Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marriott's environmental commitments are aiming to further reduce energy and water consumption by 20%. To meet the goals, Marriott Marquis initiated a long-term project to

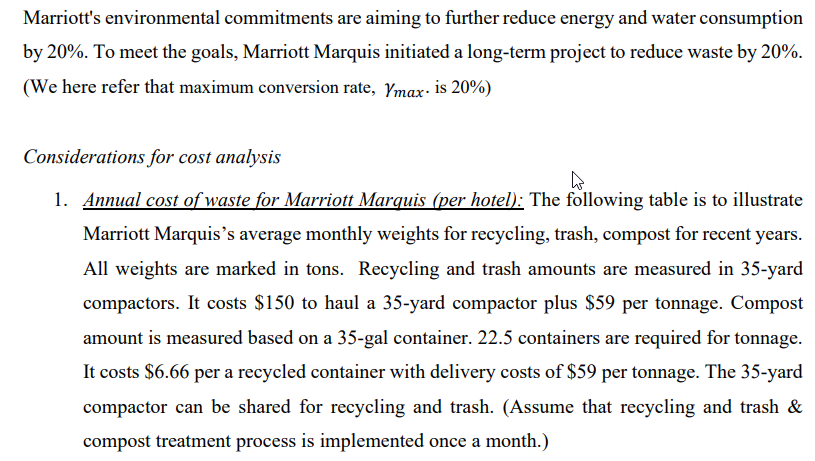

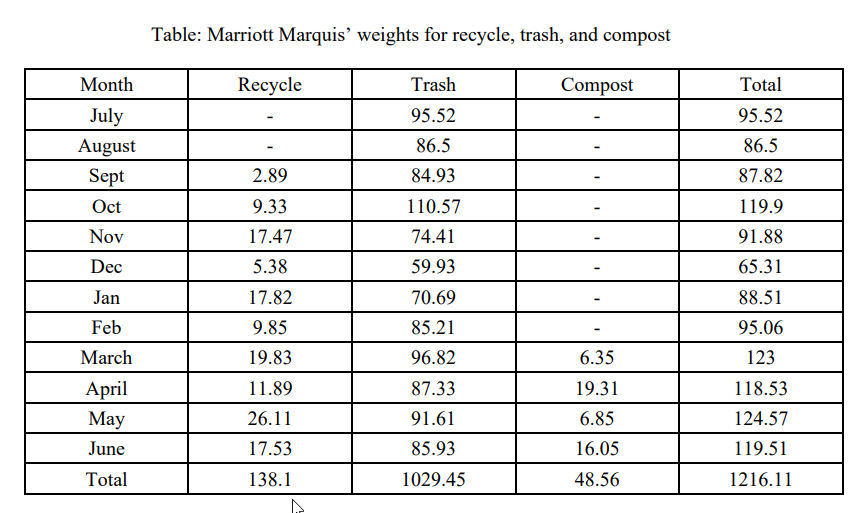

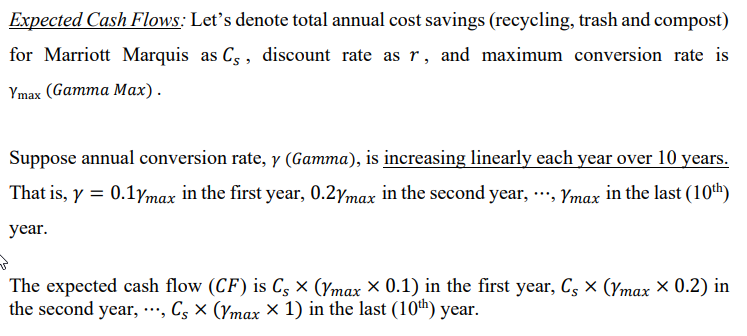

Marriott's environmental commitments are aiming to further reduce energy and water consumption by 20%. To meet the goals, Marriott Marquis initiated a long-term project to reduce waste by 20%. (We here refer that maximum conversion rate, max. is 20% ) Considerations for cost analysis 1. Annual cost of waste for Marriott Marquis (per hotel): The following table is to illustrate Marriott Marquis's average monthly weights for recycling, trash, compost for recent years. All weights are marked in tons. Recycling and trash amounts are measured in 35-yard compactors. It costs $150 to haul a 35 -yard compactor plus $59 per tonnage. Compost amount is measured based on a 35-gal container. 22.5 containers are required for tonnage. It costs $6.66 per a recycled container with delivery costs of $59 per tonnage. The 35 -yard compactor can be shared for recycling and trash. (Assume that recycling and trash \& compost treatment process is implemented once a month.) Table: Marriott Marquis' weights for recycle, trash, and compost Expected Cash Flows: Let's denote total annual cost savings (recycling, trash and compost) for Marriott Marquis as Cs, discount rate as r, and maximum conversion rate is max( Gamma Max ). Suppose annual conversion rate, (Gamma), is increasing linearly each year over 10 years. That is, =0.1max in the first year, 0.2max in the second year, ,max in the last (10th) year. The expected cash flow (CF) is Cs(max0.1) in the first year, Cs(max0.2) in the second year, ,Cs(max1) in the last (10th) year. Marriott's environmental commitments are aiming to further reduce energy and water consumption by 20%. To meet the goals, Marriott Marquis initiated a long-term project to reduce waste by 20%. (We here refer that maximum conversion rate, max. is 20% ) Considerations for cost analysis 1. Annual cost of waste for Marriott Marquis (per hotel): The following table is to illustrate Marriott Marquis's average monthly weights for recycling, trash, compost for recent years. All weights are marked in tons. Recycling and trash amounts are measured in 35-yard compactors. It costs $150 to haul a 35 -yard compactor plus $59 per tonnage. Compost amount is measured based on a 35-gal container. 22.5 containers are required for tonnage. It costs $6.66 per a recycled container with delivery costs of $59 per tonnage. The 35 -yard compactor can be shared for recycling and trash. (Assume that recycling and trash \& compost treatment process is implemented once a month.) Table: Marriott Marquis' weights for recycle, trash, and compost Expected Cash Flows: Let's denote total annual cost savings (recycling, trash and compost) for Marriott Marquis as Cs, discount rate as r, and maximum conversion rate is max( Gamma Max ). Suppose annual conversion rate, (Gamma), is increasing linearly each year over 10 years. That is, =0.1max in the first year, 0.2max in the second year, ,max in the last (10th) year. The expected cash flow (CF) is Cs(max0.1) in the first year, Cs(max0.2) in the second year, ,Cs(max1) in the last (10th) year

