Question

Martinezs Lawn Service needs to purchase a new lawnmower costing $8,486 to replace an old lawnmower that cannot be repaired. The new lawnmower is expected

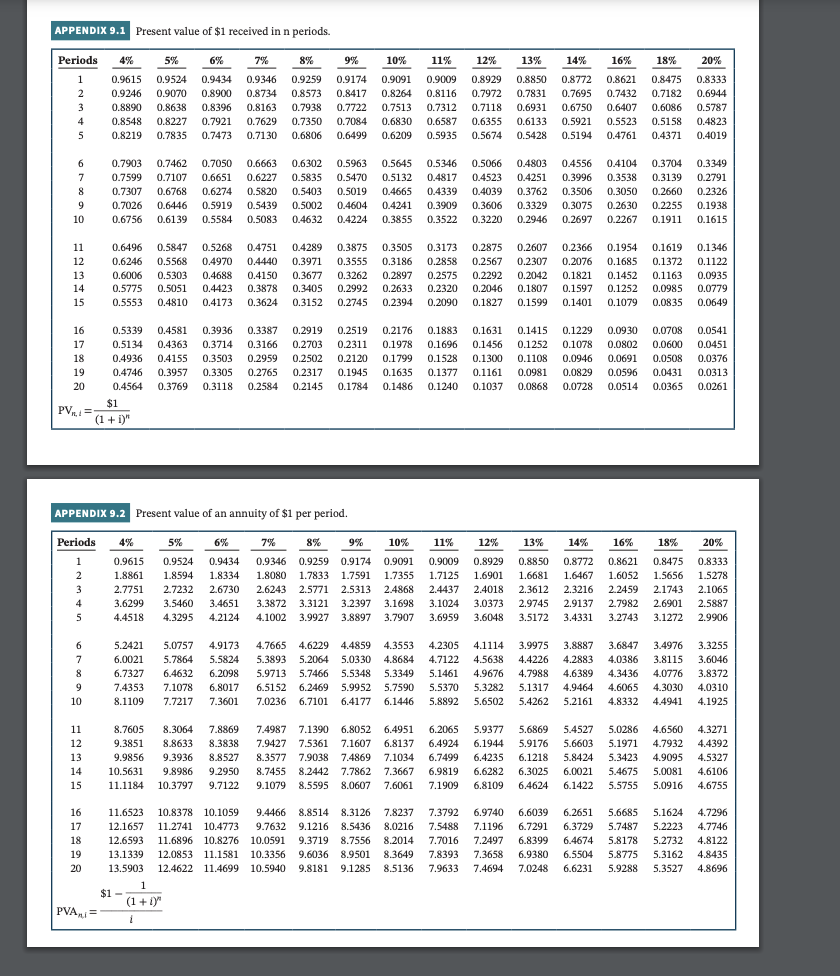

Martinezs Lawn Service needs to purchase a new lawnmower costing $8,486 to replace an old lawnmower that cannot be repaired. The new lawnmower is expected to have a useful life of 7 years, with no salvage value at the end of that period. Click here to view the factor table.

(a) If Martinezs required rate of return is 12%, what level of annual cash savings must the lawnmower generate to be considered an acceptable investment under the net present value method? (For calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to 0 decimal place, e.g. 58,971.) Annual cash savings should be $enter the annual cash savings in dollars

(b) If Martinezs required rate of return is 14%, what level of annual cash savings must the lawnmower generate to be considered an acceptable investment under the net present value method? (For calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to 0 decimal place, e.g. 58,971.) Annual cash savings should be $enter the annual cash savings in dollars

