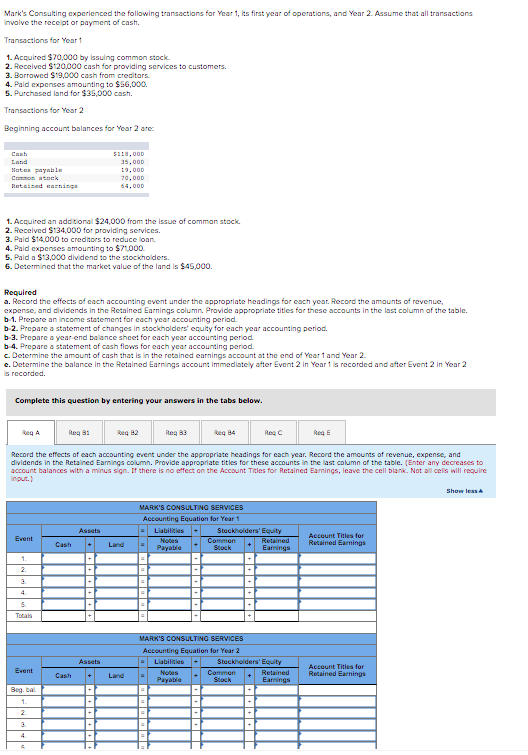

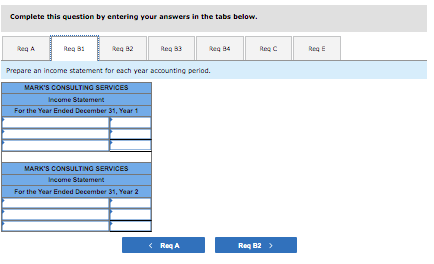

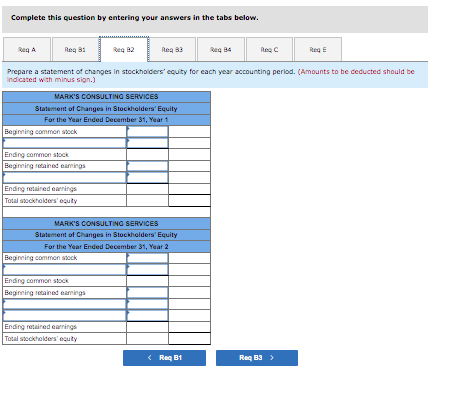

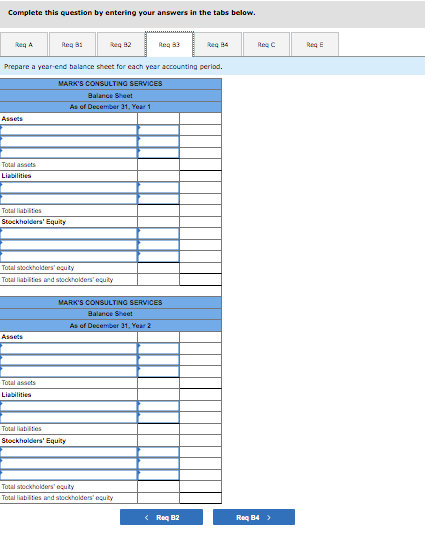

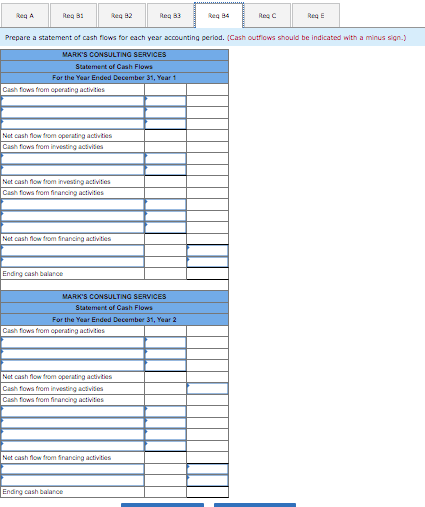

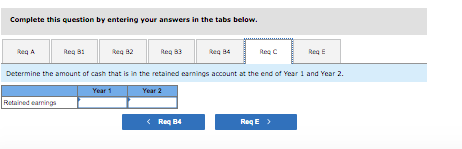

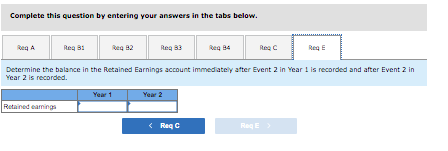

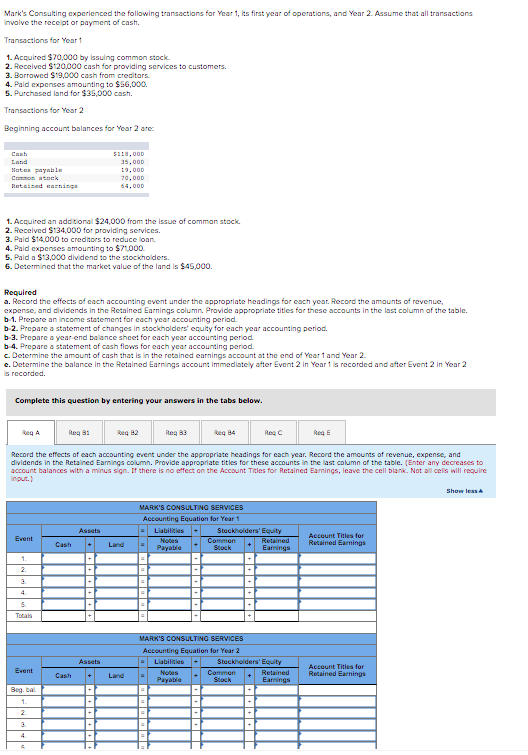

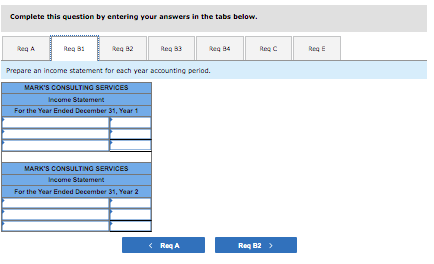

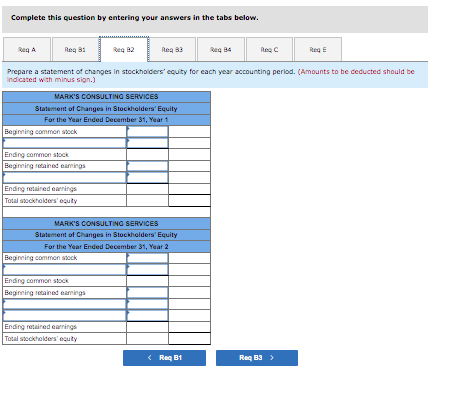

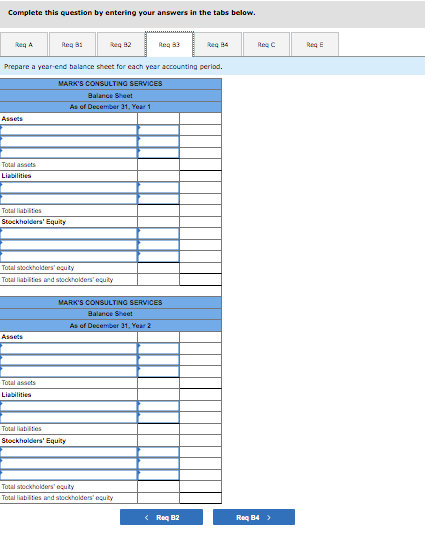

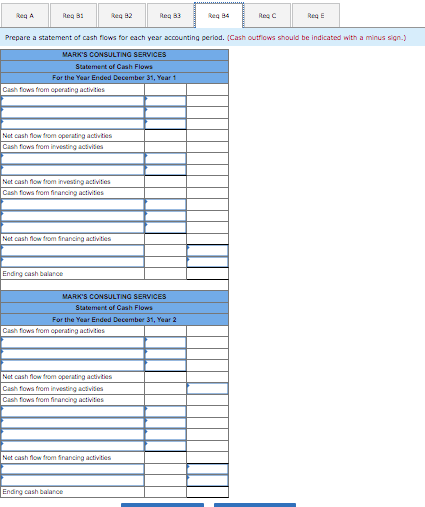

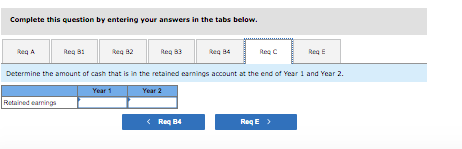

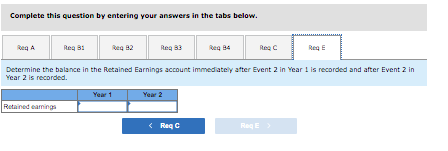

Mark's Consulting experienced the following transactions for Year 1, its first year of operations, and Year 2. Assume that all trarsactions involve the rece pt or payment of cash. Transactions for Year 1 1. Acquired $70,000 by issuling common stock. 2. Recelved $120,000 cash for providing services to customers. 3. Barrawed $9,000 cash from crealtare. 4. Paid expenses amounting to $56,000. 5. Purchased land for $35,000 cash. Transactions for Year 2 Beginning account bolances for Year 2 are: 1. Acquired an additional $24,000 from the issue of common stock. 2. Recelved $134,000 for providing serviees. 3. Paid $14,000 to credliors to reduce loan. 4. Paid expenses amounting to $71000. 5. Paid a S13,000 dividend to the stockhoiders. 6. Determined that the market value of the land is $45,000. Required a. Record the effects of each accounting cvent under the appropriate headings for each year. Record the amounts of revenue, expense, and dividends in the Retained Earrings column. Provide appropriate tities far these accounts in the last column of the table. b-1. Prepare an income statement far each year accounting periad. b-2. Prepare a statement of changes in stockholders' equity for each year accounting