Marriott's environmental commitments are aiming to further reduce energy and water consumption by 20%. To meet the goals, Marriott Marquis initiated a long-term project to reduce waste by 20%. (We here refer that maximum conversion rate, max. is 20% ) Considerations for cost analysis 1. Annual cost of waste for Marriott Marquis (per hotel): The following table is to illustrate Marriott Marquis's average monthly weights for recycling, trash, compost for recent years. All weights are marked in tons. Recycling and trash amounts are measured in 35-yard compactors. It costs $150 to haul a 35 -yard compactor plus $59 per tonnage. Compost amount is measured based on a 35-gal container. 22.5 containers are required for tonnage. It costs $6.66 per a recycled container with delivery costs of $59 per tonnage. The 35 -yard compactor can be shared for recycling and trash. (Assume that recycling and trash \& compost treatment process is implemented once a month.) Table: Marriott Marquis' weights for recycle, trash, and compost Expected Cash Flows: Let's denote total annual cost savings (recycling, trash and compost) for Marriott Marquis as Cs, discount rate as r, and maximum conversion rate is max( Gamma Max ). Suppose annual conversion rate, (Gamma), is increasing linearly each year over 10 years. That is, =0.1max in the first year, 0.2max in the second year, ,max in the last (10th) year. The expected cash flow (CF) is Cs(max0.1) in the first year, Cs(max0.2) in the second year, ,Cs(max1) in the last (10th) year. Marriott's environmental commitments are aiming to further reduce energy and water consumption by 20%. To meet the goals, Marriott Marquis initiated a long-term project to reduce waste by 20%. (We here refer that maximum conversion rate, max. is 20% ) Considerations for cost analysis 1. Annual cost of waste for Marriott Marquis (per hotel): The following table is to illustrate Marriott Marquis's average monthly weights for recycling, trash, compost for recent years. All weights are marked in tons. Recycling and trash amounts are measured in 35-yard compactors. It costs $150 to haul a 35 -yard compactor plus $59 per tonnage. Compost amount is measured based on a 35-gal container. 22.5 containers are required for tonnage. It costs $6.66 per a recycled container with delivery costs of $59 per tonnage. The 35 -yard compactor can be shared for recycling and trash. (Assume that recycling and trash \& compost treatment process is implemented once a month.) Table: Marriott Marquis' weights for recycle, trash, and compost Expected Cash Flows: Let's denote total annual cost savings (recycling, trash and compost) for Marriott Marquis as Cs, discount rate as r, and maximum conversion rate is max( Gamma Max ). Suppose annual conversion rate, (Gamma), is increasing linearly each year over 10 years. That is, =0.1max in the first year, 0.2max in the second year, ,max in the last (10th) year. The expected cash flow (CF) is Cs(max0.1) in the first year, Cs(max0.2) in the second year, ,Cs(max1) in the last (10th) year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started