Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marsh Corp. reported a deferred tax asset of $34,000 in 202, caused by a warranty liability of $100,000. The tax rate was 34%. In 203,

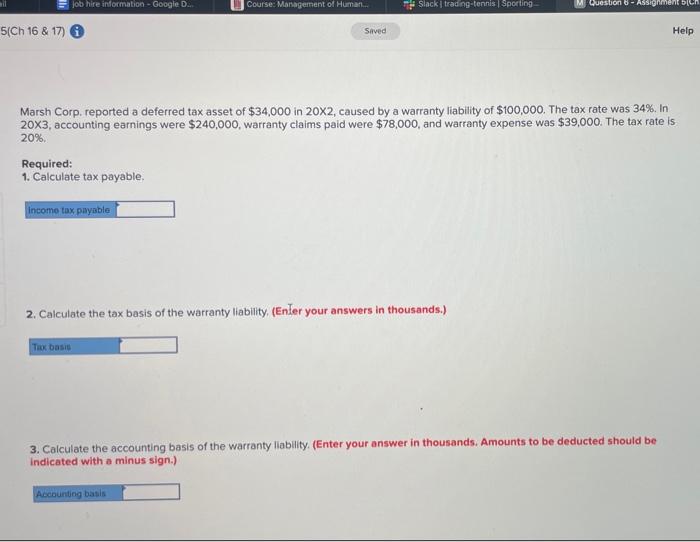

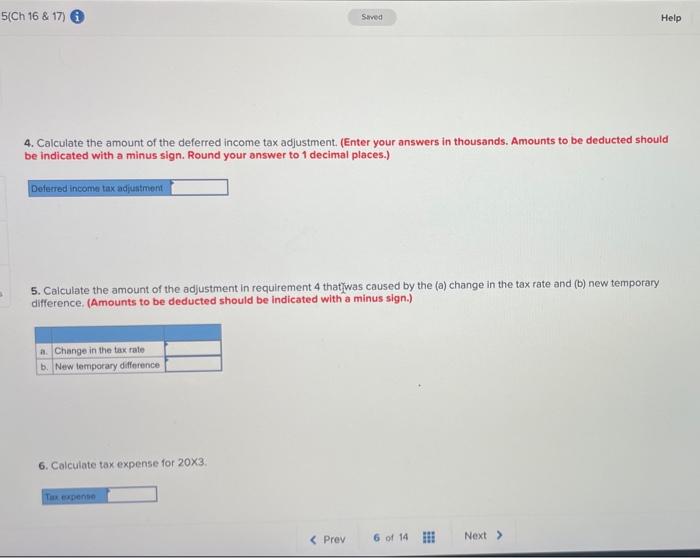

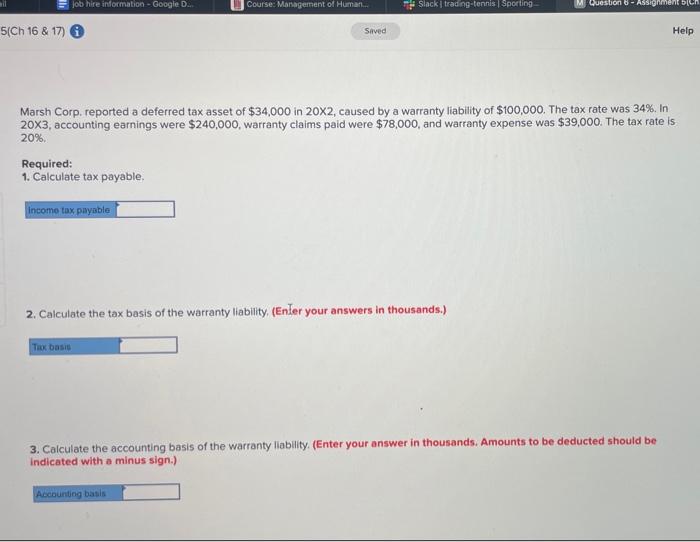

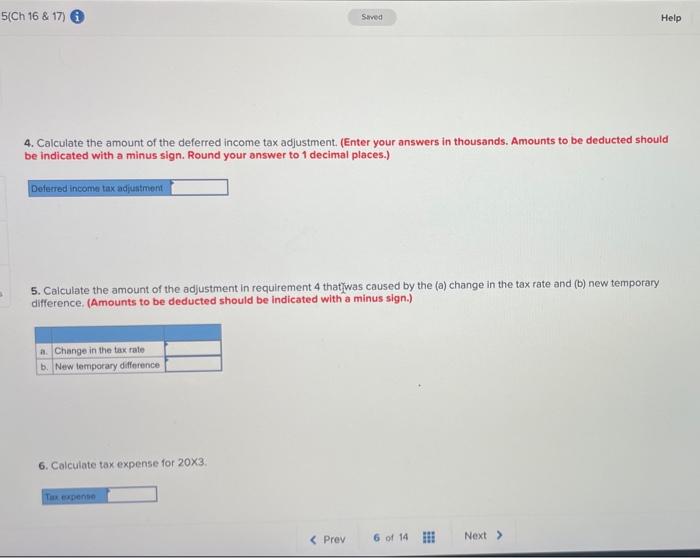

Marsh Corp. reported a deferred tax asset of $34,000 in 202, caused by a warranty liability of $100,000. The tax rate was 34%. In 203, accounting earnings were $240,000, warranty claims paid were $78,000, and warranty expense was $39,000. The tax rate is 20% Required: 1. Calculate tax payable. 2. Calculate the tax basis of the warranty liability, (Enter your answers in thousands.) 3. Calculate the accounting basis of the warranty liability. (Enter your answer in thousands. Amounts to be deducted should be indicated with a minus sign.) 4. Calculate the amount of the deferred income tax adjustment. (Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign. Round your answer to 1 decimal places.) 5. Calculate the amount of the adjustment in requirement 4 thathwas caused by the (a) change in the tax rate and (b) new temporary difference, (Amounts to be deducted should be indicated with a minus sign.) 6. Calculate tax expense for 203; Marsh Corp. reported a deferred tax asset of $34,000 in 202, caused by a warranty liability of $100,000. The tax rate was 34%. In 203, accounting earnings were $240,000, warranty claims paid were $78,000, and warranty expense was $39,000. The tax rate is 20% Required: 1. Calculate tax payable. 2. Calculate the tax basis of the warranty liability, (Enter your answers in thousands.) 3. Calculate the accounting basis of the warranty liability. (Enter your answer in thousands. Amounts to be deducted should be indicated with a minus sign.) 4. Calculate the amount of the deferred income tax adjustment. (Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign. Round your answer to 1 decimal places.) 5. Calculate the amount of the adjustment in requirement 4 thathwas caused by the (a) change in the tax rate and (b) new temporary difference, (Amounts to be deducted should be indicated with a minus sign.) 6. Calculate tax expense for 203

