Question

Martin Company is considering the introduction of a new product. To determine a selling price, the company has gathered the following information: Number of units

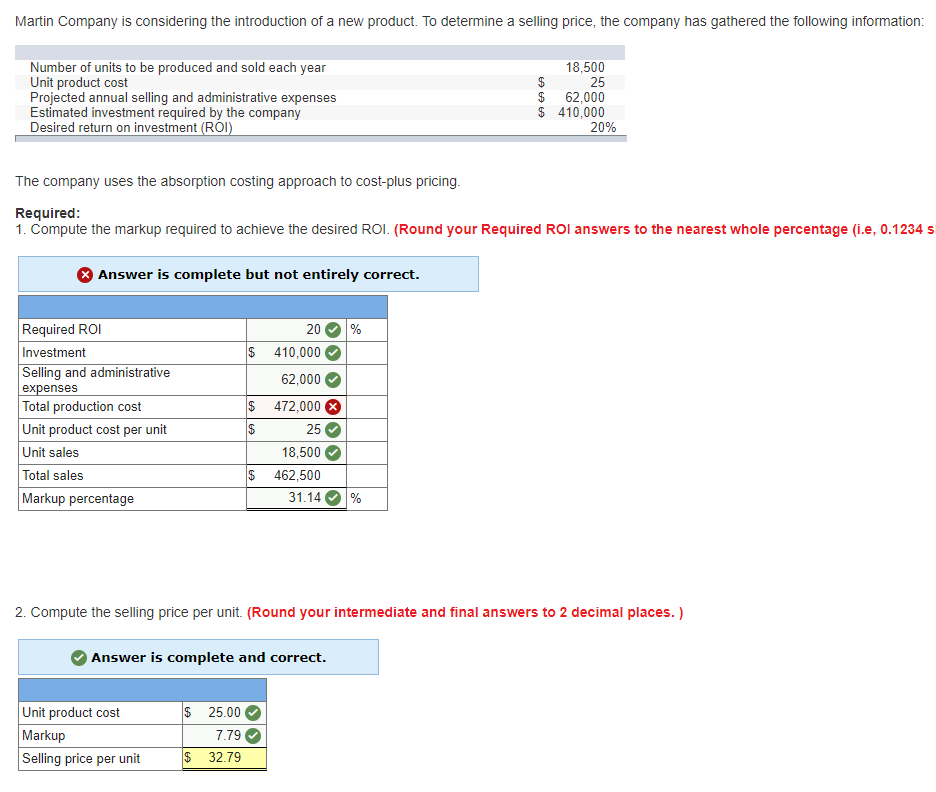

Martin Company is considering the introduction of a new product. To determine a selling price, the company has gathered the following information:

| Number of units to be produced and sold each year | 18,500 | ||

| Unit product cost | $ | 25 | |

| Projected annual selling and administrative expenses | $ | 62,000 | |

| Estimated investment required by the company | $ | 410,000 | |

| Desired return on investment (ROI) | 20 | % | |

|

| |||

The company uses the absorption costing approach to cost-plus pricing.

Required:

1. Compute the markup required to achieve the desired ROI. (Round your Required ROI answers to the nearest whole percentage (i.e, 0.1234 should be entered as 12). Round your "Markup Percentage" answers to 2 decimal places (i.e., 0.1234 should be entered as 12.34.))

2. Compute the selling price per unit. (Round your intermediate and final answers to 2 decimal places. )

PLEASE NEED TOTAL PRODUCTION COST

IT'S NOT

472,000

462,500

934,500

524,000

Martin Company is considering the introduction of a new product. To determine a selling price, the company has gathered the following information: 18,500 25 $62,000 $ 410,000 Number of units to be produced and sold each year Unit product cost Projected annual selling and administrative expenses Estimated investment required by the company Desired return on investment (RO 20% The company uses the absorption costing approach to cost-plus pricing Required 1. Compute the markup required to achieve the desired ROI. (Round your Required ROl answers to the nearest whole percentage (i.e, 0.1234 s Answer is complete but not entirely correct Required ROI Investment Selling and administrative expenses Total production cost Unit product cost per unit Unit sales Total sales $ 410,000 62,000 $ 472,000 25 18,500 $ 462,500 31.1 Markup percentage % 2. Compute the selling price per unit. (Round your intermediate and final answers to 2 decimal places.) Answer is complete and correct. $ 25.00 7.79 $ 32.79 Unit product cost Selling price per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started