Answered step by step

Verified Expert Solution

Question

1 Approved Answer

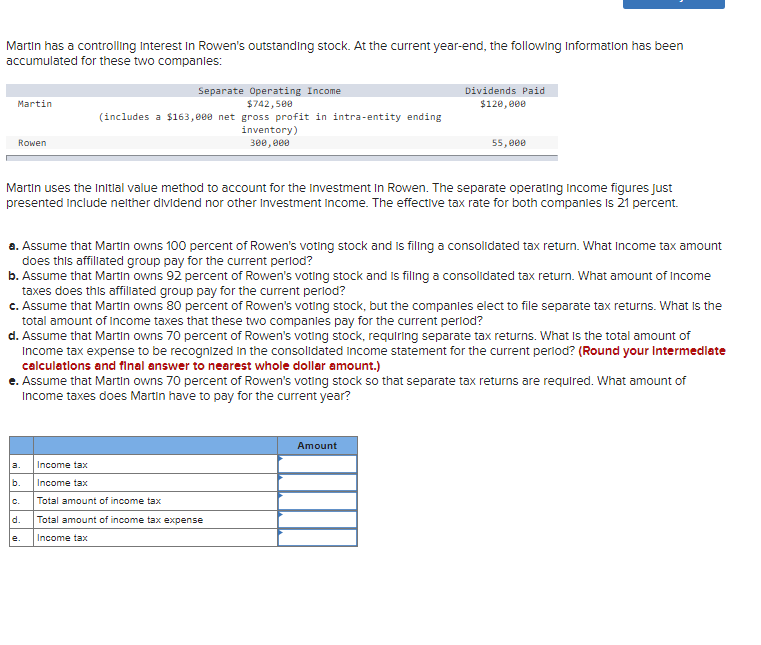

Martin has a controlling Interest In Rowen's outstanding stock. At the current year-end, the following Information has been accumulated for these two companles: Martin uses

Martin has a controlling Interest In Rowen's outstanding stock. At the current year-end, the following Information has been accumulated for these two companles: Martin uses the InItlal value method to account for the Investment In Rowen. The separate operating Income figures just presented Include nelther dividend nor other Investment Income. The effective tax rate for both companles is 21 percent. a. Assume that Martin owns 100 percent of Rowen's voting stock and is filling a consolidated tax return. What Income tax amount does this affillated group pay for the current perlod? b. Assume that Martin owns 92 percent of Rowen's voting stock and Is filling a consolidated tax return. What amount of Income taxes does this affillated group pay for the current perlod? c. Assume that Martin owns 80 percent of Rowen's voting stock, but the companles elect to file separate tax returns. What is the total amount of Income taxes that these two companles pay for the current perlod? d. Assume that Martin owns 70 percent of Rowen's voting stock, requlring separate tax returns. What is the total amount of Income tax expense to be recognized in the consolidated income statement for the current period? (Round your Intermedlate calculations and final answer to nearest whole dollar amount.) e. Assume that Martin owns 70 percent of Rowen's voting stock so that separate tax returns are required. What amount of Income taxes does Martin have to pay for the current year? Martin has a controlling Interest In Rowen's outstanding stock. At the current year-end, the following Information has been accumulated for these two companles: Martin uses the InItlal value method to account for the Investment In Rowen. The separate operating Income figures just presented Include nelther dividend nor other Investment Income. The effective tax rate for both companles is 21 percent. a. Assume that Martin owns 100 percent of Rowen's voting stock and is filling a consolidated tax return. What Income tax amount does this affillated group pay for the current perlod? b. Assume that Martin owns 92 percent of Rowen's voting stock and Is filling a consolidated tax return. What amount of Income taxes does this affillated group pay for the current perlod? c. Assume that Martin owns 80 percent of Rowen's voting stock, but the companles elect to file separate tax returns. What is the total amount of Income taxes that these two companles pay for the current perlod? d. Assume that Martin owns 70 percent of Rowen's voting stock, requlring separate tax returns. What is the total amount of Income tax expense to be recognized in the consolidated income statement for the current period? (Round your Intermedlate calculations and final answer to nearest whole dollar amount.) e. Assume that Martin owns 70 percent of Rowen's voting stock so that separate tax returns are required. What amount of Income taxes does Martin have to pay for the current year

Martin has a controlling Interest In Rowen's outstanding stock. At the current year-end, the following Information has been accumulated for these two companles: Martin uses the InItlal value method to account for the Investment In Rowen. The separate operating Income figures just presented Include nelther dividend nor other Investment Income. The effective tax rate for both companles is 21 percent. a. Assume that Martin owns 100 percent of Rowen's voting stock and is filling a consolidated tax return. What Income tax amount does this affillated group pay for the current perlod? b. Assume that Martin owns 92 percent of Rowen's voting stock and Is filling a consolidated tax return. What amount of Income taxes does this affillated group pay for the current perlod? c. Assume that Martin owns 80 percent of Rowen's voting stock, but the companles elect to file separate tax returns. What is the total amount of Income taxes that these two companles pay for the current perlod? d. Assume that Martin owns 70 percent of Rowen's voting stock, requlring separate tax returns. What is the total amount of Income tax expense to be recognized in the consolidated income statement for the current period? (Round your Intermedlate calculations and final answer to nearest whole dollar amount.) e. Assume that Martin owns 70 percent of Rowen's voting stock so that separate tax returns are required. What amount of Income taxes does Martin have to pay for the current year? Martin has a controlling Interest In Rowen's outstanding stock. At the current year-end, the following Information has been accumulated for these two companles: Martin uses the InItlal value method to account for the Investment In Rowen. The separate operating Income figures just presented Include nelther dividend nor other Investment Income. The effective tax rate for both companles is 21 percent. a. Assume that Martin owns 100 percent of Rowen's voting stock and is filling a consolidated tax return. What Income tax amount does this affillated group pay for the current perlod? b. Assume that Martin owns 92 percent of Rowen's voting stock and Is filling a consolidated tax return. What amount of Income taxes does this affillated group pay for the current perlod? c. Assume that Martin owns 80 percent of Rowen's voting stock, but the companles elect to file separate tax returns. What is the total amount of Income taxes that these two companles pay for the current perlod? d. Assume that Martin owns 70 percent of Rowen's voting stock, requlring separate tax returns. What is the total amount of Income tax expense to be recognized in the consolidated income statement for the current period? (Round your Intermedlate calculations and final answer to nearest whole dollar amount.) e. Assume that Martin owns 70 percent of Rowen's voting stock so that separate tax returns are required. What amount of Income taxes does Martin have to pay for the current year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started