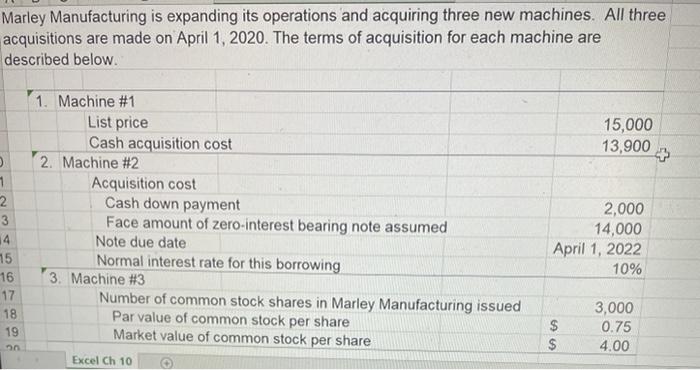

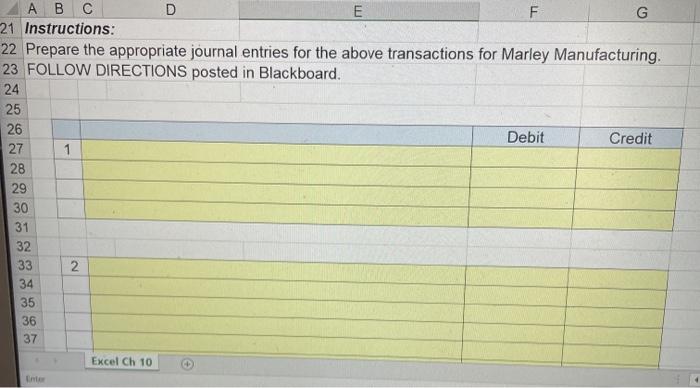

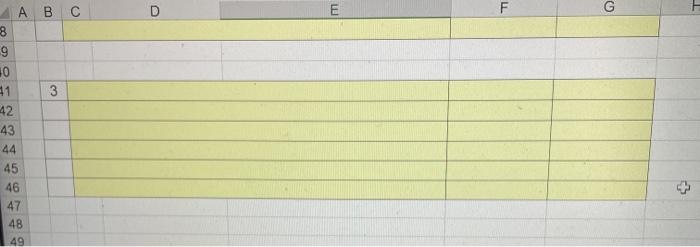

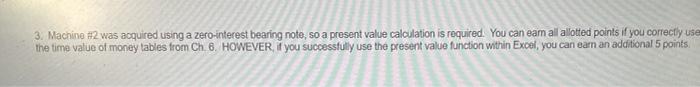

Marley Manufacturing is expanding its operations and acquiring three new machines. All three acquisitions are made on April 1, 2020. The terms of acquisition for each machine are described below. 15,000 13,900 1 2 3 4 15 16 17 18 19 1. Machine #1 List price Cash acquisition cost 2. Machine #2 Acquisition cost Cash down payment Face amount of zero interest bearing note assumed Note due date Normal interest rate for this borrowing 3. Machine #3 Number of common stock shares in Marley Manufacturing issued Par value of common stock per share Market value of common stock per share 2,000 14,000 April 1, 2022 10% $ $ 3,000 0.75 4.00 Excel Ch 10 E A B C D F G 21 Instructions: 22 Prepare the appropriate journal entries for the above transactions for Marley Manufacturing. 23 FOLLOW DIRECTIONS posted in Blackboard. 24 25 26 Debit Credit 27 1 28 29 30 31 32 33 2. 34 35 36 37 Excel Ch 10 D E F G A B C 8 9 30 91 3 42 43 44 45 46 47 48 49 3. Machine #2 was acquired using a zero-interest bearing note, so a present value calculation is required. You can eam all allotted points if you correctly use the time value of money tables from Ch 6. HOWEVER, if you successfully use the present value function within Excel, you can earn an additional 5 points Marley Manufacturing is expanding its operations and acquiring three new machines. All three acquisitions are made on April 1, 2020. The terms of acquisition for each machine are described below. 15,000 13,900 1 2 3 4 15 16 17 18 19 1. Machine #1 List price Cash acquisition cost 2. Machine #2 Acquisition cost Cash down payment Face amount of zero interest bearing note assumed Note due date Normal interest rate for this borrowing 3. Machine #3 Number of common stock shares in Marley Manufacturing issued Par value of common stock per share Market value of common stock per share 2,000 14,000 April 1, 2022 10% $ $ 3,000 0.75 4.00 Excel Ch 10 E A B C D F G 21 Instructions: 22 Prepare the appropriate journal entries for the above transactions for Marley Manufacturing. 23 FOLLOW DIRECTIONS posted in Blackboard. 24 25 26 Debit Credit 27 1 28 29 30 31 32 33 2. 34 35 36 37 Excel Ch 10 D E F G A B C 8 9 30 91 3 42 43 44 45 46 47 48 49 3. Machine #2 was acquired using a zero-interest bearing note, so a present value calculation is required. You can eam all allotted points if you correctly use the time value of money tables from Ch 6. HOWEVER, if you successfully use the present value function within Excel, you can earn an additional 5 points