Answered step by step

Verified Expert Solution

Question

1 Approved Answer

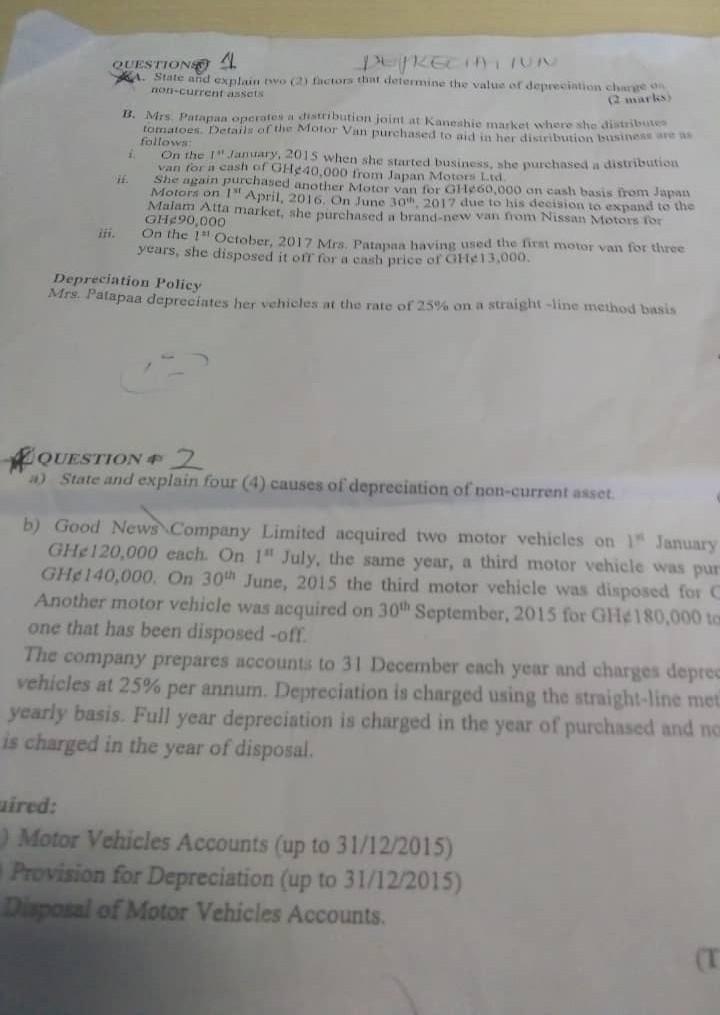

marks QUESTIONS 4. LIKECU 1. State and explain nothctors that determine the value or deprecintion charge on not-current assets B. Mrs. Patapaa operates a distribution

marks QUESTIONS 4. LIKECU 1. State and explain nothctors that determine the value or deprecintion charge on not-current assets B. Mrs. Patapaa operates a distribution joint at Kaneshie market where she distribute tomatoes. Details of the Motor Vin purchased to aid in her distribution business follows On the I" January, 2015 when she started business, she purchased a distribution van for a cash of CH440,000 from Japan Motors Ltd it She main purchased another Motor van for GH460,000 on cash basis from Japan Motors on 1 April, 2016, On June 30 2017 due to his decision to expand to the Malam Atta market, she purchased a brand-new van hom Nissan Motors for GH290,000 if On the ! October, 2017 Mrs. Patapaa having used the first motor van for three years, she disposed it off for a cash price of Ghe13,000 Depreciation Policy Mrs. Palapaa depreciates her vehicles at the rate of 25% on a straight-line method basis QUESTION 2 2) State and explain four (4) causes of depreciation of non-current asset. b) Good News Company Limited acquired two motor vehicles on 19 January GH 120,000 each. On 1" July, the same year, a third motor vehicle was pur GHe 140,000. On 30th June, 2015 the third motor vehicle was disposed for Another motor vehicle was acquired on 30th September, 2015 for GH 180,000 to one that has been disposed-off. The company prepares accounts to 31 December each year and charges deprec vehicles at 25% per annum. Depreciation is charged using the straight-line met yearly basis. Full year depreciation is charged in the year of purchased and no is charged in the year of disposal. wired: Motor Vehicles Accounts (up to 31/12/2015) Provision for Depreciation (up to 31/12/2015) Disposal of Motor Vehicles Accounts (T

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started