APPENDIX 9.1 Present value of $1 received in n periods. Periods 4% 5% 6% 7% 8% 9% 11% 12% 13% 14% 20% 1 2 3 4 5 0.9615 0.9246 0.8890 0.8548 0.8219 0.9524 0.9070 0.8638 0.8227 0.7835 0.9434 0.8900 0.8396 0.7921 0.7473 0.9346 0.8734 0.8163 0.7629 0.7130 0.9259 0.8573 0.7938 0.7350 0.6806 0.9174 0.8417 0.7722 0.7084 0.6499 10% % 0.9091 0.8264 0.7513 0.6830 0.6209 0.9009 0.8116 0.7312 0.6587 0.5935 0.8929 0.7972 0.7118 0.6355 0.5674 0.8850 0.7831 0.6931 0.6133 0.5428 0.8772 0.7695 0.6750 0.5921 0.5194 16% 18% 0.8621 0.8475 0.7432 0.7182 0.6407 0.6086 0.5523 0.5158 0.4761 0.4371 0.8333 0.6944 0.5787 0.4823 0.4019 6 7 8 9 0.7903 0.7599 0.7307 0.7026 0.6756 0.7462 0.7107 0.6768 0.6446 0.6139 0.7050 0.6651 0.6274 0.5919 0.5584 0.6663 0.6227 0.5820 0.5439 0.5083 0.6302 0.5835 0.5403 0.5002 0.4632 0.5963 0.5470 0.5019 0.4604 0.4224 0.5645 0.5132 0.4665 0.4241 0.3855 0.5346 0.4817 0.4339 0.3909 0.3522 0.5066 0.4523 0.4039 0.3606 0.3220 0.4803 0.4251 0.3762 0.3329 0.2946 0.4556 0.3996 0.3506 0.3075 0.2697 0.4104 0.3538 0.3050 0.2630 0.2267 0.3704 0.3139 0.2660 0.2255 0.1911 0.3349 0.2791 0.2326 0.1938 0.1615 10 11 12 0.6496 0.6246 0.6006 0.5775 0.5553 13 14 15 0.5847 0.5568 0.5303 0.5051 0.4810 0.5268 0.4970 0.4688 0.4423 0.4173 0.4751 0.4440 0.4150 0.3878 0.3624 0.4289 0.3971 0.3677 0.3405 0.3152 0.3875 0.3555 0.3262 0.2992 0.2745 0.3505 0.3186 0.2897 0.2633 0.2394 0.3173 0.2858 0.2575 0.2320 0.2090 0.2875 0.2567 0.2292 0.2046 0.1827 0.2607 0.2307 0.2042 0.1807 0.1599 0.2366 0.2076 0.1821 0.1954 0.1685 0.1452 0.1252 0.1079 0.1619 0.1372 0.1163 0.0985 0.0835 0.1346 0.1122 0.0935 0.0779 0.0649 0.1597 0.1401 16 0.5339 17 0.5134 18 0.4936 19 0.4746 20 0.4564 $1 PV1 = (1 + i)" 0.4581 0.4363 0.4155 0.3957 0.3769 0.3936 0.3714 0.3503 0.3305 0.3118 0.3387 0.3166 0.2959 0.2765 0.2584 0.2919 0.2703 0.2502 0.2317 0.2145 0.2519 0.2311 0.2120 0.1945 0.1784 0.2176 0.1978 0.1799 0.1635 0.1486 0.1883 0.1696 0.1528 0.1377 0.1240 0.1631 0.1456 0.1300 0.1161 0.1037 0.1415 0.1252 0.1108 0.0981 0.0868 0.1229 0.1078 0.0946 0.0829 0.0728 0.0930 0.0802 0.0691 0.0596 0.0514 0.0708 0.0600 0.0508 0.0431 0.0365 0.0541 0.0451 0.0376 0.0313 0.0261 APPENDIX 9.2 Present value of an annuity of $1 per period. Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 14% 16% 18% 1 2 3 4 5 0.9615 1.8861 2.7751 3.6299 4.4518 0.9524 1.8594 2.7232 3.5460 4.3295 0.9434 1.8334 2.6730 3.4651 4.2124 0.9346 0.9259 0.9174 1.8080 1.7833 1.7591 2.6243 2.5771 2.5313 3.3872 3.3121 3.2397 4.1002 3.9927 3.8897 0.9091 1.7355 2.4868 3.1698 3.7907 0.9009 1.7125 2.4437 3.1024 3.6959 0.8929 1.6901 2.4018 3.0373 3.6048 13% 0.8850 1.6681 2.3612 2.9745 3.5172 0.8772 1.6467 2.3216 2.9137 3.4331 0.8621 1.6052 2.2459 2.7982 3.2743 0.8475 1.5656 2.1743 2.6901 3.1272 20% 0.8333 1.5278 2.1065 2.5887 2.9906 6 7 8 9 10 5.2421 6.0021 6.7327 7.4353 8.1109 5.0757 5.7864 6.4632 7.1078 7.7217 4.9173 5.5824 6.2098 6.8017 7.3601 4.7665 4.6229 5.3893 5.2064 5.9713 5.7466 6.5152 6.2469 7.0236 6.7101 4.4859 5.0330 5.5348 5.9952 6.4177 4.3553 4.8684 5.3349 5.7590 6.1446 4.2305 4.7122 5.1461 5.5370 5.8892 4.1114 4.5638 4.9676 5.3282 5.6502 3.9975 4.4226 4.7988 5.1317 5.4262 3.8887 4.2883 4.6389 4.9464 5.2161 3.6847 4.0386 4.3436 4.6065 4.8332 3.4976 3.8115 4.0776 4.3030 4.4941 3.3255 3.6046 3.8372 4.0310 4.1925 11 12 13 14 15 8.7605 9.3851 9.9856 10.5631 11.1184 8.3064 8.8633 9.3936 9.8986 10.3797 7.8869 8.3838 8.8527 9.2950 9.7122 7.4987 7.1390 6.8052 7.9427 7.5361 7.1607 8.3577 7.9038 7.4869 8.74558.2442 7.7862 9.1079 8.5595 8.0607 6.4951 6.8137 7.1034 7.3667 7.6061 6,2065 6.4924 6.7499 6.9819 7.1909 5.9377 6.1944 6.4235 6.6282 6.8109 5.6869 5.9176 6.1218 6.3025 6.4624 5.4527 5.6603 5.8424 6.0021 6.1422 5.0286 5.1971 5.3423 5.467 5.5755 4.6560 4.7932 4.9095 5.0081 5,0916 4.3271 4.4392 4.5327 4.6106 4.6755 16 11.6523 10.8378 10.1059 9.4466 8.8514 8.3126 7.8237 17 12.1657 11.2741 10.4773 9.7632 9.1216 8.5436 8.0216 18 12.6593 11.6896 10.8276 10.0591 9.3719 8.7556 8.2014 19 13.1339 12.0853 11.1581 10.3356 9.6036 8.9501 8.3649 20 13.5903 12.4622 11.4699 10.5940 9.8181 9.1285 8.5136 1 $1 - (1+1) PVA,,i = i 7.3792 7.5488 7.7016 7.8393 7.9633 6.9740 7.1196 7.2497 7.3658 7.4694 6.6039 6.7291 6.8399 6.9380 7.0248 6.2651 6.3729 6.4674 6.5504 6.6231 5.6685 5.7487 5.8178 5.8775 5.9288 5.1624 5.2223 5.2732 5.3162 5.3527 4.7296 4.7746 4.8122 4.8435 4.8696Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started