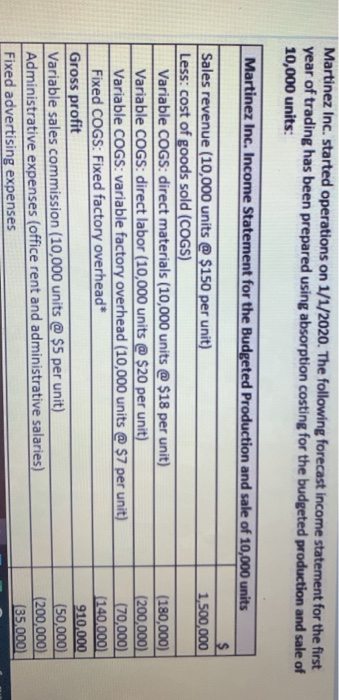

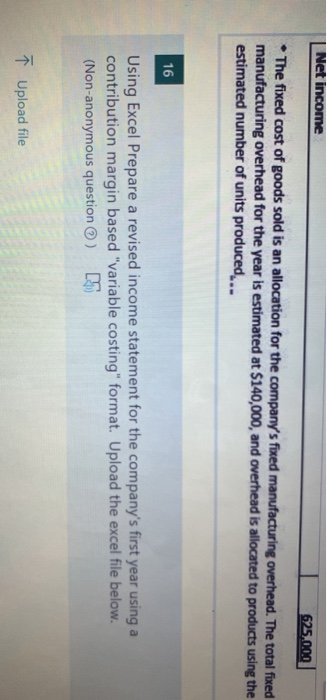

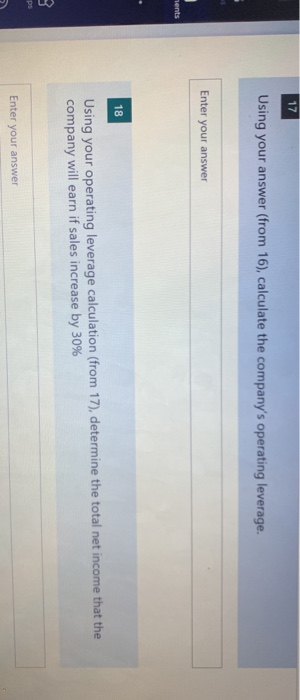

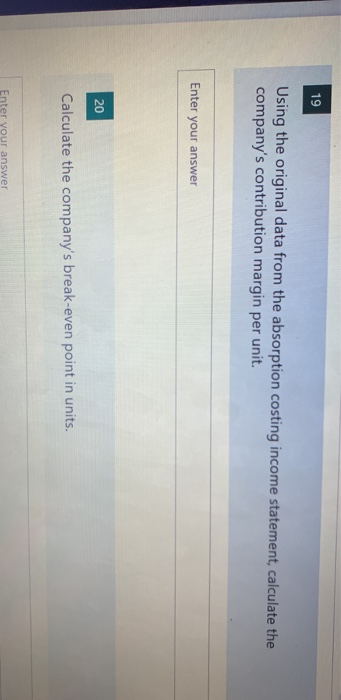

Martinez Inc. started operations on 1/1/2020. The following forecast income statement for the first year of trading has been prepared using absorption costing for the budgeted production and sale of 10,000 units: Martinez Inc. Income Statement for the Budgeted Production and sale of 10,000 units $ Sales revenue (10,000 units @ $150 per unit) 1,500,000 Less: cost of goods sold (COGS) Variable COGS: direct materials (10,000 units @ $18 per unit) (180,000) Variable COGS: direct labor (10,000 units @ $20 per unit) (200,000) Variable COGS: variable factory overhead (10,000 units @ $7 per unit) (70,000) Fixed COGS: Fixed factory overhead* (140.000) Gross profit 910,000 Variable sales commission (10,000 units @ $5 per unit) (50,000) Administrative expenses (office rent and administrative salaries) (200,000 Fixed advertising expenses (35.000) Net income 625.000 The fixed cost of goods sold is an allocation for the company's fixed manufacturing overhead. The total fixed manufacturing overhead for the year is estimated at $140,000, and overhead is allocated to products using the estimated number of units produced... 16 Using Excel Prepare a revised income statement for the company's first year using a contribution margin based "variable costing" format. Upload the excel file below. (Non-anonymous question ) Upload file 17 Using your answer (from 16), calculate the company's operating leverage. Enter your answer nents 18 Using your operating leverage calculation (from 17), determine the total net income that the company will earn if sales increase by 30% 3 ps Enter your answer 19 Using the original data from the absorption costing income statement, calculate the company's contribution margin per unit. Enter your answer 20 Calculate the company's break-even point in units. Enter your answer 21 hat Assume that the administrative salaries are expected to increase by $30,000. What would be the revised break-even point in units, assuming all other cost and revenue data remain the same? eams Enments Enter your answer 22 Based on your answer for 20 and 21, state the impact of changes in fixed cost on Break-even units. Apps