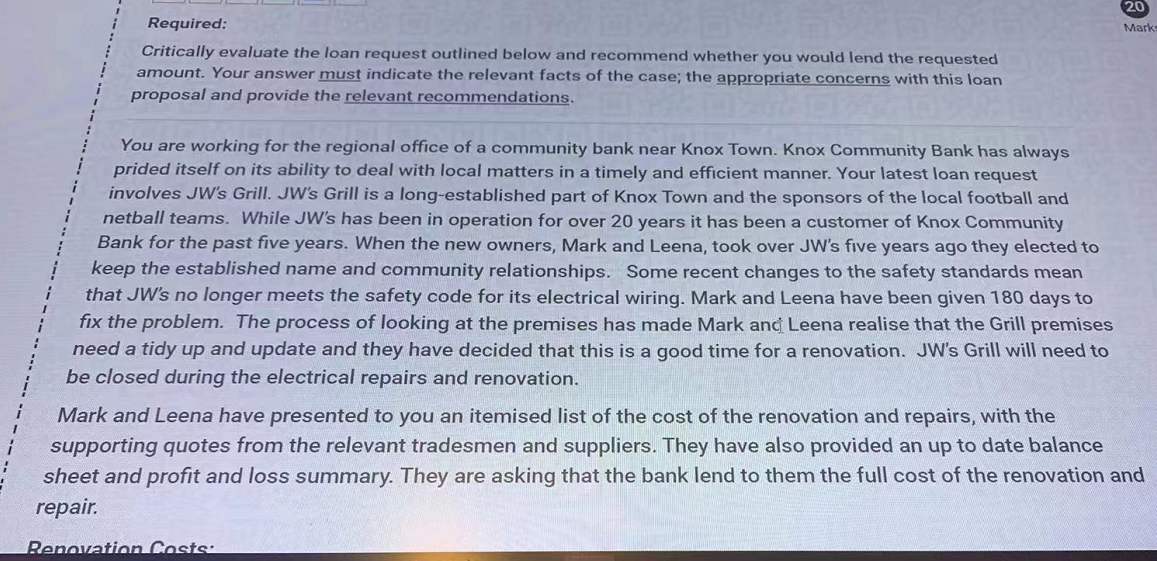

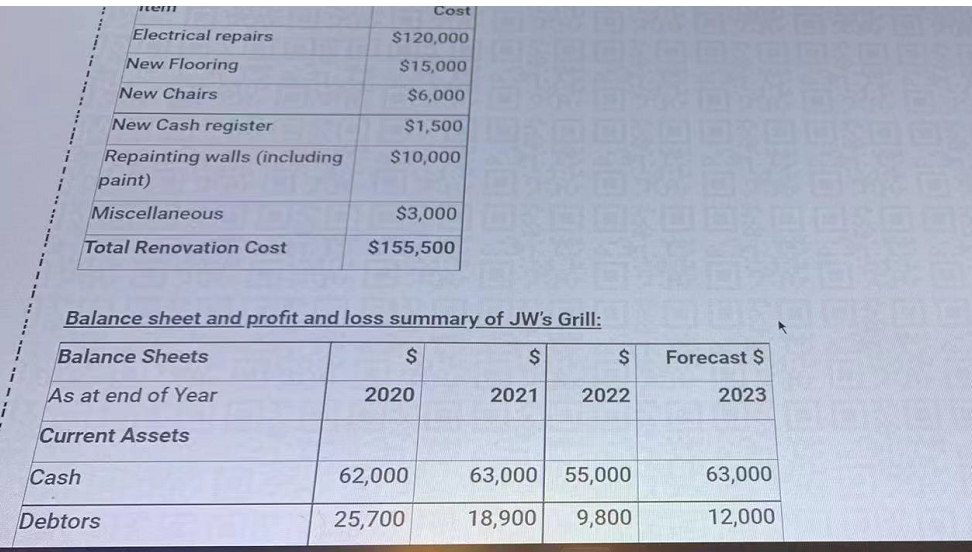

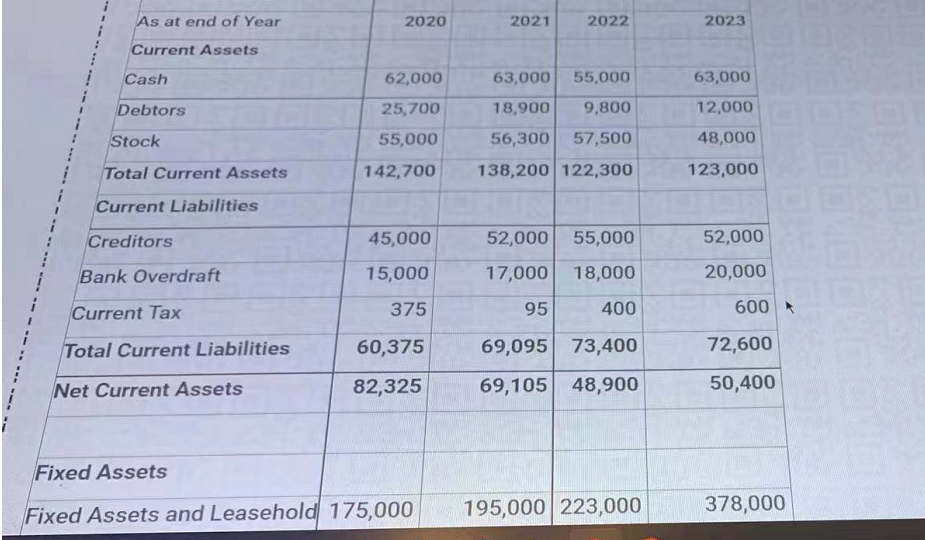

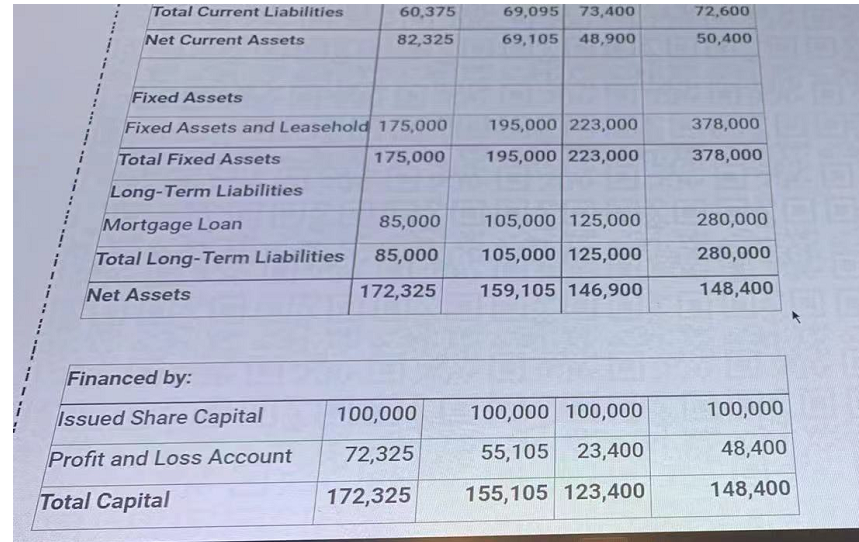

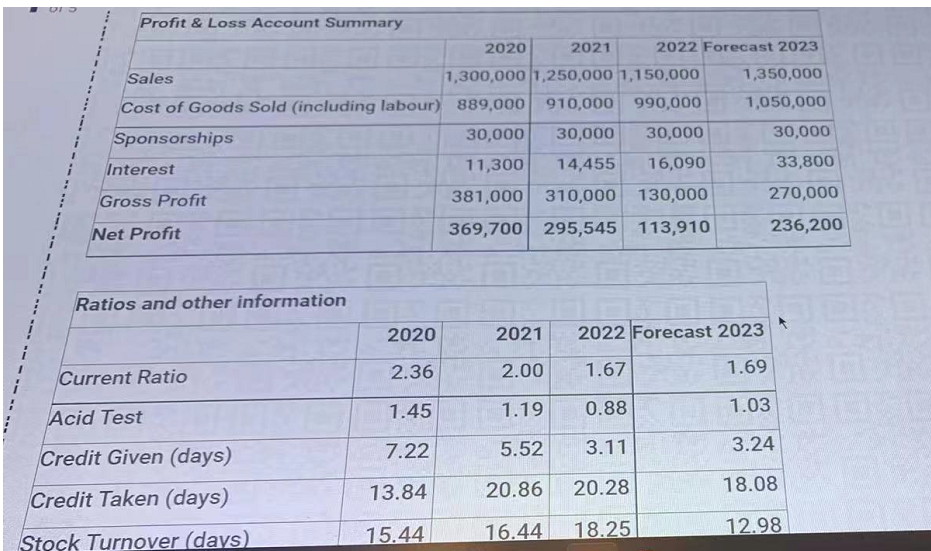

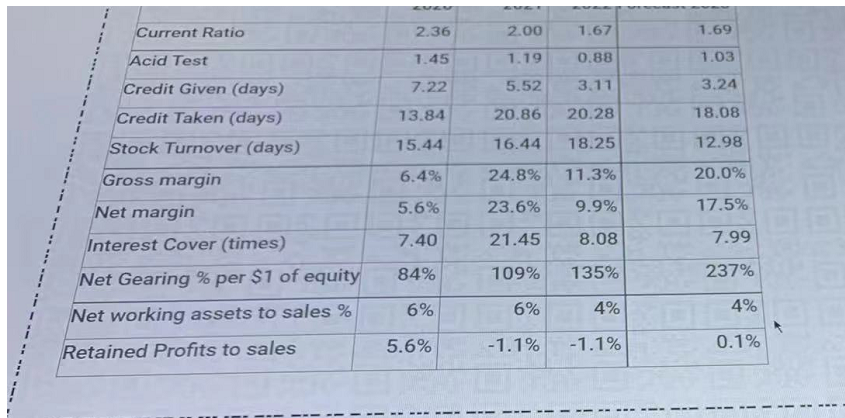

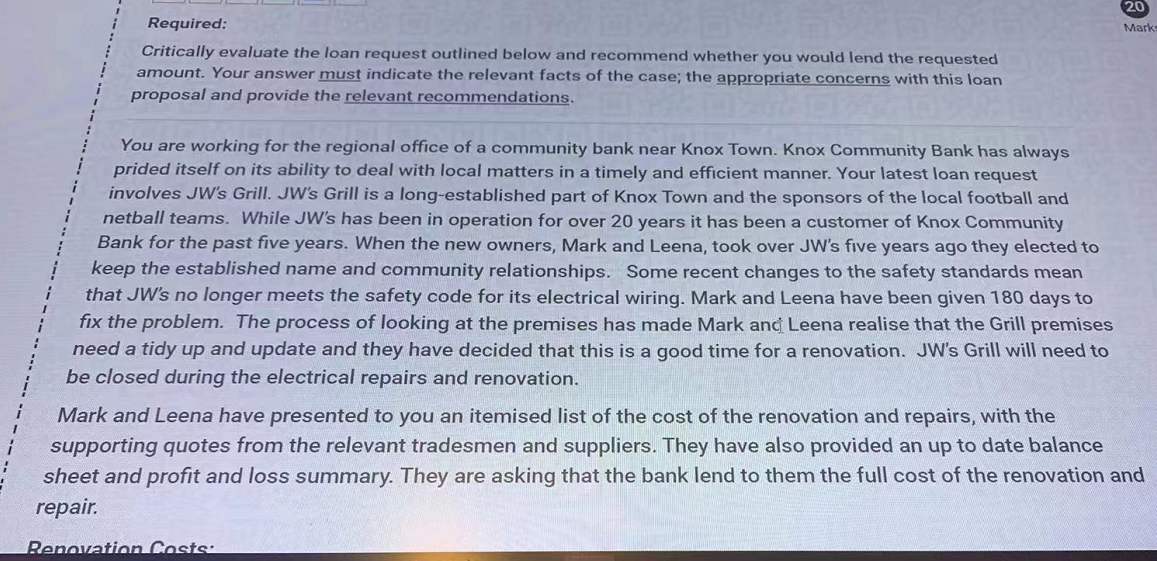

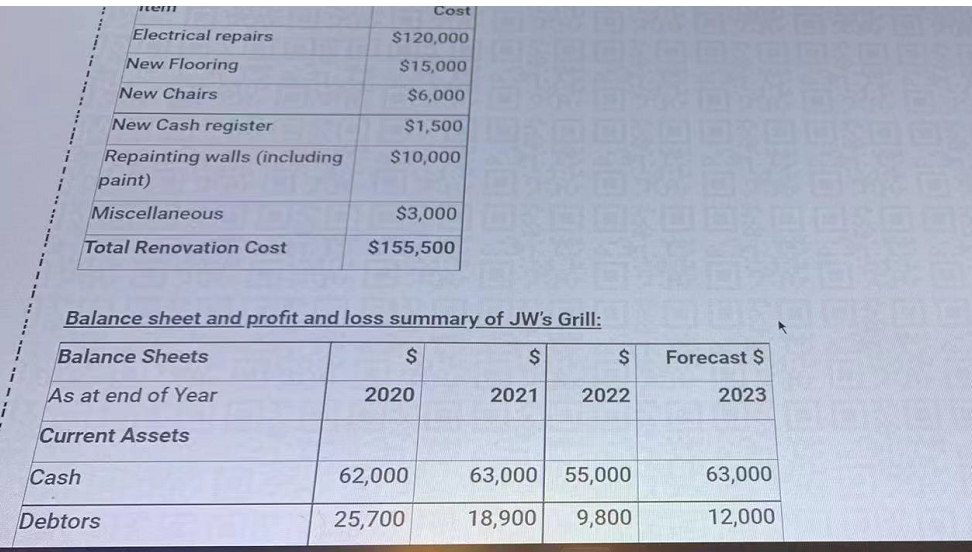

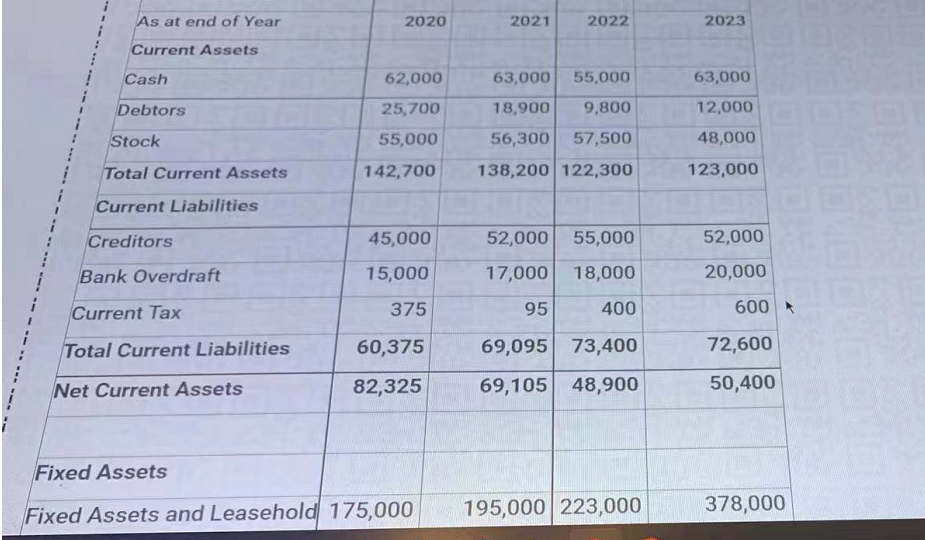

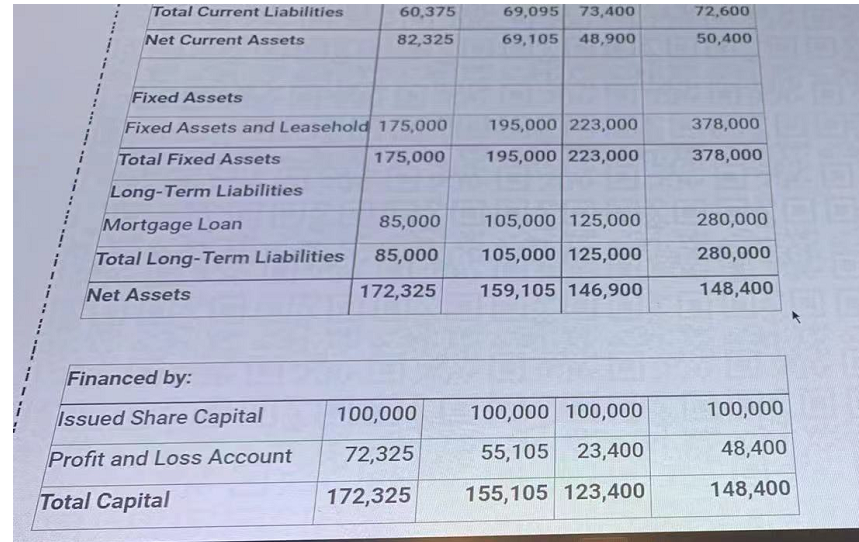

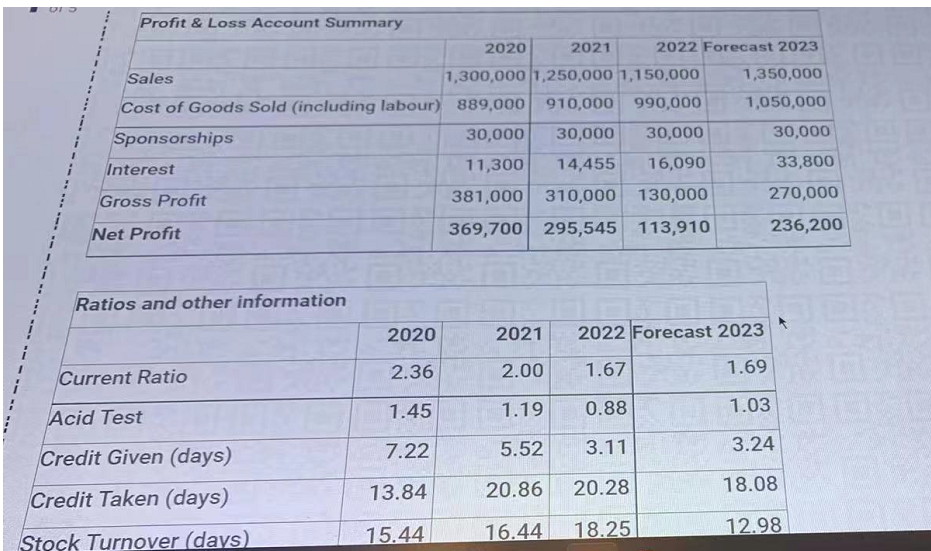

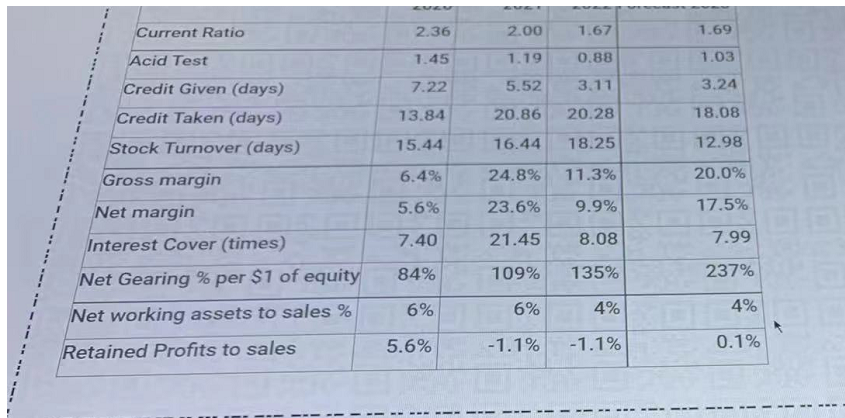

Marks Required: Critically evaluate the loan request outlined below and recommend whether you would lend the requested amount. Your answer must indicate the relevant facts of the case; the appropriate concerns with this loan proposal and provide the relevant recommendations. You