Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marsha is 23 years old and single. She cannot be claimed as a dependent by another taxpayer. Marsha earned wages of $18,500 and had

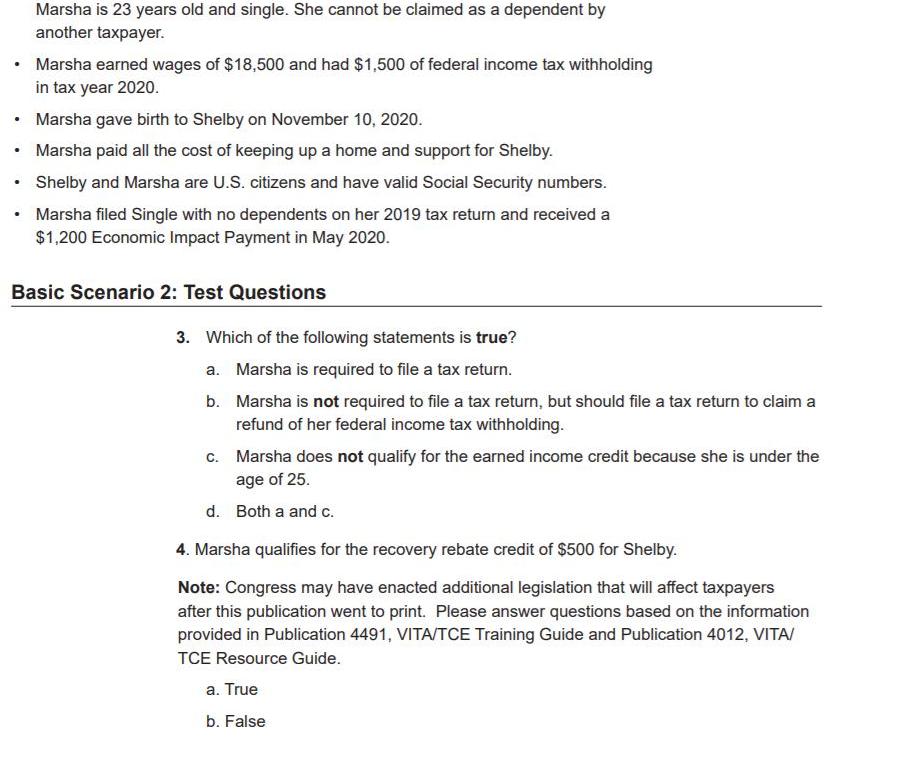

Marsha is 23 years old and single. She cannot be claimed as a dependent by another taxpayer. Marsha earned wages of $18,500 and had $1,500 of federal income tax withholding in tax year 2020. Marsha gave birth to Shelby on November 10, 2020. Marsha paid all the cost of keeping up a home and support for Shelby. Shelby and Marsha are U.S. citizens and have valid Social Security numbers. Marsha filed Single with no dependents on her 2019 tax return and received a $1,200 Economic Impact Payment in May 2020. Basic Scenario 2: Test Questions 3. Which of the following statements is true? a. Marsha is required to file a tax return. b. Marsha is not required to file a tax return, but should file a tax return to claim a refund of her federal income tax withholding. c. Marsha does not qualify for the earned income credit because she is under the age of 25. d. Both a and c. 4. Marsha qualifies for the recovery rebate credit of $500 for Shelby. Note: Congress may have enacted additional legislation that will affect taxpayers after this publication went to print. Please answer questions based on the information provided in Publication 4491, VITA/TCE Training Guide and Publication 4012, VITA/ TCE Resource Guide. a. True b. False

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

3a the statement that marsha is not required to fil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started