Answered step by step

Verified Expert Solution

Question

1 Approved Answer

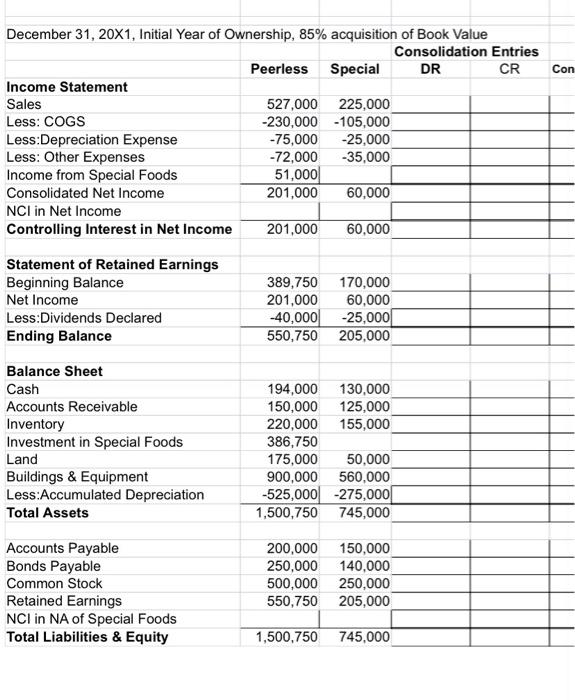

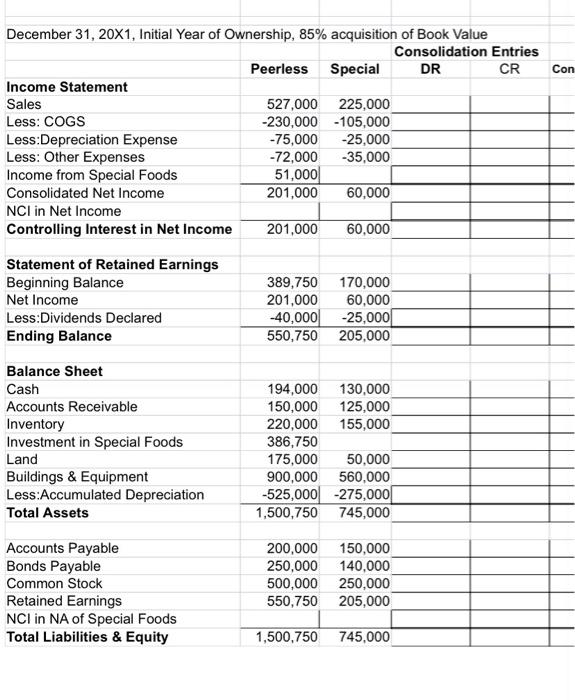

Martin acquires 85% of Special Foods outstanding stock for $357,000, an amount equal to 85% of the fair value of Specials net assets on January

Martin acquires 85% of Special Foods outstanding stock for

$357,000, an amount equal to 85% of the fair value of Specials net

assets on January 1, 20X1. On this date, the fair values of Specials

individual assets and liabilities are equal to their book value.

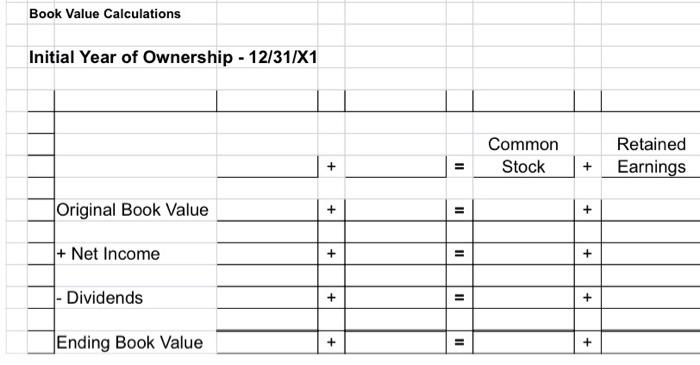

Specials Common Stock on January 1, 20X1 was $250,000 and its

Retained Earnings at January 1, 20X1 was $170,000.

Specials Accumulated Depreciation at time of acquisition was $250,000.

During 20X1

Separate Operating Income, Peerless$150,000

Dividends, Peerless$ 40,000

Net Income, Special Foods$ 60,000

Dividends, Special Foods $ 25,000

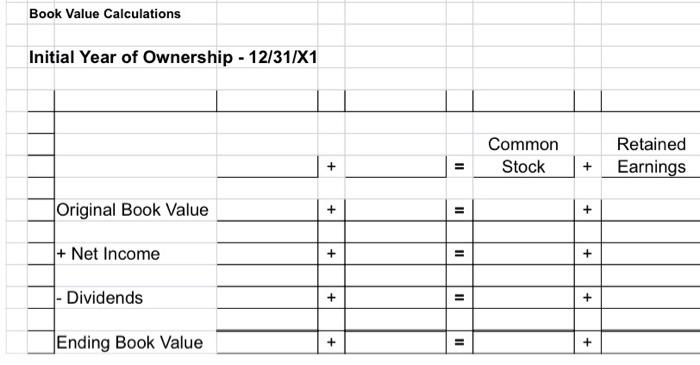

provide a book value calculation and an initial year of ownership

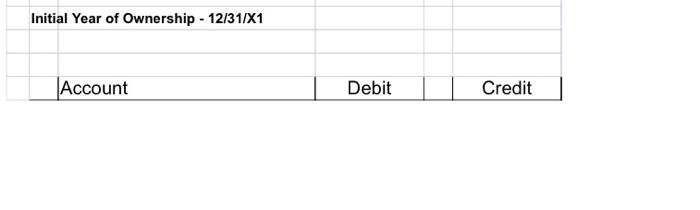

provide the following entry for the intial year of ownership

Initial Year of Ownership - 12/31/X1 Account Debit Credit Con December 31, 20X1. Initial Year of Ownership, 85% acquisition of Book Value Consolidation Entries Peerless Special DR CR Income Statement Sales 527,000 225,000 Less: COGS -230,000 -105,000 Less:Depreciation Expense -75,000 -25,000 Less: Other Expenses -72,000 -35,000 Income from Special Foods 51,000 Consolidated Net Income 201,000 60,000 NCI in Net Income Controlling Interest in Net Income 201,000 60,000 Statement of Retained Earnings Beginning Balance Net Income Less:Dividends Declared Ending Balance 389,750 170,000 201,000 60,000 -40,000 -25,000 550,750 205,000 Balance Sheet Cash Accounts Receivable Inventory Investment in Special Foods Land Buildings & Equipment Less:Accumulated Depreciation Total Assets 194,000 130,000 150,000 125,000 220,000 155,000 386,750 175,000 50,000 900,000 560,000 -525,000 -275,000 1,500,750 745,000 Accounts Payable Bonds Payable Common Stock Retained Earnings NCI in NA of Special Foods Total Liabilities & Equity 200,000 150,000 250,000 140,000 500,000 250,000 550,750 205,000 1,500.750 745,000 Book Value Calculations Initial Year of Ownership - 12/31/X1 Common Stock Retained Earnings + = + Original Book Value + + 1+ Net Income + II + |- Dividends + + Ending Book Value + +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started