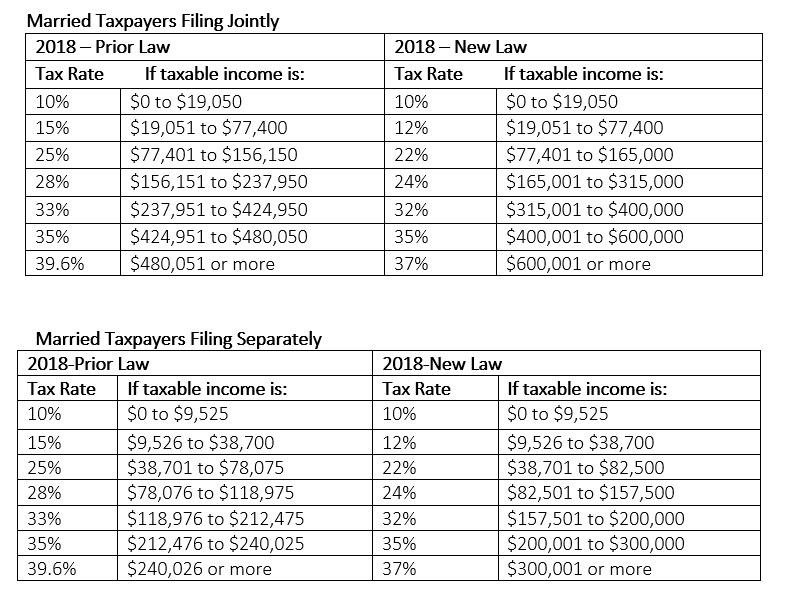

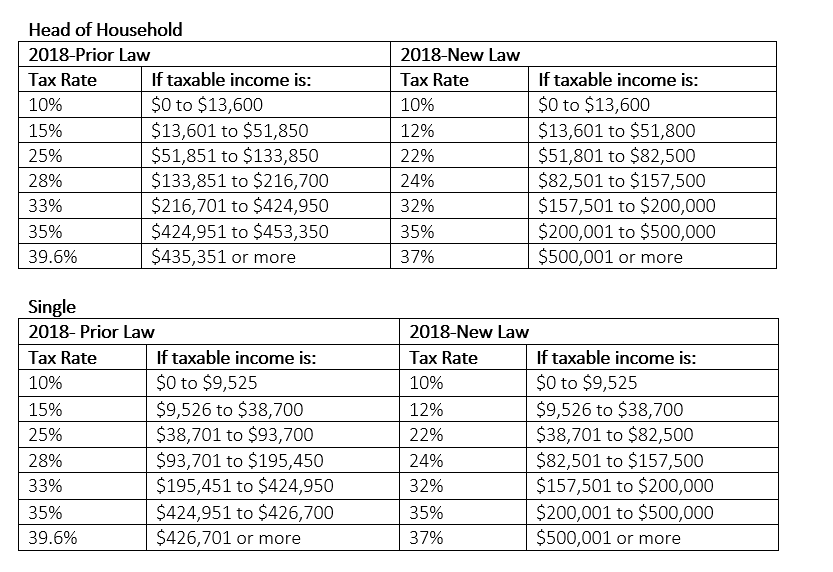

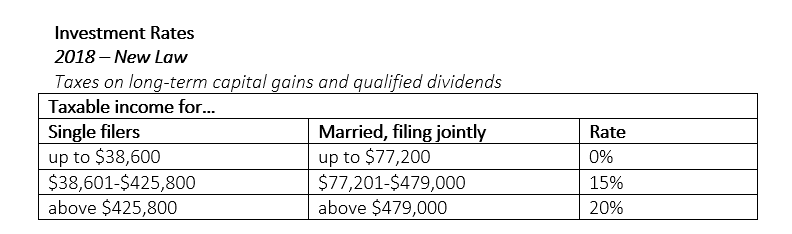

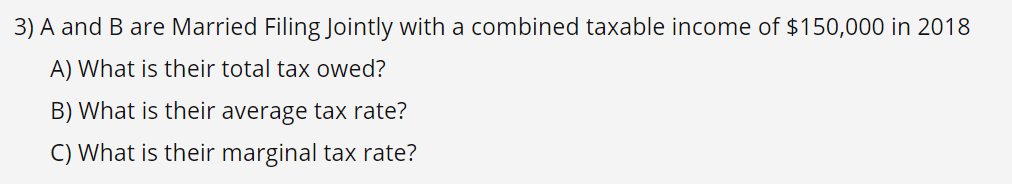

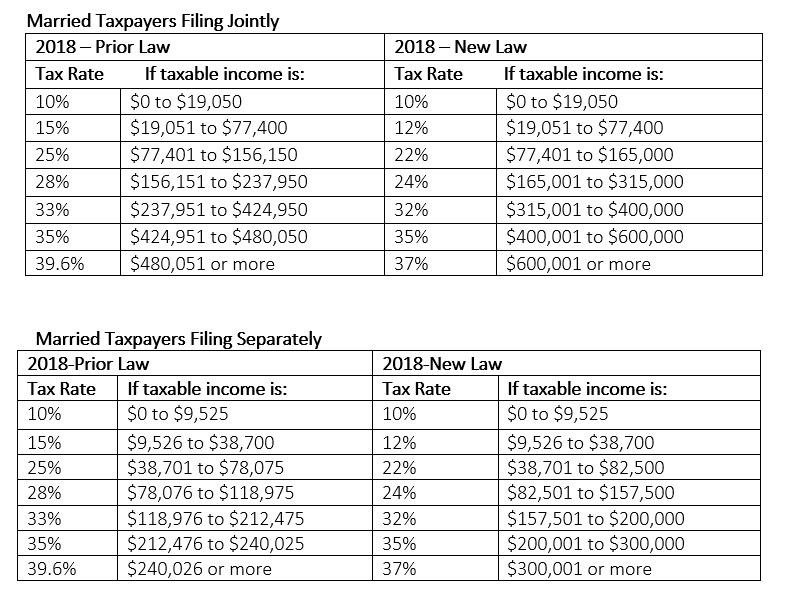

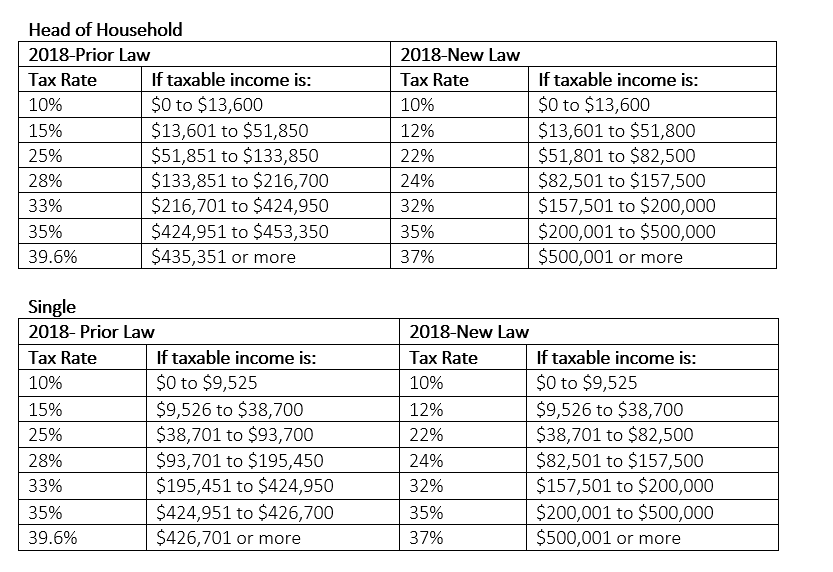

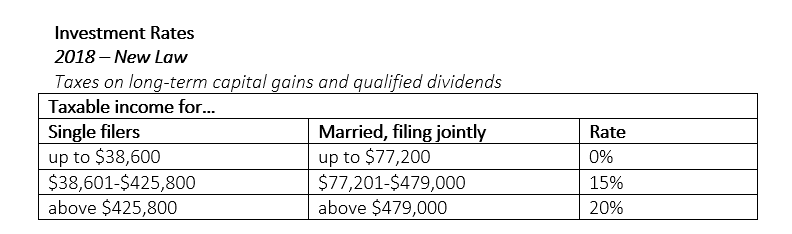

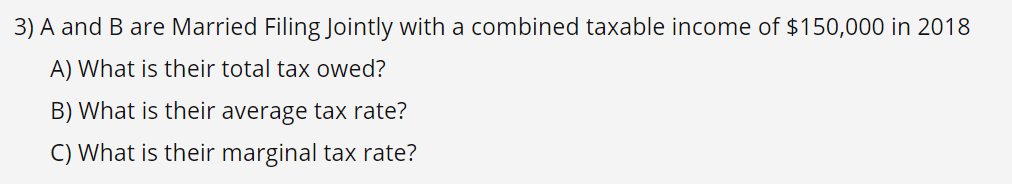

Married Taxpayers Filing Jointly 2018-Prior Law Tax Rate If taxable income is: 10% $0 to $19,050 15% $19,051 to $77,400 25% $77,401 to $156,150 28% $156,151 to $237,950 33% $237,951 to $424,950 35% $424,951 to $480,050 39.6% $480,051 or more 2018- New Law Tax Rate If taxable income is: 10% $0 to $19,050 12% $19,051 to $77,400 22% $77,401 to $165,000 24% $165,001 to $315,000 32% $315,001 to $400,000 35% $400,001 to $600,000 37% $600,001 or more Married Taxpayers Filing Separately 2018-Prior Law Tax