Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Martin Chicken Corporation processes and packages chicken for grocery stores. It purchases chickens from farmers and processes them into two different products chicken drumsticks and

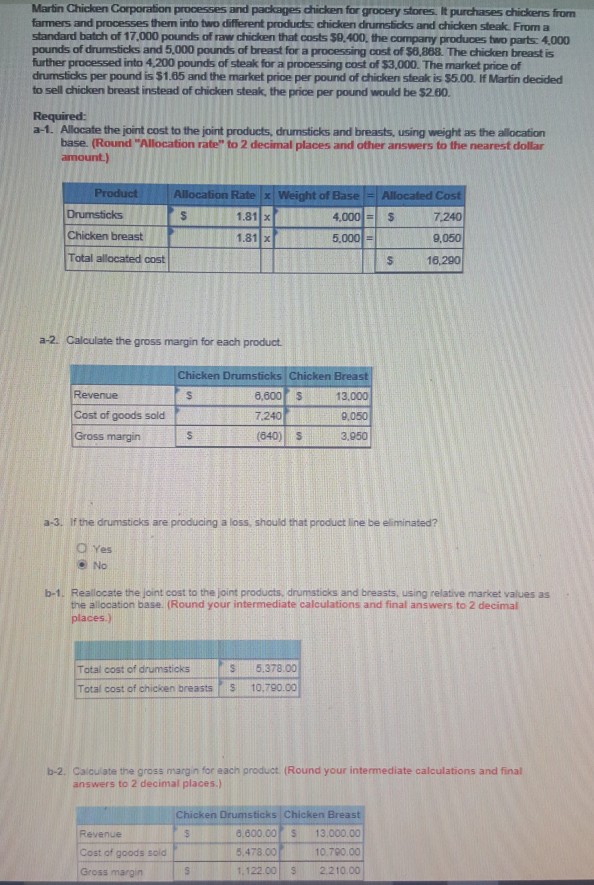

Martin Chicken Corporation processes and packages chicken for grocery stores. It purchases chickens from farmers and processes them into two different products chicken drumsticks and chicken steak. From a standard batch of 17,000 pounds of raw chicken that costs $9, 400, the company produces two parts: 4,000 pounds of drumsticks and 5,000 pounds of breast for a processing cost of $8, 868. The chicken breast is further processed into 4, 200 pounds of steak for a processing cost of $3,000. The market price of drumsticks per pound is $1.65 and the market price per pound of chicken steak is $5.00. If Martin decided to sell chicken breast instead of chicken steak, the price per pound would be $2.60. Allocate the joint cost to the joint products, drumsticks and breasts, using weight as the allocation base. (Round "Allocation rate" to 2 decimal places and other answers to the nearest dollar amount.) Calculate the gross margin for each product. If the drumsticks are producing a loss, should that product line be eliminated? Yes No Reallocate the joint cost to the joint products, drumsticks and breasts, using relative market values as the allocation base. (Round your intermediate calculations and final answers to 2 decimal places.) Calculate the gross margin for each product (Round your intermediate calculations and final answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started