Answered step by step

Verified Expert Solution

Question

1 Approved Answer

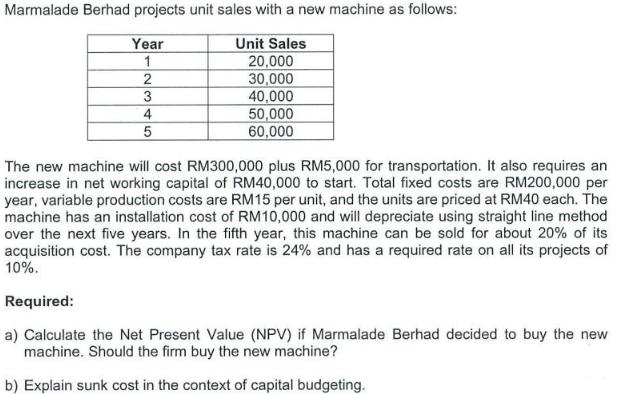

Marmalade Berhad projects unit sales with a new machine as follows: Year Unit Sales 1 20,000 30,000 40,000 50,000 60,000 2 3 4 5

Marmalade Berhad projects unit sales with a new machine as follows: Year Unit Sales 1 20,000 30,000 40,000 50,000 60,000 2 3 4 5 The new machine will cost RM300,000 plus RM5,000 for transportation. It also requires an increase in net working capital of RM40,000 to start. Total fixed costs are RM200,000 per year, variable production costs are RM15 per unit, and the units are priced at RM40 each. The machine has an installation cost of RM10,000 and will depreciate using straight line method over the next five years. In the fifth year, this machine can be sold for about 20% of its acquisition cost. The company tax rate is 24% and has a required rate on all its projects of 10%. Required: a) Calculate the Net Present Value (NPV) if Marmalade Berhad decided to buy the new machine. Should the firm buy the new machine? b) Explain sunk cost in the context of capital budgeting.

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below a Net Present Value NPV Year 0 300000 5...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started