Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Married taxpayers Otto and Ruth are both self-employed. Otto earns $419,600 of self-employment income and Ruth has a self-employment loss of $25,500. How much

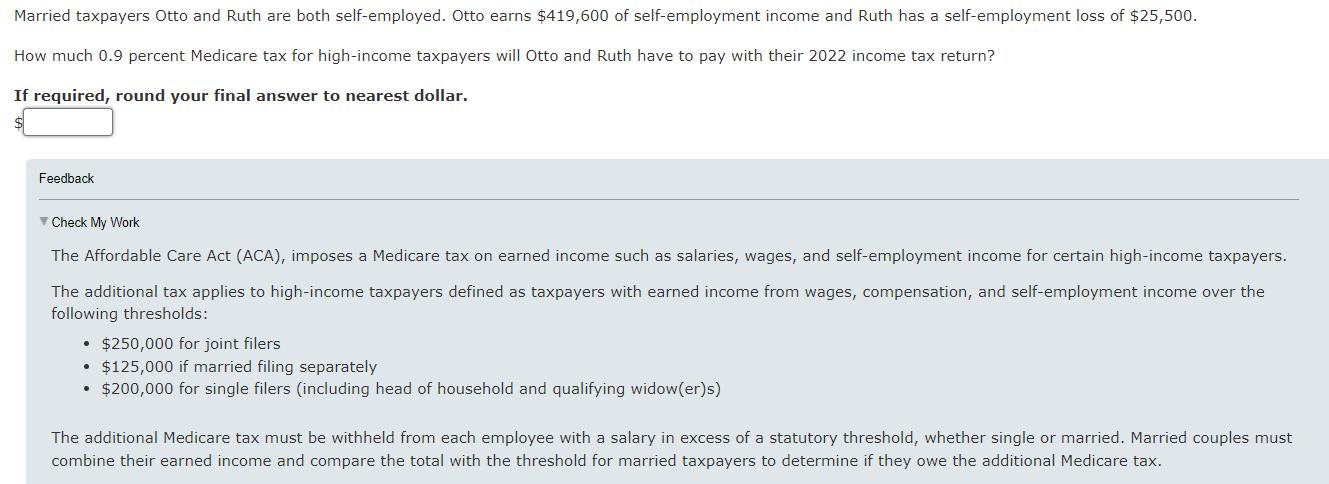

Married taxpayers Otto and Ruth are both self-employed. Otto earns $419,600 of self-employment income and Ruth has a self-employment loss of $25,500. How much 0.9 percent Medicare tax for high-income taxpayers will Otto and Ruth have to pay with their 2022 income tax return? If required, round your final answer to nearest dollar. Feedback Check My Work The Affordable Care Act (ACA), imposes a Medicare tax on earned income such as salaries, wages, and self-employment income for certain high-income taxpayers. The additional tax applies to high-income taxpayers defined as taxpayers with earned income from wages, compensation, and self-employment income over the following thresholds: $250,000 for joint filers $125,000 if married filing separately $200,000 for single filers (including head of household and qualifying widow(er)s) The additional Medicare tax must be withheld from each employee with a salary in excess of a statutory threshold, whether single or married. Married couples must combine their earned income and compare the total with the threshold for married taxpayers to determine if they owe the additional Medicare tax.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I can help you solve this problem Otto and Ruth are filing jointly so the threshold for the Additional Medicare Tax is 250000 Since Ottos income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started