Rate If taxable income is: 10% $0 to $9,525 15% $9,526 to $38,700 25% $38,701 to $78,075 28% $78,076 to $118,975 33% $118,976 to $212,475 35% $212,476 to $240,025 39.6% $240,026 or more 2018-New Law Tax Rate If taxable income is: 10% $0 to $9,525 12% $9,526 to $38,700 22% $38,701 to $82,500 24% $82,501 to $157,500 32% $157,501 to $200,000 35% $200,001 to $300,000 37% $300,001 or more Head of Household 2018-Prior Law Tax Rate If taxable income is: 10% $0 to $13,600 15% $13,601 to $51,850 25% $51,851 to $133,850 28% $133,851 to $216,700 33% $216,701 to $424,950 35% $424,951 to $453,350 39.6% $435,351 or more 2018-New Law Tax Rate 10% 12% 22% 24% 32% 35% 37% If taxable income is: $0 to $13,600 $13,601 to $51,800 $51,801 to $82,500 $82,501 to $157,500 $157,501 to $200,000 $200,001 to $500,000 $500,001 or more Single 2018- Prior Law Tax Rate If taxable income is: 10% $0 to $9,525 15% $9,526 to $38,700 25% $38,701 to $93,700 28% $93,701 to $195,450 33% $195,451 to $424,950 35% $424,951 to $426,700 39.6% $426,701 or more 2018-New Law Tax Rate If taxable income is: 10% $0 to $9,525 12% $9,526 to $38,700 22% $38,701 to $82,500 24% $82,501 to $157,500 32% $157,501 to $200,000 35% $200,001 to $500,000 37% $500,001 or more Investment Rates 2018-New Law Taxes on long-term capital gains and qualified dividends Taxable income for... Single filers Married, filing jointly up to $38,600 up to $77,200 $38,601-$425,800 $77,201-$479,000 above $425,800 above $479,000 Rate 0% 15% 20% 3) A and B are Married Filing Jointly with a combined taxable income of $150,000 in 2018 A) What is their total tax owed? B) What is their average tax rate? C) What is their marginal tax rate