period. b-3. Prepare a yearend balance sheet for each year accounting period. b 4. Prepare a statement of cash flows for each year accounting period. c. Determine the amount of cash that is in the retained earnings account at the end of Year 1 and Year 2 . e. Determine the balance in the Retained Earnings account immediately after Event 2 in Year 1 is recorded and after Event 2 in Year 2 is recorded. Complete this question by entering your answers in the tabs below. Record the effects of each accounting event under the appropriate headings for each year. Record the amounts of revenue, expense, and dividends in the Retained Eamings column. Provide appropriate tities for these accounts in the last column of the table. (Enter any cecreases to account balanoes with a minus sign. If there is no effect on the Account Tites for Retained Eamings, leave the cell blank. Not all cel's will roguire inpus.) Complete this question by entering your answers in the tabs belove. Prepare an income statement for each year acoounting period. Complete this question by entering your answers in the tabs below. Prepare a statement of changes in stockholders' equity for each year accounting period. (Amounts to he ceducted should be indicated with minus sion. Complete this question by entering your answers in the tabs below. Prepare a statement of cash flows for each year acoounting period. (Cash outfiows should be indicatod with a minus sign.) Complete this question by entering your answers in the tabs below. Determine the amount of cash that is in the retained eamings aocount at the end of Year 1 and Year 2. Complete this question by entering your answers in the tabs below. Determine the balance in the Rectained Earnings account immedately after Event 2 in Year 1 is recorded and after Event 2 in Year 2 is recorded