are working for the regional office a community bank near Knox Town. Knox Community Bank has always prided itself on its ability to deal with local matters in a timely and efficient manner. Your latest loan request involves JW's Grill. JW's Grill is a long-established part of Knox Town and the sponsors of the local football and netball teams. While JW's has been in operation for over 20 years it has been a customer of Knox Community Bank for the past five years. When the new owners, Mark and Leena, took over JW's five years ago they elected to keep the established name and community relationships. Some recent changes to the safety standards mean that JW's no longer meets the safety code for its electrical wiring. Mark and Leena have been given 180 days to fix the problem. The process of looking at the premises has made Mark and Leena realise that the Grill premises need a tidy up and update and they have decided that this is a good time for a renovation. JW's Grill will need to be closed during the electrical repairs and renovation. i Mark and Leena have presented to you an itemised list of the cost of the renovation and repairs, with the supporting quotes from the relevant tradesmen and suppliers. They have also provided an up to date balance sheet and profit and loss summary. They are asking that the bank lend to them the full cost of the renovation and repair. Renovation Costs: nem Cost Electrical repairs $120,000 New Flooring $15,000 New Chairs $6,000 New Cash register $1,500 Repainting walls (including $10,000 paint) Miscellaneous $3,000 Total Renovation Cost $155,500 Balance sheet and profit and loss summary of JW's Grill: Balance Sheets $ $ $ As at end of Year 2020 2021 2022 Current Assets Cash 62,000 63,000 55,000 Debtors 25,700 18,900 9,800 Forecast $ 2023 63,000 12,000 As at end of Year 2020 Current Assets Cash 62,000 Debtors 25,700 Stock 55,000 Total Current Assets 142,700 Current Liabilities Creditors 45,000 Bank Overdraft 15,000 Current Tax 375 Total Current Liabilities 60,375 Net Current Assets 82,325 Fixed Assets Fixed Assets and Leasehold 175,000 2021 2022 63,000 55,000 18,900 9,800 56,300 57,500 138,200 122,300 52,000 55,000 17,000 18,000 95 400 69,095 73,400 69,105 48,900 195,000 223,000 2023 63,000 12,000 48,000 123,000 52,000 20,000 600 72,600 50,400 378,000 10 Total Current Liabilities 60,375 