Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marlboro Ltd. Has an authorized share capital of sh. 1,000,000 in ordinary shares of sh.5 each 120,000 shares have been issued on which sh. 3.75

- Marlboro Ltd. Has an authorized share capital of sh. 1,000,000 in ordinary shares of sh.5 each 120,000 shares have been issued on which sh. 3.75 per share has been called up.

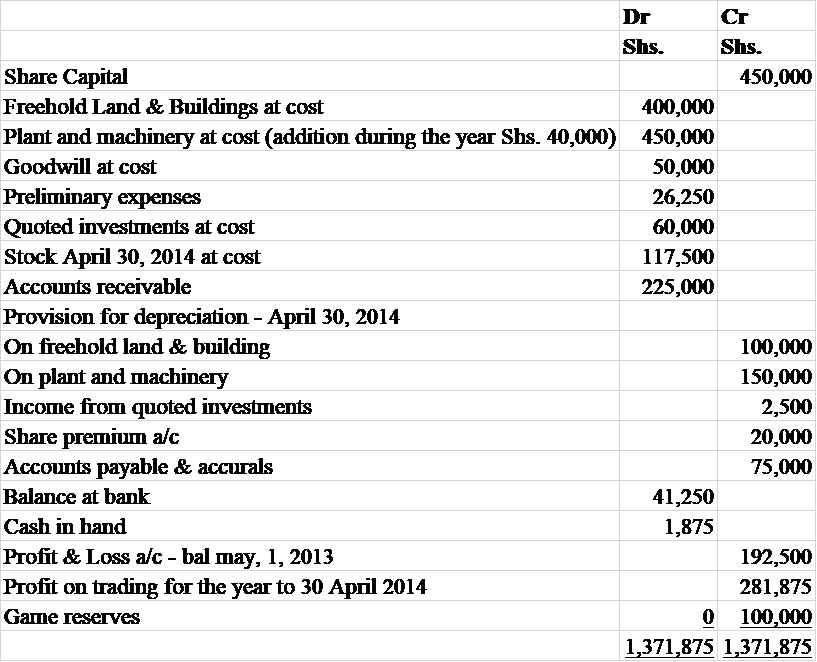

The following is the trial balance on 30th April, 2014.

The following information is relevant:

- The following items are provided for

- Directors fees sh. 45,000

- Auditors remunerations sh. 9,000

- Depreciation at 2% on cost of the freehold, land & buildings and 10% on cost of the plant & machinery.

- Sh. 7,500 for doubtful debts.

- Quoted investments have a market value of sh.64, 000.

- The corporation tax at 30% based on the profits of the year is estimated at sh. 85,000.

- The directors decided to write off the preliminary expenses, transfer sh. 11,000 to General Revenue and sh.10,000 to a reserve for future fluctuations in raw material prices and distribute a divided of 50 cents per share.

Required

- Prepare in a vertical form for publication profit & lost account for the year ended 30th April 2014. (8 marks)

A balance sheet as at that date. (7 marks

7 Dr Shs. Shs. Share Capital 450,000 Freehold Land & Buildings at cost 400,000 Plant and machinery at cost (addition during the year Shs. 40,000) 450,000 Goodwill at cost 50,000 Preliminary expenses 26,250 Quoted investments at cost 60,000 Stock April 30, 2014 at cost 117,500 Accounts receivable 225,000 Provision for depreciation - April 30, 2014 On freehold land & building 100,000 On plant and machinery 150,000 Income from quoted investments 2,500 Share premium a/c 20,000 Accounts payable & accurals 75,000 Balance at bank 41,250 Cash in hand 1,875 Profit & Loss a/c - bal may, 1, 2013 192,500 Profit on trading for the year to 30 April 2014 281,875 Game reserves 0 100,000 1,371,875 1,371,875Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started