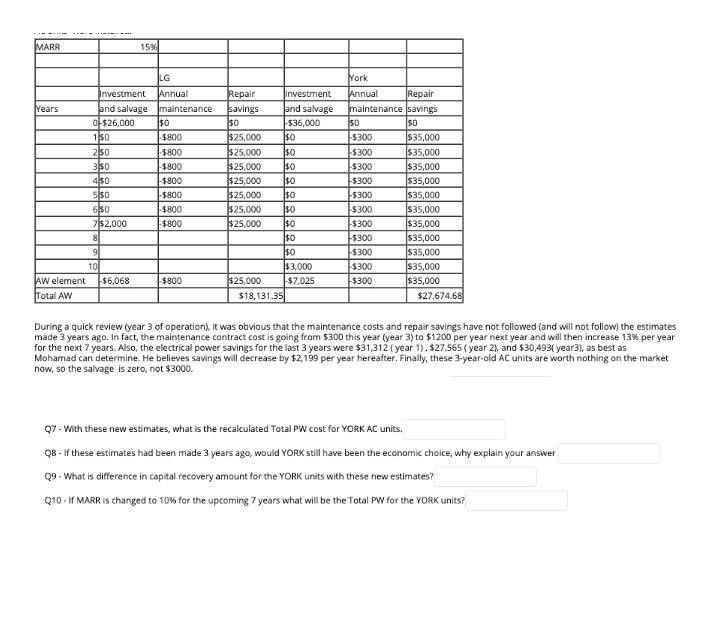

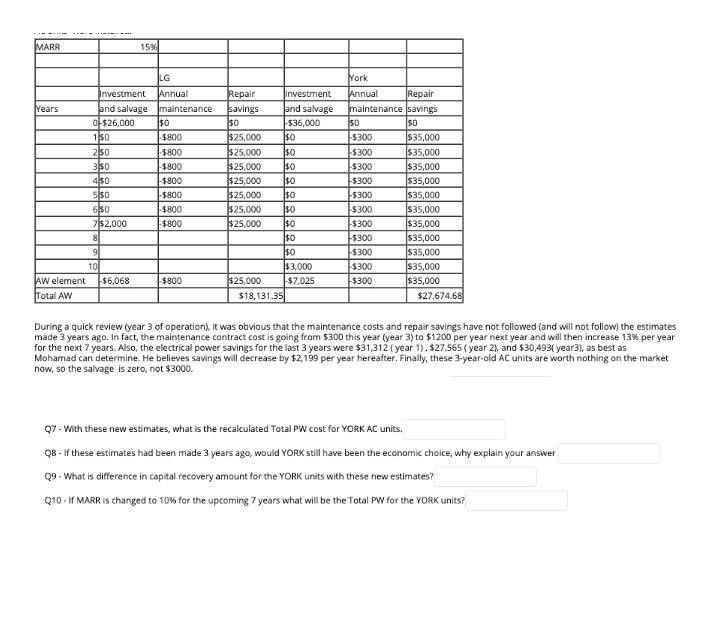

MARR 15% LG York Years Investment Annual and salvage maintenance of $26,000 $0 150 $800 250 $800 3150 $800 4150 $800 Siso $800 650 $800 71$2,000 $800 8 Repair Investment savings and salvage $0 -536,000 $25,000 $0 $25,000 $0 $25,000 $0 $25,000 $0 $25,000 50 $25.000 $0 $25,000 $0 $0 50 $3,000 $25,000 $7,025 $18,131.35 Annual Repair maintenance savings so SO $300 $35,000 $300 $35,000 $300 $35,000 $300 $35,000 5300 $35,000 $300 $35.000 $300 $35,000 5300 $35,000 $300 $35,000 $300 $35,000 $300 $35,000 $27,674.68 9 10 AW element $6,068 Total AW $800 During a quick review year 3 of operation, it was obvious that the maintenance costs and repair savings have not followed (and will not follow the estimates made 3 years ago. In fact, the maintenance contract cost is going from $300 this year (year 3) to $1200 per year next year and will then increase 13% per year for the next 7 years. Also, the electrical power savings for the last 3 years were $31,312 [year 1). $27,565 ( year 2), and $30,4931 year3), as best as Mohamad can determine. He believes savings will decrease by $2,199 per year hereafter. Finally, these 3-year-old AC units are worth nothing on the market now, so the salvage is zero, not $3000. Q7. With these new estimates, what is the recalculated Total PW cost for YORK AC units. 08 - If these estimates had been made 3 years ago, would YORK still have been the economic choice, why explain your answer 09. What is difference in capital recovery amount for the YORK units with these new estimates? Q10 - I MARR is changed to 10% for the upcoming 7 years what will be the Total PW for the YORK units? MARR 15% LG York Years Investment Annual and salvage maintenance of $26,000 $0 150 $800 250 $800 3150 $800 4150 $800 Siso $800 650 $800 71$2,000 $800 8 Repair Investment savings and salvage $0 -536,000 $25,000 $0 $25,000 $0 $25,000 $0 $25,000 $0 $25,000 50 $25.000 $0 $25,000 $0 $0 50 $3,000 $25,000 $7,025 $18,131.35 Annual Repair maintenance savings so SO $300 $35,000 $300 $35,000 $300 $35,000 $300 $35,000 5300 $35,000 $300 $35.000 $300 $35,000 5300 $35,000 $300 $35,000 $300 $35,000 $300 $35,000 $27,674.68 9 10 AW element $6,068 Total AW $800 During a quick review year 3 of operation, it was obvious that the maintenance costs and repair savings have not followed (and will not follow the estimates made 3 years ago. In fact, the maintenance contract cost is going from $300 this year (year 3) to $1200 per year next year and will then increase 13% per year for the next 7 years. Also, the electrical power savings for the last 3 years were $31,312 [year 1). $27,565 ( year 2), and $30,4931 year3), as best as Mohamad can determine. He believes savings will decrease by $2,199 per year hereafter. Finally, these 3-year-old AC units are worth nothing on the market now, so the salvage is zero, not $3000. Q7. With these new estimates, what is the recalculated Total PW cost for YORK AC units. 08 - If these estimates had been made 3 years ago, would YORK still have been the economic choice, why explain your answer 09. What is difference in capital recovery amount for the YORK units with these new estimates? Q10 - I MARR is changed to 10% for the upcoming 7 years what will be the Total PW for the YORK units