Question

Martin originally acquired his farm many years ago for $102,000. This year, Martin sold the farm for its fair market value of $450,000 to

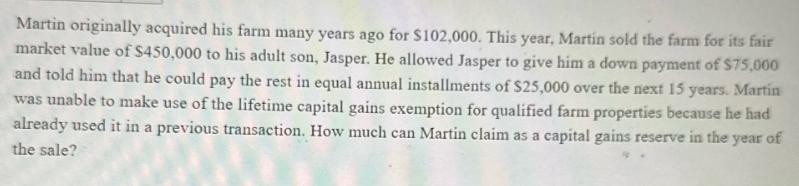

Martin originally acquired his farm many years ago for $102,000. This year, Martin sold the farm for its fair market value of $450,000 to his adult son, Jasper. He allowed Jasper to give him a down payment of $75,000 and told him that he could pay the rest in equal annual installments of $25,000 over the next 15 years. Martin was unable to make use of the lifetime capital gains exemption for qualified farm properties because he had already used it in a previous transaction. How much can Martin claim as a capital gains reserve in the year of the sale?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the capital gains reserve that Martin can claim in the year of the sale we need to dete...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations Of Financial Management

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

11th Canadian Edition

1259024970, 978-1259265921

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App