Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Martha, a cash basis and calendar year taxpayer, is nearing the end of a year she would like to forget. Several years ago she loaned

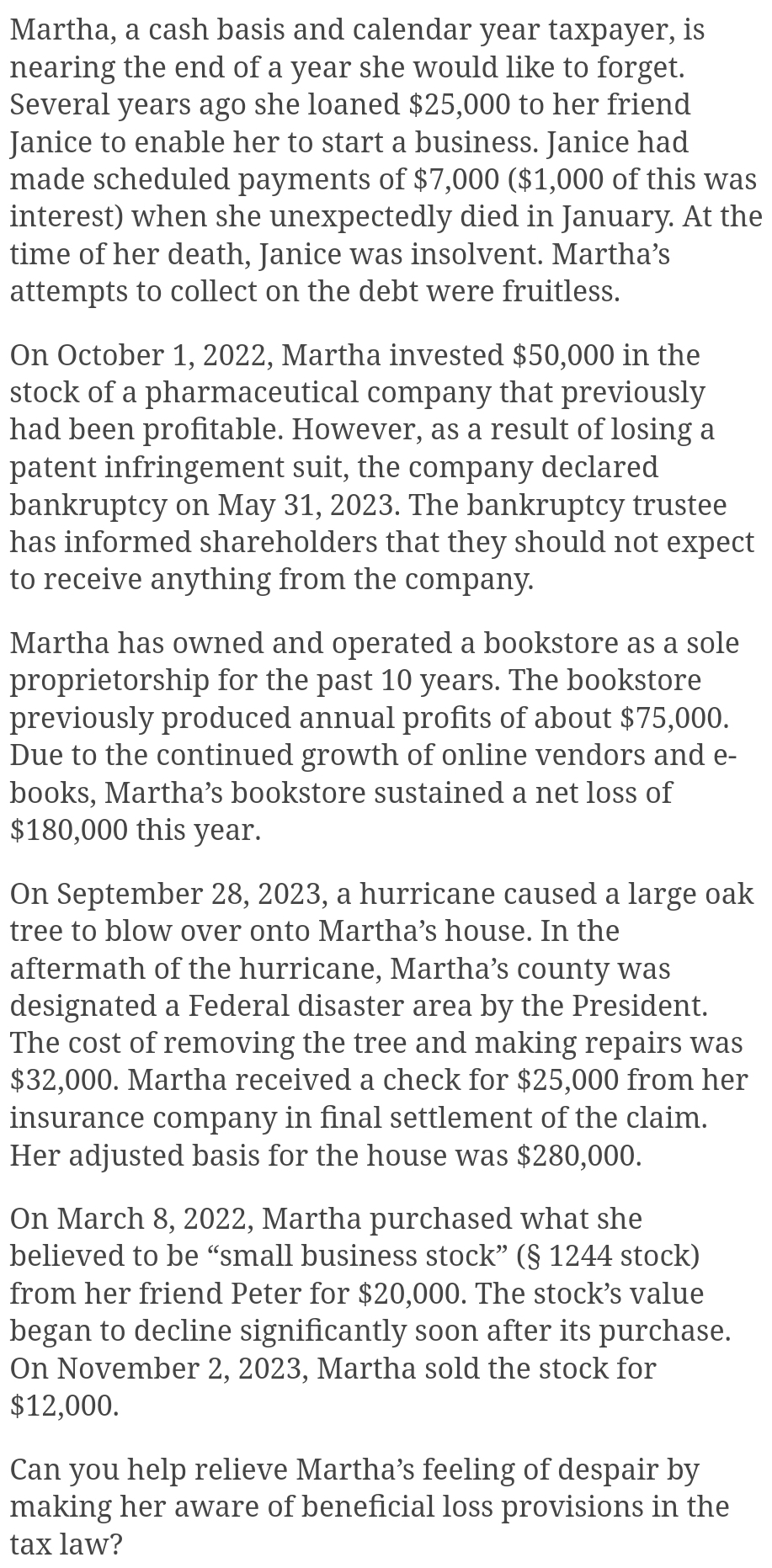

Martha, a cash basis and calendar year taxpayer, is

nearing the end of a year she would like to forget.

Several years ago she loaned $ to her friend

Janice to enable her to start a business. Janice had

made scheduled payments of $ $ of this was

interest when she unexpectedly died in January. At the

time of her death, Janice was insolvent. Martha's

attempts to collect on the debt were fruitless.

On October Martha invested $ in the

stock of a pharmaceutical company that previously

had been profitable. However, as a result of losing a

patent infringement suit, the company declared

bankruptcy on May The bankruptcy trustee

has informed shareholders that they should not expect

to receive anything from the company.

Martha has owned and operated a bookstore as a sole

proprietorship for the past years. The bookstore

previously produced annual profits of about $

Due to the continued growth of online vendors and e

books, Martha's bookstore sustained a net loss of

$ this year.

On September a hurricane caused a large oak

tree to blow over onto Martha's house. In the

aftermath of the hurricane, Martha's county was

designated a Federal disaster area by the President.

The cost of removing the tree and making repairs was

$ Martha received a check for $ from her

insurance company in final settlement of the claim.

Her adjusted basis for the house was $

On March Martha purchased what she

believed to be "small business stock" stock

from her friend Peter for $ The stock's value

began to decline significantly soon after its purchase.

On November Martha sold the stock for

$

Can you help relieve Martha's feeling of despair by

making her aware of beneficial loss provisions in the

tax law?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started