Question

Marshall Industries Limited is a large publicly listed company and is the market leader in vacuum cleaner manufacturing in New Zealand. The company is undertaking

Marshall Industries Limited is a large publicly listed company and is the market leader in vacuum cleaner manufacturing in New Zealand. The company is undertaking a six-year project to set up a manufacturing plant overseas to produce a new line of commercial vacuum cleaners. The company bought a piece of land four years ago for $ 8 million in anticipation of using it for its proposed manufacturing plant. If the company sold the land today, it would receive $ 9.75 million after taxes. In six years, the land can be sold for $14 million after taxes and reclamation costs. The manufacturing plant will cost $275 million to build. The following market data on Marshall Industries Ltd are current:

The following information is relevant:

• Marshall Industries Limited’s tax rate is 28%

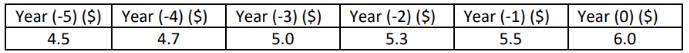

• The company had been paying dividends on its ordinary shares consistently. Dividends paid during the past six years is as follows

• The project requires $8.25 million in initial net working capital investment in year zero.

$120,000,000,7.25% coupon bonds outstanding with 20 years to maturity redeemable at par, selling for 95 per cent of par; the bonds have a $1000 par value each and make semi-annual coupon payments. Debt Equity 15,000,000ordinary shares, selling for $55 per share 12,000,000 shares (par value $ 10 per share) with 6.5% dividends (after taxes), selling for $32 per share Non-redeemable Preference shares

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The initial investment in the project comprises of the cost to build the manufacturi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started