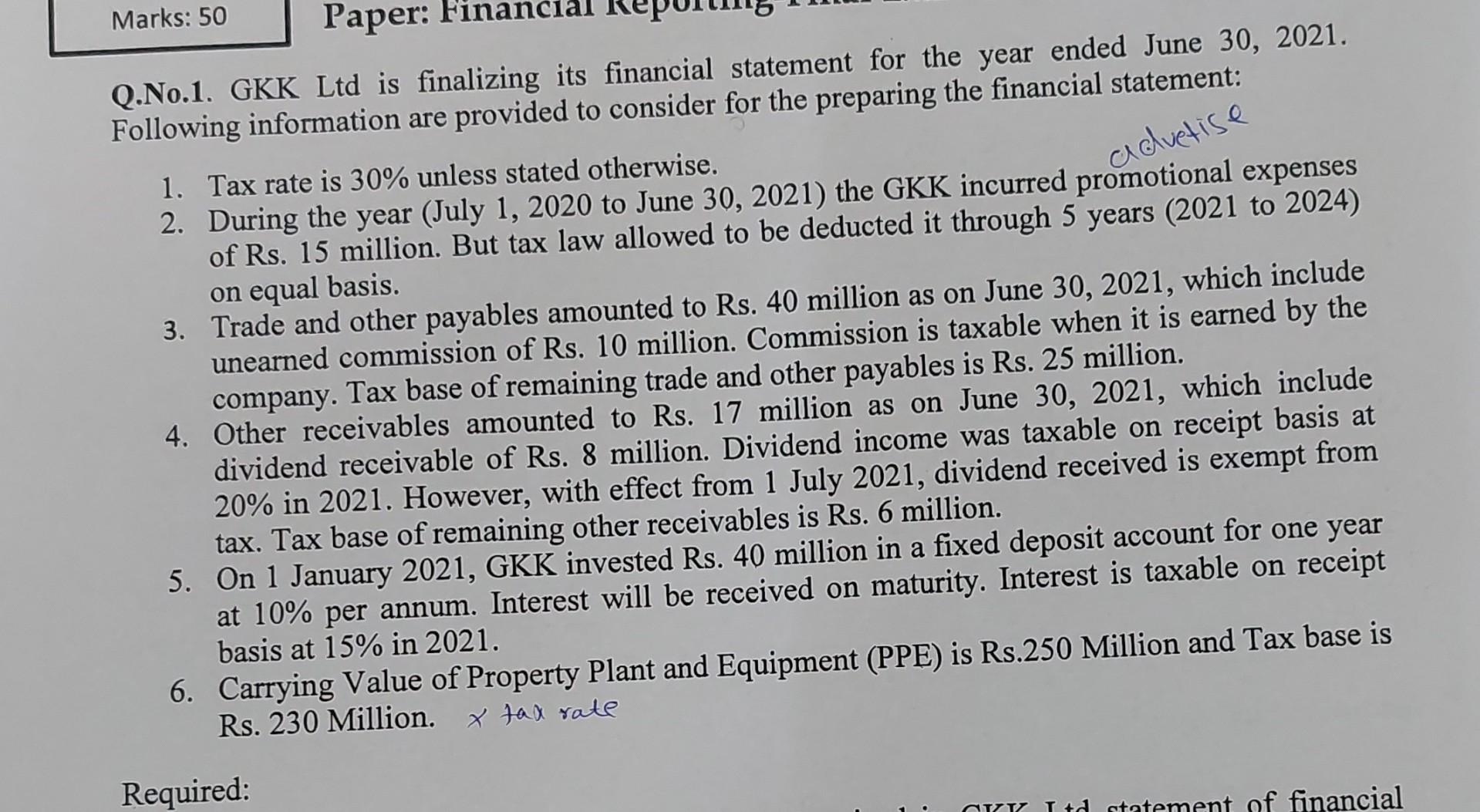

Marks: 50 Paper: Financial advetise Q.No.1. GKK Ltd is finalizing its financial statement for the year ended June 30, 2021. Following information are provided to

Marks: 50 Paper: Financial advetise Q.No.1. GKK Ltd is finalizing its financial statement for the year ended June 30, 2021. Following information are provided to consider for the preparing the financial statement: 1. Tax rate is 30% unless stated otherwise. 2. During the year (July 1, 2020 to June 30, 2021) the GKK incurred promotional expenses of Rs. 15 million. But tax law allowed to be deducted it through 5 years (2021 to 2024) on equal basis. 3. Trade and other payables amounted to Rs. 40 million as on June 30, 2021, which include unearned commission of Rs. 10 million. Commission is taxable when it is earned by the company. Tax base of remaining trade and other payables is Rs. 25 million. 4. Other receivables amounted to Rs. 17 million as on June 30, 2021, which include dividend receivable of Rs. 8 million. Dividend income was taxable on receipt basis at 20% in 2021. However, with effect from 1 July 2021, dividend received is exempt from tax. Tax base of remaining other receivables is Rs. 6 million. 5. On 1 January 2021, GKK invested Rs. 40 million in a fixed deposit account for one year at 10% per annum. Interest will be received on maturity. Interest is taxable on receipt basis at 15% in 2021. 6. Carrying Value of Property Plant and Equipment (PPE) is Rs.250 Million and Tax base is Rs. 230 Million. x tax rate a Required: KY I td statement of financial

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started