Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Martin Dorne is 5 3 years old and employed by a large public construction company with gross revenues of $ 1 1 5 million. His

Martin Dorne is years old and employed by a large public construction company with gross revenues of $

million. His annual salary is $ none of which is commissions. The company was very successful in

and Martin has been provided with a $ bonus. that will be paid in equal amounts $ over the five

year period through

Martin's employer withheld maximum EI premiums and CPP contributions, along with $ in federal

income tax. Other amounts withheld by his employer are as follows:

Martin's commonlaw partner is Brian Lassiter. Brian is years old and is legally blind. Brian has net income

of $ in all of which is from investments.

Martin and Brian adopted three orphaned brothers years ago. Information on the brothers is as follows:

David is years old, in good health, and has net income from part time employment of $

Devon is years old and suffers from a physical infirmity that prevent him from working on a full time basis.

He lives with Martin and Brian and has net income from part time employment of $

Derek is years old and attends university on a full time basis for months of the year. Martin pays his

tuition fees of $ along with textbook costs of $ He lives with Martin and Brian and is in good

health. He has net income and taxable income of $ all of which is from a business he carries on as a sole

proprietor. Assume that his net income is determined after the appropriate CPP deduction.

Other Information:

In Martin spent $ on meals and entertainment with clients of his employer in the local area. His

employer reimbursed $ of these expenses all of which relate to the clients. The remaining $

represents Martin's own meal expenses.

In Martin makes his regular annual donation of $ to a registered charity,

The family's medical expenses, all of which were paid by Martin, were as follows:

Martin was granted options to purchase shares of his employer at a price of $ a share in March

At the time the options were granted, the market price of the shares was $ a share. In July, when the

shares are trading at $ a share, Martin exercises all of the options. He continues to own the shares on

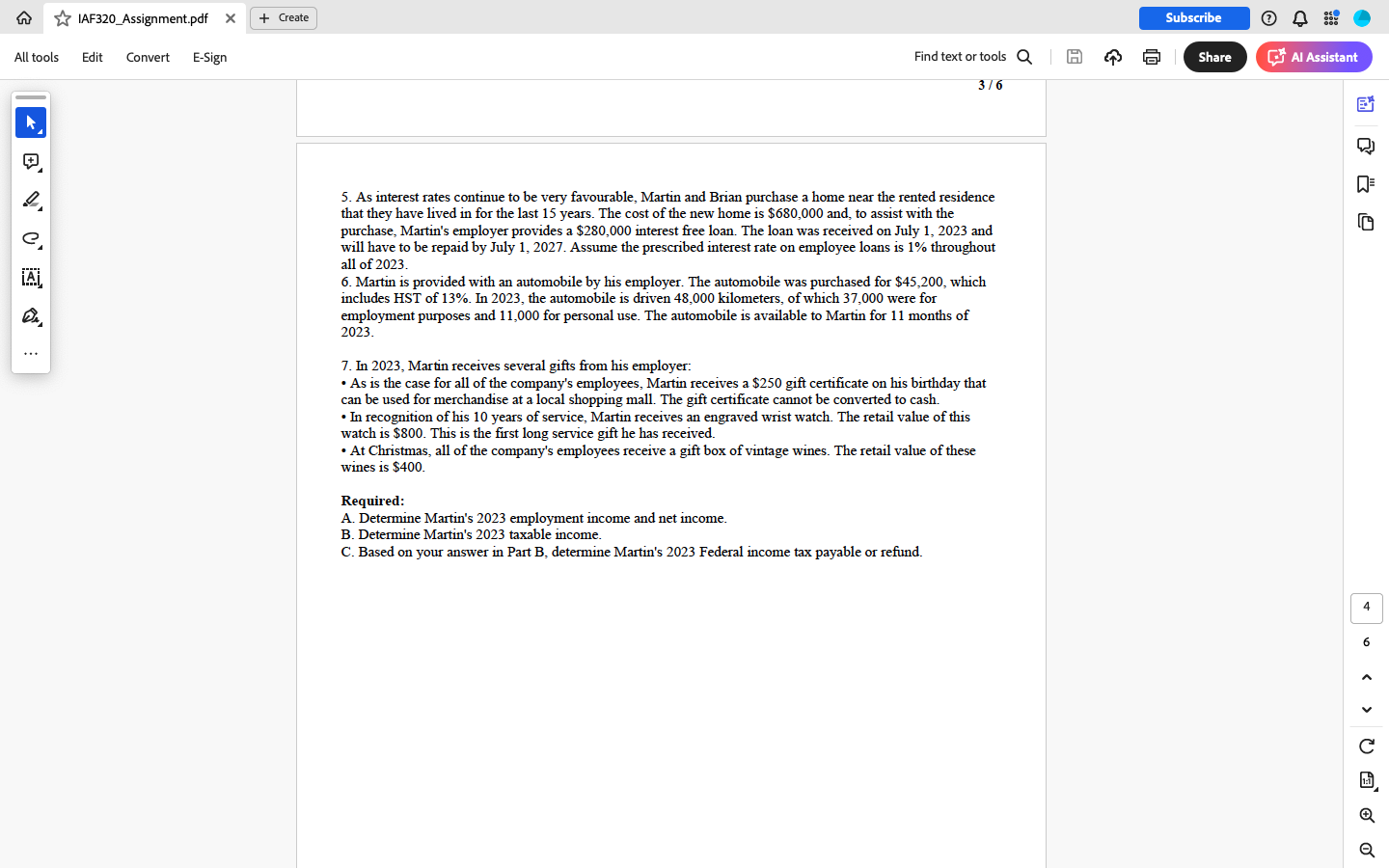

December As interest rates continue to be very favourable, Martin and Brian purchase a home near the rented residence

that they have lived in for the last years. The cost of the new home is $ and, to assist with the

purchase, Martin's employer provides a $ interest free loan. The loan was received on July and

will have to be repaid by July Assume the prescribed interest rate on employee loans is throughout

all of

Martin is provided with an automobile by his employer. The automobile was purchased for $ which

includes HST of In the automobile is driven kilometers, of which were for

employment purposes and for personal use. The automobile is available to Martin for months of

In Martin receives several gifts from his employer:

As is the case for all of the company's employees, Martin receives a $ gift certificate on his birthday that

can be used for merchandise at a local shopping mall. The gift certificate cannot be converted to cash.

In recognition of his years of service, Martin receives an engraved wrist watch. The retail value of this

watch is $ This is the first long service gift he has received.

At Christmas, all of the company's employees receive a gift box of vintage wines. The retail value of these

wines is $

Required:

A Determine Martin's employment income and net income.

B Determine Martin's taxable income.

C Based on your answer in Part B determine Martin's Federal income tax payable or refund.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started