Marsh Corp. reported a deferred tax asset of $34,000 in 202, caused by a warranty liability of $100,000. The tax rate was 34%. In 203, accounting earnings were $240,000, warranty claims paid were $78,000, and warranty expense was $39,000. The tax rate is 20% Required: 1. Calculate tax payable. 2. Calculate the tax basis of the warranty liability, (Enter your answers in thousands.) 3. Calculate the accounting basis of the warranty liability. (Enter your answer in thousands. Amounts to be deducted should be indicated with a minus sign.) 4. Calculate the amount of the deferred income tax adjustment. (Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign. Round your answer to 1 decimal places.) 5. Calculate the amount of the adjustment in requirement 4 thathwas caused by the (a) change in the tax rate and (b) new temporary difference, (Amounts to be deducted should be indicated with a minus sign.) 6. Calculate tax expense for 203; Marsh Corp. reported a deferred tax asset of $34,000 in 202, caused by a warranty liability of $100,000. The tax rate was 34%. In 203, accounting earnings were $240,000, warranty claims paid were $78,000, and warranty expense was $39,000. The tax rate is 20% Required: 1. Calculate tax payable. 2. Calculate the tax basis of the warranty liability, (Enter your answers in thousands.) 3. Calculate the accounting basis of the warranty liability. (Enter your answer in thousands. Amounts to be deducted should be indicated with a minus sign.) 4. Calculate the amount of the deferred income tax adjustment. (Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign. Round your answer to 1 decimal places.) 5. Calculate the amount of the adjustment in requirement 4 thathwas caused by the (a) change in the tax rate and (b) new temporary difference, (Amounts to be deducted should be indicated with a minus sign.) 6. Calculate tax expense for 203

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started