Question

Martha Smithhave asked you as their new CPA to prepare her 2021 Tax Return Form 1040 with schedules. Birth year is 1986, she has 2

Martha Smithhave asked you as their new CPA to prepare her 2021

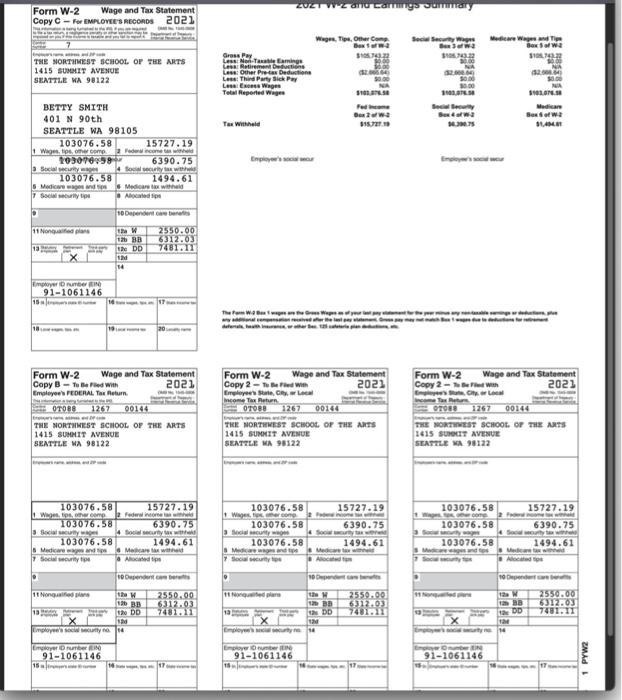

Tax Return Form 1040 with schedules. Birth year is 1986, she has 2 sons, she works full time as a Teacher ( ATTACHED is her W-2)

Martha'

Martha Smith have asked you as their new CPA to prepare her 2021

Tax Return Form 1040 with schedules.

Birth year is 1986, she has 2 sons, she works full time as a Teacher (ATTACHED is her W-2)

Martha's husband died in 2018 from heart disease, he had a life insurance policy that he had paid

into.

Martha receives $1,500 per month from her Husband's Life Insurance

Policy.

- Martha also receives Municipal Bond interest of: $500

- Bank of America Savings Account Interest: $70

- Ordinary Dividends from Schwab: $300

- Qualified Dividends from Schwab: $290

- One Stock Sale of GOOGLE: purchased 1/21/2021, 3 shares for $2,000 each and sold 12/29/2021 for $2,929 each

Rental Passive Activity

- Income, from owning a single family" home rental in Bellevue, Washington

- Monthly Rent collect: $1,800 per month for 12 months in

- 2021

- Expenses: Utilities $1,200,

- Yardwork $1,750, Maintenance $1,450, Repairs $500, New Fire Alarms put in $1,900

- House was purchased 7/1/2017 for $440,000, and already $66,000 of tax depreciation has been taken

Lastly, her 2 sons are put in childcare from 3pm-5pm when she is working late at school.

Cost: $10,000 per year, per child

This is a qualified after-school daycare program.

Martha owns her home:

Her Mortgage interest is: $11,600 for 2021

King County Property taxes is:

$7,800

Her estimated sales tax is: $1,760

Donations to her church: $2,000

Questions:

- What is her taxable income?

- Calculate her itemized deductions and what schedules should she use?

- Should she file as Head of Household?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started