Net Current Assets 82,325 Fixed Assets Fixed Assets and Leasehold 175,000 Total Fixed Assets 175,000 Long-Term Liabilities Mortgage Loan 85,000 Total Long-Term Liabilities 85,000 Net Assets 172,325 Financed by: Issued Share Capital Profit and Loss Account Total Capital 100,000 72,325 172,325 69,095 73,400 69,105 48,900 195,000 223,000 195,000 223,000 105,000 125,000 105,000 125,000 159,105 146,900 100,000 100,000 55,105 23,400 155,105 123,400 72,600 50,400 378,000 378,000 280,000 280,000 148,400 100,000 48,400 148,400 Profit & Loss Account Summary 2020 2021 Sales 1,300,000 1,250,000 1,150,000 Cost of Goods Sold (including labour) 889,000 910,000 990,000 Sponsorships 30,000 30,000 30,000 Interest 11,300 14,455 16,090 Gross Profit 381,000 310,000 130,000 Net Profit 369,700 295,545 113,910 Ratios and other information Current Ratio Acid Test Credit Given (days) Credit Taken (days) Stock Turnover (days) 2020 2.36 1.45 7.22 13.84 15.44 2022 Forecast 2023 1,350,000 1,050,000 30,000 33,800 270,000 236,200 2021 2022 Forecast 2023 2.00 1.67 1.69 1.19 0.88 1.03 5.52 3.11 3.24 20.86 20.28 18.08 16.44 18.25 12.98 Current Ratio Acid Test Credit Given (days) Credit Taken (days) Stock Turnover (days) Gross margin Net margin Interest Cover (times) Net Gearing % per $1 of equity Net working assets to sales % Retained Profits to sales 2.36 1.45 7.22 13.84 15.44 6.4% 5.6% 7.40 84% 6% 5.6% 2.00 1.67 1.19 0.88 5.52 3.11 20.86 20.28 16.44 18.25 24.8% 11.3% 23.6% 9.9% 21.45 8.08 109% 135% 6% 4% -1.1% -1.1% 1.69 1.03 3.24 18.08 12.98 20.0% 17.5% 7.99 237% 4% 0.1% 20